Firefighter Tax Deductions Worksheet Form

What is the Firefighter Tax Deductions Worksheet

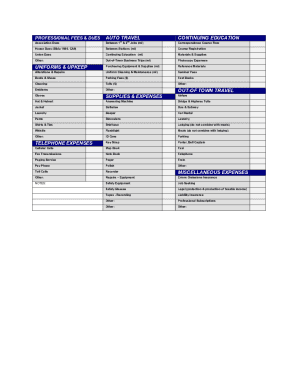

The firefighter tax deductions worksheet is a specialized form designed to help firefighters accurately calculate and claim eligible tax deductions related to their profession. This worksheet assists in identifying various expenses that can be deducted from taxable income, such as uniforms, equipment, and training costs. By using this worksheet, firefighters can ensure they maximize their deductions, ultimately reducing their overall tax liability.

How to use the Firefighter Tax Deductions Worksheet

Using the firefighter tax deductions worksheet involves several straightforward steps. First, gather all relevant documentation, including receipts and invoices for expenses incurred during the tax year. Next, follow the worksheet's structured format to input each expense category, ensuring that all entries are accurate and supported by documentation. Finally, review the completed worksheet for accuracy before submitting it with your tax return.

Steps to complete the Firefighter Tax Deductions Worksheet

Completing the firefighter tax deductions worksheet requires careful attention to detail. Begin by listing all deductible expenses, such as:

- Uniform costs

- Protective gear

- Training and education expenses

- Tools and equipment

- Vehicle expenses related to job duties

After listing the expenses, calculate the total for each category and ensure that all amounts are supported by valid receipts. Finally, sum the totals to arrive at the overall deduction amount, which will be included in your tax filing.

Legal use of the Firefighter Tax Deductions Worksheet

The legal use of the firefighter tax deductions worksheet hinges on compliance with IRS regulations. It is essential to ensure that all claimed deductions are legitimate and backed by appropriate documentation. The IRS requires that taxpayers maintain records of all expenses claimed, which may be requested during an audit. Utilizing the worksheet correctly can help establish a clear and defensible position if questioned by tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for tax returns, including those utilizing the firefighter tax deductions worksheet, are typically set by the IRS. For most taxpayers, the deadline is April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial for firefighters to be aware of these dates to ensure timely submission of their tax returns and avoid penalties.

Required Documents

To complete the firefighter tax deductions worksheet accurately, several documents are necessary. These include:

- Receipts for all deductible expenses

- W-2 forms from employers

- 1099 forms if applicable

- Records of any additional income

- Previous tax returns for reference

Having these documents organized and readily available will facilitate a smoother completion of the worksheet and ensure that all deductions are properly accounted for.

Examples of using the Firefighter Tax Deductions Worksheet

Examples of using the firefighter tax deductions worksheet can illustrate how various expenses are documented. For instance, if a firefighter spends two hundred dollars on a new pair of boots required for their job, this expense should be recorded in the appropriate section of the worksheet. Another example could include costs associated with attending a training seminar, which can also be deducted. By providing clear examples, firefighters can better understand how to utilize the worksheet effectively.

Quick guide on how to complete firefighter tax deductions 2020 worksheet

Effortlessly Prepare Firefighter Tax Deductions Worksheet on Any Device

Managing documents online has gained signNow traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents efficiently without any interruptions. Handle Firefighter Tax Deductions Worksheet on any device with airSlate SignNow's Android or iOS applications, and simplify your document-related processes today.

How to Modify and eSign Firefighter Tax Deductions Worksheet with Ease

- Find Firefighter Tax Deductions Worksheet and click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which only takes a few seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Choose how you wish to send your form, whether via email, text message (SMS), invite link, or download it to your computer.

Put an end to lost or misplaced documents, cumbersome form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from your preferred device. Modify and eSign Firefighter Tax Deductions Worksheet to ensure outstanding communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the firefighter tax deductions worksheet?

The firefighter tax deductions worksheet is a tool designed to help firefighters track and calculate tax-deductible expenses related to their profession. This worksheet simplifies the process of itemizing deductions and ensures that all eligible expenses are accounted for when filing taxes.

-

How can airSlate SignNow enhance my firefighter tax deductions worksheet process?

airSlate SignNow streamlines your firefighter tax deductions worksheet process by allowing you to easily create, sign, and manage your documents online. Our platform provides user-friendly features that help you compile your deductions efficiently, ensuring you maximize your tax savings.

-

Is the firefighter tax deductions worksheet included in your pricing plan?

Yes, the firefighter tax deductions worksheet is included in our pricing plans, giving you access to essential tools for managing your tax deductions. By subscribing, you can utilize this worksheet along with our comprehensive eSignature solutions at a competitive price.

-

What features can I expect when using the firefighter tax deductions worksheet?

When using the firefighter tax deductions worksheet, you'll have access to features such as customizable templates, digital signatures, and secure document storage. These features work together to simplify your documentation process, making tax season less stressful for firefighters.

-

Can I integrate other tools with the firefighter tax deductions worksheet?

Absolutely! AirSlate SignNow offers various integration options that allow you to connect the firefighter tax deductions worksheet with other applications, such as accounting software or tax filing services. This integration enhances your workflow and ensures your financial records are well-organized.

-

What benefits do I gain by using airSlate SignNow for my firefighter tax deductions worksheet?

By using airSlate SignNow for your firefighter tax deductions worksheet, you gain efficiency, accuracy, and ease of use. This empowers you to focus on your firefighting responsibilities while ensuring that your tax deductions are handled professionally.

-

Is airSlate SignNow suitable for all types of firefighters?

Yes, airSlate SignNow is suitable for both volunteer and professional firefighters looking to manage their firefighter tax deductions worksheet effectively. Regardless of your employment status, our platform provides the necessary tools to simplify your tax documentation.

Get more for Firefighter Tax Deductions Worksheet

Find out other Firefighter Tax Deductions Worksheet

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement