Iht217 Form

What is the IHT217 form?

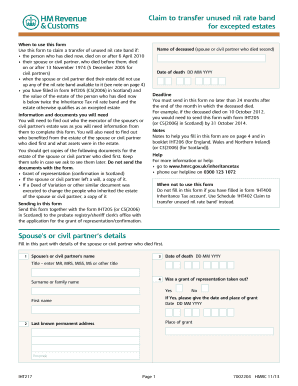

The IHT217 form is a document used in the United Kingdom to claim relief from inheritance tax for certain estates. This form is specifically designed for estates that qualify for the spouse or civil partner exemption, allowing the surviving partner to inherit without incurring inheritance tax. The IHT217 serves as a declaration to HM Revenue and Customs (HMRC) that the estate meets the necessary criteria for tax relief.

How to use the IHT217

Using the IHT217 form involves several steps to ensure accurate completion and submission. First, gather all necessary information about the deceased’s estate, including assets, liabilities, and details of the surviving spouse or civil partner. Next, fill out the form carefully, ensuring that all sections are completed accurately. Once completed, submit the form to HMRC as part of the inheritance tax return process. It is essential to keep a copy for your records.

Steps to complete the IHT217

Completing the IHT217 form requires attention to detail. Follow these steps for successful completion:

- Collect information about the deceased, including their full name, date of death, and details of the estate.

- Provide information about the surviving spouse or civil partner, including their name and relationship to the deceased.

- Complete the sections of the form that pertain to the estate’s assets and liabilities.

- Review the form for accuracy and completeness before submission.

- Submit the IHT217 form to HMRC along with any other required documentation.

Legal use of the IHT217

The IHT217 form is legally binding when submitted correctly and in compliance with HMRC regulations. It is essential to ensure that all information provided is truthful and accurate, as any discrepancies may lead to penalties or delays in processing. The form must be submitted within the specified timeframes to ensure the estate benefits from the tax relief available under UK law.

Required Documents

When completing the IHT217 form, certain documents are necessary to support the claim. These may include:

- The death certificate of the deceased.

- A copy of the will or any relevant legal documents regarding the estate.

- Financial statements detailing the assets and liabilities of the estate.

- Identification documents for the surviving spouse or civil partner.

Form Submission Methods

The IHT217 form can be submitted to HMRC through various methods. The primary options include:

- Online submission through the HMRC website, which is often the fastest method.

- Mailing a paper copy of the completed form to the designated HMRC address.

- In-person submission at local HMRC offices, although this option may be limited.

Quick guide on how to complete iht217

Complete Iht217 effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Iht217 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign Iht217 with ease

- Find Iht217 and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and eSign Iht217 and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the iht217 form and why is it important?

The iht217 form is a crucial document used in the UK to report and disclose various asset values for inheritance tax purposes. Properly completing the iht217 form helps ensure compliance with tax regulations and aids in the transparent handling of estates. Understanding its importance can simplify the probate process for executors and beneficiaries.

-

How can airSlate SignNow assist with the iht217 form?

airSlate SignNow offers a streamlined solution for filling out and signing the iht217 form electronically. With features like customizable templates and secure eSigning, completing the iht217 form can be done efficiently, reducing the time and effort required. By utilizing airSlate SignNow, you get to ensure accuracy and compliance throughout the process.

-

Is airSlate SignNow affordable for small businesses managing the iht217 form?

Yes, airSlate SignNow provides cost-effective pricing plans suitable for small businesses and individuals handling the iht217 form. The flexible pricing options allow users to choose a plan that fits their budget while still gaining access to essential features for document management. This makes it an excellent investment for managing legal paperwork efficiently.

-

What features does airSlate SignNow offer for managing the iht217 form?

airSlate SignNow includes a variety of features tailored for managing the iht217 form, such as an intuitive form builder and robust eSigning capabilities. Users can easily create, send, and track the status of their iht217 forms, ensuring a smooth workflow from start to finish. In addition, it allows for secure data storage, enhancing document security.

-

Can I integrate airSlate SignNow with other software for the iht217 form?

Absolutely! airSlate SignNow offers seamless integrations with popular applications such as Google Drive, Dropbox, and CRM systems. This enables users to easily import data or manage documents associated with the iht217 form across various platforms, creating a cohesive workflow that saves time and resources.

-

What are the benefits of using airSlate SignNow for the iht217 form?

Using airSlate SignNow for the iht217 form provides numerous benefits, including faster turnaround times and enhanced accuracy in documentation. The platform’s user-friendly interface simplifies the process of completing and submitting the iht217 form. Additionally, it helps to maintain security and compliance in handling sensitive information.

-

How secure is airSlate SignNow for processing the iht217 form?

airSlate SignNow prioritizes security, employing robust encryption protocols to protect documents like the iht217 form. All data is stored in secure servers, and user authentication measures are in place to ensure unauthorized access is prevented. This makes airSlate SignNow a reliable choice for sensitive legal documentation.

Get more for Iht217

- Swiss bank account opening form

- Peoples health medical necessity form 46315167

- Nana regional corporation dividend form

- Agriinvest program appeal submission form

- Annual confidential report form for teachers

- Weightlifting score sheet form

- Small claims court rochester ny form

- Revocation of transfer on death deed minn stat 507 071 form

Find out other Iht217

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure