Sample Profit and Loss Statement for SelfEmployed Borrowers Form

What is the sample profit and loss statement for self-employed borrowers?

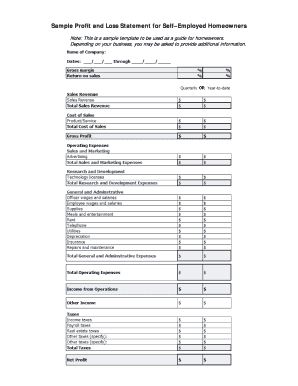

The sample profit and loss statement for self-employed borrowers is a financial document that outlines the income and expenses of a self-employed individual over a specific period. This statement is essential for assessing the financial health of a business and is often required when applying for loans or mortgages. It provides lenders with a clear picture of the borrower's earnings, helping them determine the borrower's ability to repay a loan. Typically, this statement includes various categories such as gross income, operating expenses, and net profit or loss.

How to use the sample profit and loss statement for self-employed borrowers

Using the sample profit and loss statement for self-employed borrowers involves several steps. First, gather all necessary financial records, including invoices, receipts, and bank statements. Next, categorize your income and expenses accurately. For income, include all revenue sources, while expenses should be divided into fixed and variable costs. Once you have compiled this information, input it into the sample statement format. This document can then be used for loan applications or tax purposes, ensuring that it reflects your financial situation accurately.

Key elements of the sample profit and loss statement for self-employed borrowers

Several key elements must be included in the sample profit and loss statement for self-employed borrowers. These elements provide a comprehensive overview of financial performance:

- Gross Income: Total revenue generated from business activities.

- Operating Expenses: Costs incurred in running the business, such as rent, utilities, and salaries.

- Net Profit or Loss: The difference between total income and total expenses, indicating financial gain or loss.

- Time Period: The specific timeframe for which the statement is prepared, typically monthly, quarterly, or annually.

Steps to complete the sample profit and loss statement for self-employed borrowers

Completing the sample profit and loss statement for self-employed borrowers involves a systematic approach:

- Collect all financial documents, including sales records and expense receipts.

- Organize your income sources and list them under gross income.

- Itemize your expenses, categorizing them into fixed and variable costs.

- Calculate total income and total expenses.

- Determine your net profit or loss by subtracting total expenses from total income.

- Review the statement for accuracy and completeness before submission.

Legal use of the sample profit and loss statement for self-employed borrowers

The sample profit and loss statement for self-employed borrowers serves a legal purpose in financial transactions. When submitted to lenders, it must meet specific legal standards to be considered valid. This includes ensuring that the information is accurate and truthful, as discrepancies can lead to legal consequences. Additionally, the statement may need to comply with local and federal regulations regarding financial reporting. Using a reliable platform like signNow can help ensure that the document is securely signed and stored, maintaining its legal integrity.

IRS guidelines

The Internal Revenue Service (IRS) provides guidelines for self-employed individuals regarding the use of profit and loss statements. These guidelines emphasize the importance of maintaining accurate records for income and expenses. Self-employed individuals must report their earnings on Schedule C of their tax returns, where the profit and loss statement can serve as supporting documentation. Adhering to IRS guidelines ensures compliance and helps avoid potential audits or penalties.

Quick guide on how to complete sample profit and loss statement for selfemployed borrowers

Complete Sample Profit And Loss Statement For SelfEmployed Borrowers effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents quickly and without delays. Manage Sample Profit And Loss Statement For SelfEmployed Borrowers on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Sample Profit And Loss Statement For SelfEmployed Borrowers without hassle

- Locate Sample Profit And Loss Statement For SelfEmployed Borrowers and click Get Form to begin.

- Use the tools we offer to finish your document.

- Emphasize essential parts of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Ray off lost or misplaced documents, exhausting form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your needs in document management within a few clicks from any device you prefer. Alter and eSign Sample Profit And Loss Statement For SelfEmployed Borrowers to ensure excellent communication at any step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a sample statement in the context of airSlate SignNow?

A sample statement in airSlate SignNow refers to a template or example of a document that your business can customize and send for eSignature. By utilizing these sample statements, users can streamline the signing process while ensuring all necessary information is clearly presented. This enhances efficiency and accuracy in business communications.

-

How can I create a sample statement with airSlate SignNow?

Creating a sample statement in airSlate SignNow is simple and intuitive. You can start from scratch or choose from a library of templates. Once you've selected a template, you can customize it to fit your specific needs, making the document ready for eSigning.

-

What features does airSlate SignNow offer for sample statements?

AirSlate SignNow provides a range of features for sample statements, including customizable fields, secure eSignature capabilities, and the ability to track document status. These features ensure that your sample statements are not only professional but also legally binding, facilitating a smooth transaction process.

-

Are there any cost-effective plans for using sample statements in airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that cater to different business sizes and needs. By choosing an appropriate plan, businesses can effectively utilize sample statements without straining their budget. Each plan ensures you have the necessary tools to send and manage your documents.

-

Can I integrate airSlate SignNow with other applications for sample statements?

Absolutely! airSlate SignNow supports numerous integrations with popular applications, allowing you to enhance your document workflows. Whether it's CRM systems, cloud storage, or project management tools, these integrations make it easier for you to manage your sample statements efficiently.

-

What are the benefits of using sample statements with airSlate SignNow?

Using sample statements with airSlate SignNow streamlines the process of document management and eSigning. It increases efficiency, reduces errors, and ensures compliance with legal standards. Moreover, the ability to track changes and signatures enhances transparency in transactions.

-

Is support available for creating sample statements in airSlate SignNow?

Yes, airSlate SignNow provides robust customer support for users creating sample statements. Whether you need help navigating the platform or customizing your documents, the support team is available to assist you via chat, email, or phone, ensuring a smooth user experience.

Get more for Sample Profit And Loss Statement For SelfEmployed Borrowers

- Advanced grammar in use pdf slideshare form

- Moa uae sample form

- Indiana qma curriculum form

- How to write attestation of parent guardian consent form

- Form 42a809

- Indian scammer script form

- D17a original application for vehicle dealer license d17a original application for vehicle dealer license form

- Class a liquor cider only form

Find out other Sample Profit And Loss Statement For SelfEmployed Borrowers

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice