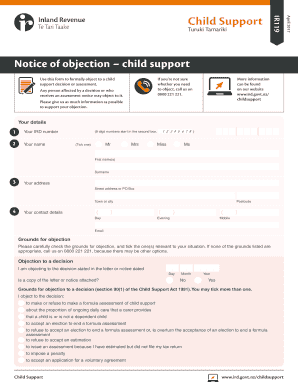

Notice of Objection Child Support IRD Form

What is the Notice of Objection Child Support IRD

The Notice of Objection Child Support IRD is a formal document used in the United States to contest a child support assessment made by the Internal Revenue Service (IRS). This form allows individuals to challenge the amount of child support they are required to pay or receive. It is essential for parents who believe that the assessment does not accurately reflect their financial situation or the needs of their child. The form serves as a mechanism to ensure that child support obligations are fair and equitable, taking into account the specific circumstances of each case.

Steps to Complete the Notice of Objection Child Support IRD

Completing the Notice of Objection Child Support IRD involves several important steps:

- Gather necessary documentation, including your current child support assessment and any financial records that support your objection.

- Clearly outline the reasons for your objection, focusing on specific aspects of the assessment that you believe are incorrect.

- Fill out the form accurately, ensuring that all required fields are completed and that your information is up to date.

- Review the form for any errors or omissions before submission to avoid delays in processing.

- Submit the completed form to the appropriate IRS office, either online or via mail, as per the guidelines provided.

Legal Use of the Notice of Objection Child Support IRD

The legal use of the Notice of Objection Child Support IRD is crucial for ensuring that disputes regarding child support assessments are handled appropriately. This form must be filed within a specific timeframe to be considered valid. It is important to understand that submitting this notice does not automatically halt child support payments; it merely initiates a review process. The legal framework surrounding child support objections ensures that both parents have the opportunity to present their case, and the outcome is based on a thorough examination of the evidence provided.

Required Documents

When filing the Notice of Objection Child Support IRD, certain documents are typically required to support your claim. These may include:

- Your current child support assessment notice.

- Proof of income, such as pay stubs or tax returns.

- Documentation of any changes in financial circumstances, such as job loss or increased expenses.

- Any relevant court orders or agreements related to child support.

Providing comprehensive documentation will strengthen your case and facilitate a smoother review process.

Form Submission Methods (Online / Mail / In-Person)

The Notice of Objection Child Support IRD can be submitted through various methods, depending on your preference and the guidelines set by the IRS. Common submission methods include:

- Online: Many jurisdictions allow for electronic submission through secure government portals.

- Mail: You can send the completed form via postal service to the designated IRS office.

- In-Person: Some individuals may choose to deliver the form directly to their local IRS office for immediate processing.

It is important to verify the submission method that is most appropriate for your situation and to keep a copy of the submitted form for your records.

Eligibility Criteria

To file the Notice of Objection Child Support IRD, individuals must meet certain eligibility criteria. Generally, the following conditions apply:

- You must be a parent or guardian involved in the existing child support arrangement.

- The objection must be filed within the specified timeframe following the receipt of the child support assessment.

- You should have valid reasons supported by evidence for contesting the assessment.

Understanding these criteria is essential to ensure that your objection is valid and can be processed effectively.

Quick guide on how to complete notice of objection child support ird

Complete Notice Of Objection Child Support IRD effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent environmentally friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to generate, modify, and eSign your documents rapidly without delays. Manage Notice Of Objection Child Support IRD on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

How to modify and eSign Notice Of Objection Child Support IRD with ease

- Find Notice Of Objection Child Support IRD and click on Get Form to start.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form - via email, SMS, or an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Notice Of Objection Child Support IRD while ensuring outstanding communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the 2017 ir119 form and its purpose?

The 2017 ir119 form is a tax form used to report certain information required by the IRS. It is important for businesses to accurately complete this form to ensure compliance with tax regulations. Using airSlate SignNow can streamline the process of preparing and signing the 2017 ir119 form efficiently.

-

How can I electronically sign the 2017 ir119 form with airSlate SignNow?

With airSlate SignNow, you can easily upload the 2017 ir119 form and add your electronic signature. The platform guides you through the signing process, ensuring that your form is legally compliant. This feature saves time and enhances the security of your document management.

-

What are the pricing options for using airSlate SignNow to manage the 2017 ir119 form?

AirSlate SignNow offers several pricing plans that accommodate different business needs, starting from a free trial to more comprehensive packages. Each plan provides access to essential features for handling the 2017 ir119 form efficiently. Prospective users can select a plan that suits their size and volume of document management.

-

Can I integrate airSlate SignNow with other software to manage the 2017 ir119 form?

Yes, airSlate SignNow supports various integrations with popular software solutions such as Google Workspace, Salesforce, and more. These integrations can help streamline the process of collecting data and documents necessary for the 2017 ir119 form. Enhanced compatibility makes it easier to work within your existing workflows.

-

What are the benefits of using airSlate SignNow for the 2017 ir119 form?

Using airSlate SignNow for the 2017 ir119 form offers several benefits, including time-saving features and enhanced accuracy. The platform allows for quick document sharing and secure electronic signatures, ensuring your forms are completed efficiently. Additionally, it provides an audit trail for compliance and accountability.

-

Is it safe to use airSlate SignNow for the 2017 ir119 form?

AirSlate SignNow prioritizes security with features such as encryption and secure cloud storage for your documents. This is especially important for sensitive forms like the 2017 ir119 form, as it contains personal and financial information. Users can confidently sign and store documents knowing they are protected.

-

How does airSlate SignNow streamline the preparation of the 2017 ir119 form?

AirSlate SignNow simplifies the preparation of the 2017 ir119 form by enabling users to fill out, edit, and sign documents in one platform. The user-friendly interface helps eliminate paperwork hassles, allowing for quick modifications and approvals. This leads to a more efficient document workflow.

Get more for Notice Of Objection Child Support IRD

Find out other Notice Of Objection Child Support IRD

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding