Goodwill Donation Receipt Form

What is the goodwill donation receipt?

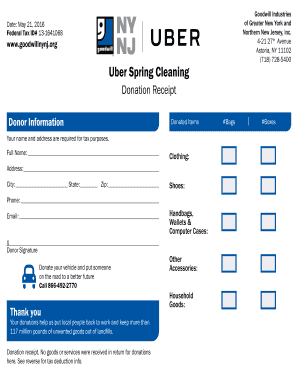

A goodwill donation receipt is a document provided by charitable organizations, such as Goodwill, to acknowledge the donation of goods or services made by an individual or business. This receipt serves as proof of the donation for tax purposes and is essential for donors who wish to claim a deduction on their income tax return. The receipt typically includes details such as the name of the donor, the date of the donation, a description of the donated items, and the organization's tax identification number.

Key elements of the goodwill donation receipt

To ensure the goodwill donation receipt is valid and useful for tax deduction purposes, it should contain several key elements:

- Donor Information: The name and address of the individual or business making the donation.

- Organization Information: The name and address of the charitable organization receiving the donation.

- Date of Donation: The specific date when the donation was made.

- Description of Donated Items: A clear description of the items donated, including their condition.

- Value of Donation: An estimated value of the donated items, although the organization may not provide a specific dollar amount.

- Tax Identification Number: The organization's tax ID number, which is necessary for tax filing.

How to obtain the goodwill donation receipt

Obtaining a goodwill donation receipt is a straightforward process. After making a donation to a Goodwill location, donors should request a receipt from the staff. Many Goodwill locations provide a printed receipt at the time of donation. For larger donations or those made through scheduled pickups, the organization may send a receipt via mail or email. It is important to keep this receipt in a safe place, as it will be needed for tax filing purposes.

Legal use of the goodwill donation receipt

The goodwill donation receipt is legally recognized as a valid document for tax purposes in the United States. To ensure compliance with IRS regulations, donors should retain the receipt as part of their tax records. The IRS requires documentation for any charitable contributions claimed on tax returns, and the goodwill donation receipt serves as this documentation. It is advisable to consult IRS guidelines regarding the value of donated items and the necessary documentation required for different donation amounts.

Steps to complete the goodwill donation receipt

Completing a goodwill donation receipt involves a few simple steps:

- Gather necessary information, including donor and organization details.

- List the items donated, ensuring to describe them accurately.

- Estimate the value of the donated items, if applicable.

- Fill out the receipt with all required information, ensuring clarity and accuracy.

- Sign and date the receipt to validate it.

IRS Guidelines

The IRS provides specific guidelines regarding the deduction of charitable contributions. Donors should be aware that for donations exceeding a certain value, additional documentation may be required. For example, if the total value of donated items exceeds five hundred dollars, donors must complete Form 8283 and obtain a qualified appraisal for the items. It is essential to follow these guidelines to ensure compliance and maximize potential tax benefits.

Quick guide on how to complete goodwill donation receipt

Prepare Goodwill Donation Receipt easily on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents quickly without delays. Manage Goodwill Donation Receipt on any device using airSlate SignNow Android or iOS applications and streamline any document-based task today.

The simplest way to modify and eSign Goodwill Donation Receipt with ease

- Find Goodwill Donation Receipt and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional ink signature.

- Verify all the details and click on the Done button to save your updates.

- Choose how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that require printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Goodwill Donation Receipt and guarantee outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the goodwill donation receipt

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a goodwill donation receipt?

A goodwill donation receipt is a document provided by charitable organizations that confirms your donation. It helps itemize the value of the items donated, which can be used for tax deductions. Utilizing airSlate SignNow, you can easily eSign your goodwill donation receipt for your records.

-

How can airSlate SignNow help with goodwill donation receipts?

airSlate SignNow offers a seamless way to create, send, and eSign goodwill donation receipts. This digital process ensures that you can quickly document your charitable contributions. Plus, it provides a secure storage solution for all your important receipts.

-

Are there any costs associated with creating a goodwill donation receipt using airSlate SignNow?

AirSlate SignNow operates on a subscription model, providing a cost-effective solution for document management. Depending on your plan, creating a goodwill donation receipt can be included in your services without additional fees. Check the pricing page for tailored plans that fit your needs.

-

Can I customize my goodwill donation receipt with airSlate SignNow?

Yes, airSlate SignNow allows you to customize your goodwill donation receipt to include specific information, logos, and item descriptions. This flexibility ensures that your receipts meet your branding and record-keeping standards. Personalizing your receipts helps reflect your organization’s values.

-

Is it easy to eSign goodwill donation receipts with airSlate SignNow?

Absolutely! AirSlate SignNow's user-friendly interface makes it simple to eSign goodwill donation receipts. Just upload your document, add the necessary fields, and send it for signing — all in a few clicks, making the process efficient and hassle-free.

-

What integrations does airSlate SignNow offer for managing goodwill donation receipts?

AirSlate SignNow seamlessly integrates with various applications like Google Drive, Dropbox, and CRM systems. This allows for easy document management and retrieval of goodwill donation receipts, helping you keep your records organized. Integration enhances efficiency and accessibility for your documents.

-

Can I track the status of my goodwill donation receipt with airSlate SignNow?

Yes, airSlate SignNow provides tracking capabilities that let you monitor the status of your goodwill donation receipt. You can see when it has been sent, viewed, and signed, ensuring you always have visibility over your important documents. This feature helps maintain accountability and organization.

Get more for Goodwill Donation Receipt

- Circuit court for city or county civil domestic form

- 8505 program form

- Municipal court probation form

- Lesson 1 homework practice integers and absolute value answer key form

- Stormwater plan review form

- Sponsorshipprogram book advertising form pennsylvania bar pabar

- Gc 400ph2 gc 405ph2 non cash assets on hand at beginning of account period standard and simplified accounts judicial council form

- California initial disclosures form

Find out other Goodwill Donation Receipt

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template