Employment Use the SA102 Supplementary Pages to Record Your Employment Details When Filing a Tax Return for the Tax Year Ended 5 Form

What is the Employment Use of the SA102 Supplementary Pages

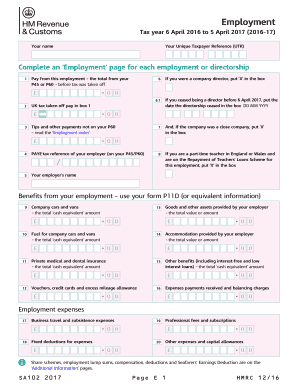

The Employment Use of the SA102 Supplementary Pages is a crucial component for individuals filing a tax return in the UK for the tax year ending April 5, 2017. This form is specifically designed to capture detailed information about an individual's employment income. It allows taxpayers to report earnings from various employment sources, including salaries, bonuses, and benefits in kind. Accurate completion of this form is essential for ensuring compliance with tax regulations and for calculating the correct amount of tax owed or refunded.

Steps to Complete the Employment Use of the SA102 Supplementary Pages

Completing the SA102 Supplementary Pages involves several key steps:

- Gather necessary documents: Collect all relevant documents, such as your P60, P45, and any payslips that detail your earnings for the tax year.

- Fill out personal information: Enter your personal details, including your name, address, and National Insurance number.

- Report your income: Accurately report all employment income, including any taxable benefits and allowances.

- Calculate tax owed: Use the information provided to calculate your total tax liability or any refund due.

- Review and submit: Double-check all entries for accuracy before submitting the completed form with your tax return.

Legal Use of the Employment Use of the SA102 Supplementary Pages

The legal use of the SA102 Supplementary Pages is governed by tax laws that require accurate reporting of income. This form must be completed truthfully and submitted by the tax filing deadline to avoid penalties. Failure to comply with these regulations can result in fines or additional tax assessments. It is important to ensure that all information is correct and that any supporting documents are retained for future reference.

Required Documents for the Employment Use of the SA102 Supplementary Pages

To complete the SA102 Supplementary Pages, certain documents are required:

- P60: This document summarizes your total earnings and tax deductions for the year.

- P45: If you changed jobs during the year, this form details your earnings and tax deductions up to your last day of employment.

- Payslips: These provide a breakdown of your earnings and any deductions made throughout the year.

- Benefit statements: If you received any benefits in kind, documentation detailing their value is necessary.

Filing Deadlines for the Employment Use of the SA102 Supplementary Pages

Filing deadlines are critical for compliance. For the tax year ending April 5, 2017, the deadline for submitting your tax return, including the SA102 Supplementary Pages, was January 31, 2018, for online submissions. Paper submissions had an earlier deadline of October 31, 2017. It is essential to adhere to these deadlines to avoid late filing penalties and interest on any taxes owed.

Examples of Using the Employment Use of the SA102 Supplementary Pages

Examples of when to use the SA102 Supplementary Pages include:

- When you have multiple jobs and need to report income from each source.

- If you received bonuses or other taxable benefits that must be included in your income.

- When you need to claim tax relief on work-related expenses that are not reimbursed by your employer.

Quick guide on how to complete employment 2017 use the sa1022017 supplementary pages to record your employment details when filing a tax return for the tax

Complete Employment Use The SA102 Supplementary Pages To Record Your Employment Details When Filing A Tax Return For The Tax Year Ended 5 effortlessly on any device

Web-based document management has gained traction with companies and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely keep it online. airSlate SignNow provides all the resources you require to create, modify, and eSign your documents quickly without delays. Manage Employment Use The SA102 Supplementary Pages To Record Your Employment Details When Filing A Tax Return For The Tax Year Ended 5 on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Employment Use The SA102 Supplementary Pages To Record Your Employment Details When Filing A Tax Return For The Tax Year Ended 5 with ease

- Locate Employment Use The SA102 Supplementary Pages To Record Your Employment Details When Filing A Tax Return For The Tax Year Ended 5 and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Select how you prefer to send your form, either by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Employment Use The SA102 Supplementary Pages To Record Your Employment Details When Filing A Tax Return For The Tax Year Ended 5 and ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to 2017 UK employment?

airSlate SignNow is an eSignature solution that empowers businesses to send and eSign documents seamlessly. In the context of 2017 UK employment, it facilitates compliance and efficiency in handling employment contracts and documents, ensuring a smooth onboarding process.

-

How can airSlate SignNow benefit my business regarding 2017 UK employment regulations?

Using airSlate SignNow helps businesses adhere to the regulations surrounding 2017 UK employment, as it provides legally binding eSignatures. This simplifies the signing process of documents required to comply with UK employment standards, ensuring your operations remain lawful and efficient.

-

What features does airSlate SignNow offer for managing 2017 UK employment contracts?

airSlate SignNow offers features like template creation, document sharing, and real-time tracking, which are essential for managing 2017 UK employment contracts. These tools streamline the document workflow, making it easier to manage multiple employment agreements effectively.

-

Is airSlate SignNow a cost-effective solution for businesses looking to streamline 2017 UK employment processes?

Yes, airSlate SignNow is a cost-effective solution for businesses aiming to streamline their 2017 UK employment processes. With various pricing plans and features designed to reduce administrative burdens, it allows companies to enhance productivity while controlling costs.

-

Can I integrate airSlate SignNow with other tools I use for 2017 UK employment?

Absolutely! airSlate SignNow offers integrations with various business tools like CRM systems and payroll software. This interoperability enhances the management of 2017 UK employment scenarios by connecting disparate systems for a smoother operational workflow.

-

What kind of support does airSlate SignNow provide for managing 2017 UK employment documents?

airSlate SignNow provides comprehensive customer support, including onboarding assistance and tutorials tailored to handling 2017 UK employment documents. Whether you are new to the platform or need advanced help, their support team ensures you can successfully navigate the solution.

-

How secure is airSlate SignNow for handling 2017 UK employment documents?

Security is a top priority for airSlate SignNow, especially when handling sensitive 2017 UK employment documents. The platform employs advanced encryption and security measures to protect your data, ensuring that all employee information remains confidential and safe.

Get more for Employment Use The SA102 Supplementary Pages To Record Your Employment Details When Filing A Tax Return For The Tax Year Ended 5

Find out other Employment Use The SA102 Supplementary Pages To Record Your Employment Details When Filing A Tax Return For The Tax Year Ended 5

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors