Ontario Works Income Statement Form

What is the Ontario Works Income Statement

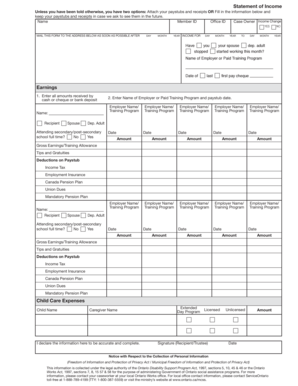

The Ontario Works Income Statement is a crucial document for individuals receiving financial assistance through the Ontario Works program. This statement outlines the income received during a specific reporting period and is essential for determining ongoing eligibility for benefits. It includes details such as employment income, social assistance payments, and any other sources of income that may affect the assistance amount. Understanding this document is vital for recipients to ensure they remain compliant with program requirements and avoid any potential penalties.

Steps to complete the Ontario Works Income Statement

Completing the Ontario Works Income Statement involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including pay stubs, bank statements, and any other proof of income. Next, fill out the form by entering your income details for the reporting period. It is important to include all sources of income, as omitting information can lead to complications. After completing the form, review it carefully for any errors. Finally, submit the statement according to the preferred method, whether online, by mail, or in person.

How to use the Ontario Works Income Statement

The Ontario Works Income Statement serves multiple purposes for recipients of assistance. It is primarily used to report income to the Ontario Works program, which helps determine eligibility and benefit amounts. Additionally, this statement can be useful for personal record-keeping, allowing individuals to track their income over time. It may also be required for other applications, such as housing assistance or financial aid for education. Understanding how to effectively use this document can help recipients manage their financial situations more efficiently.

Legal use of the Ontario Works Income Statement

Legal compliance is a critical aspect of using the Ontario Works Income Statement. The information provided must be accurate and truthful, as any discrepancies can lead to penalties or loss of benefits. Recipients should be aware of the legal obligations associated with reporting income and the consequences of failing to comply with these requirements. Proper completion and submission of the statement ensure that individuals remain in good standing with the Ontario Works program and avoid any legal ramifications.

Key elements of the Ontario Works Income Statement

The Ontario Works Income Statement contains several key elements that recipients must understand. These include personal identification information, the reporting period, and a detailed breakdown of all income sources. Additionally, the form may require information about dependents or other household members, which can affect the overall assistance amount. Familiarity with these elements is essential for accurately completing the statement and ensuring that all necessary information is reported.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Ontario Works Income Statement can be done through various methods, providing flexibility for recipients. The online submission option allows for quick and efficient processing, while mailing the completed form offers a traditional approach. For those who prefer face-to-face interactions, submitting the form in person at a designated Ontario Works office is also an option. Each method has its own advantages, and recipients should choose the one that best fits their circumstances and preferences.

Quick guide on how to complete ontario works income statement

Complete Ontario Works Income Statement with ease on any device

Digital document management has become popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow provides you with all the resources required to create, edit, and eSign your documents efficiently without delays. Manage Ontario Works Income Statement on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Ontario Works Income Statement effortlessly

- Find Ontario Works Income Statement and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and has the same legal validity as an ink signature.

- Review all the details and then click on the Done button to save your updates.

- Choose how you wish to send your form—via email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, exhausting searches for forms, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device. Modify and eSign Ontario Works Income Statement to ensure effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an ODSP income report form?

The ODSP income report form is a document that individuals receiving Ontario Disability Support Program benefits must complete to report their income. This form ensures that the reported income aligns with the requirements of the program, allowing for accurate benefit calculation. Using airSlate SignNow, you can easily and securely eSign your ODSP income report form online.

-

How does airSlate SignNow help with the ODSP income report form?

AirSlate SignNow simplifies the process of completing and submitting the ODSP income report form by providing an intuitive platform for electronic signatures and document management. The platform allows users to fill out, sign, and send their forms quickly, streamlining the administrative tasks associated with income reporting. With our solution, you can save time and reduce paperwork.

-

Is there a cost associated with using airSlate SignNow for the ODSP income report form?

AirSlate SignNow offers a cost-effective solution with various pricing plans to suit different needs. The plans are designed to provide value for businesses and individuals who frequently handle documents like the ODSP income report form. Check our pricing page for details on plans that fit your budget.

-

Can I integrate airSlate SignNow with other applications for managing the ODSP income report form?

Yes, airSlate SignNow offers robust integrations with an array of applications, including document storage and management systems. This means you can seamlessly manage your ODSP income report form alongside other essential business tools. Integrating these applications helps enhance workflow efficiency.

-

What are the benefits of using airSlate SignNow for the ODSP income report form?

Using airSlate SignNow for your ODSP income report form allows for quicker processing times due to our efficient eSigning features. Additionally, our platform enhances security through encryption and audit trails, ensuring that your sensitive information remains protected. Overall, it streamlines your compliance with regulatory requirements.

-

Is it easy to edit the ODSP income report form using airSlate SignNow?

Absolutely! AirSlate SignNow provides an easy-to-use editor that allows you to modify the ODSP income report form as needed. You can quickly fill out required fields, adjust information, and ensure that the document reflects your current income situation before sending it for eSignature.

-

How do I securely store my completed ODSP income report form?

Upon completion, airSlate SignNow automatically securely stores your ODSP income report form in the cloud. Our platform uses advanced security measures to protect your data, ensuring that you can access your forms anytime while maintaining compliance with privacy regulations. You can also download copies for your records.

Get more for Ontario Works Income Statement

- 5 areas model worksheet form

- Missouri divorce papers form

- Pet depot application form

- Indiana retirement medical benefits account form

- Lapf online statement form

- Lead based paint disclosure california pdf form

- Ok kids roster form fillable pdf sallisaw youth league

- Info sheet for applicants for a daad scholarship httpswww daad form

Find out other Ontario Works Income Statement

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document

- Help Me With Sign New Mexico Banking Word

- Help Me With Sign New Mexico Banking Document

- How Do I Sign New Mexico Banking Form

- How To Sign New Mexico Banking Presentation

- How Do I Sign New York Banking PPT

- Help Me With Sign Ohio Banking Document

- How To Sign Oregon Banking PDF

- Help Me With Sign Oregon Banking Presentation

- Can I Sign Pennsylvania Banking Form