Informacin Sobre El Formulario 1040 PRInternal Revenue Service

Understanding the Form 1040 PR

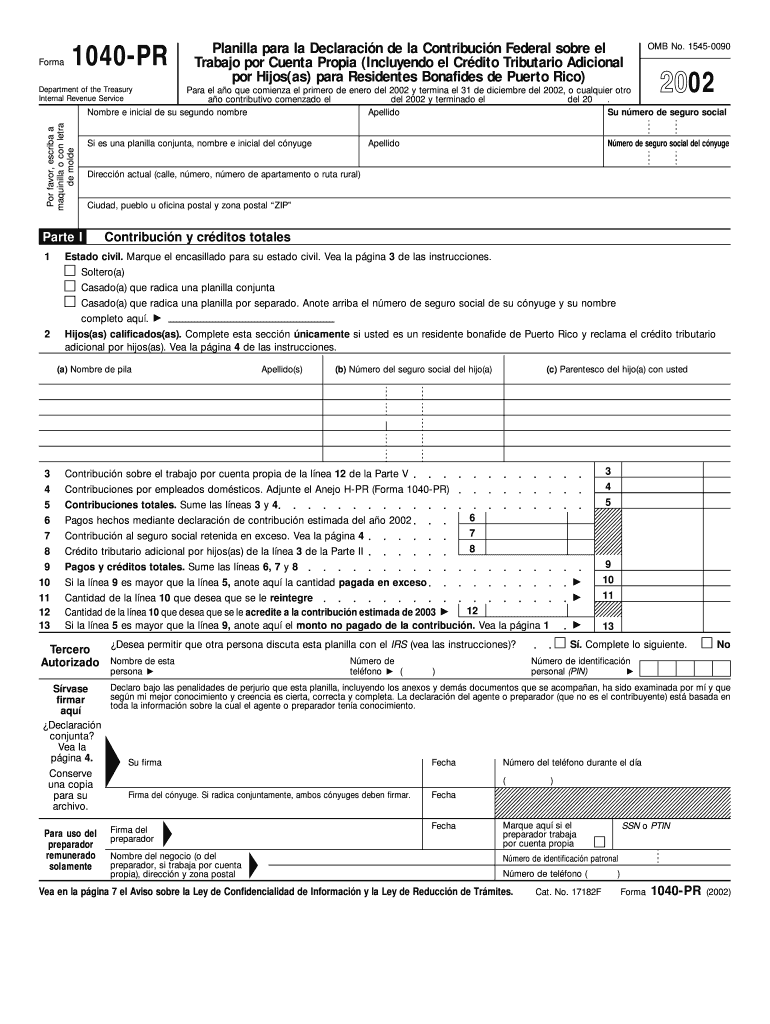

The Form 1040 PR is a crucial document for residents of Puerto Rico who need to report their income to the Internal Revenue Service (IRS). It serves as a tax return form for individuals, allowing them to declare their income, claim deductions, and calculate their tax liability. This form is specifically designed to accommodate the unique tax situation of residents in Puerto Rico, distinguishing it from the standard Form 1040 used on the mainland United States.

Steps to Complete the Form 1040 PR

Completing the Form 1040 PR involves several key steps:

- Gather necessary documents: Collect all relevant financial documents, including W-2 forms, 1099s, and any records of income or deductions.

- Fill in personal information: Enter your name, address, and Social Security number at the top of the form.

- Report income: List all sources of income, including wages, self-employment income, and any other earnings.

- Claim deductions: Identify and claim any eligible deductions to reduce your taxable income.

- Calculate tax liability: Use the tax tables provided with the form to determine the amount of tax owed or refund due.

- Sign and date the form: Ensure that you sign and date the form before submission.

Required Documents for Form 1040 PR

When preparing to file the Form 1040 PR, it is essential to have the following documents on hand:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of any other income sources

- Documentation for deductions, such as mortgage interest statements or medical expenses

- Proof of any tax credits you plan to claim

Filing Deadlines for Form 1040 PR

It is important to be aware of the filing deadlines to avoid penalties. The deadline for submitting the Form 1040 PR is typically April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also consider any extensions that may be available, which can provide additional time to file.

IRS Guidelines for Form 1040 PR

The IRS provides specific guidelines for completing and submitting the Form 1040 PR. These guidelines outline eligibility requirements, instructions for filling out the form, and information on how to address common issues that may arise during the filing process. Familiarizing yourself with these guidelines can help ensure compliance and reduce the likelihood of errors.

Penalties for Non-Compliance with Form 1040 PR

Failure to file the Form 1040 PR on time or inaccuracies in reporting can result in penalties. The IRS may impose fines for late submissions, and underreporting income can lead to additional taxes owed, along with interest and penalties. It is crucial to ensure that all information is accurate and submitted by the deadline to avoid these consequences.

Quick guide on how to complete planilla para la declaracin de la contribucin federal sobre el trabajo por cuenta propia incluyendo el crdito tributario

Complete Informacin Sobre El Formulario 1040 PRInternal Revenue Service seamlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without any hold-ups. Manage Informacin Sobre El Formulario 1040 PRInternal Revenue Service across any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Informacin Sobre El Formulario 1040 PRInternal Revenue Service without hassle

- Locate Informacin Sobre El Formulario 1040 PRInternal Revenue Service and click on Get Form to begin.

- Take advantage of the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure private information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, SMS, invitation link, or download it to your PC.

Forget about lost or misplaced files, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow manages all your document organization needs in just a few clicks from any device you choose. Modify and eSign Informacin Sobre El Formulario 1040 PRInternal Revenue Service to guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Spanish (language): How does one translate “Adoro en todo la voluntad de Dios para conmigo” into French?

The most common French traduction of the famous words of Juan Bautista is: "J'adore en toutes choses la conduite de Dieu à mon égard".

-

Returning from a short vacation in Mexico we breezed through customs without having to fill out a customs declaration, and without even a single question, only having to show our passports. How come?

It's just the way things are often done for US citizens returning home. Sometimes you'll get a question or three, sometimes not. They don't stamp your passports anymore when returning home, nor do you have to fill out a pen-and-ink customs declaration — just that kiosk thing. (Did you have to do that?)Everything is visible to the customs agents. They can see when you left the country. They know your passports are legit. They assume the reason you went to Mexico is obvious (short vacation). You don't fit any profile that would set off a red flag to them. Your bags have been scanned for obvious bad stuff, and probably sniffed by dogs. There's really not much for them to ask that they don't already know the answer to.For non-US citizens, it's a different story.

-

How can I download the book “La Mojito Diet (Spanish Edition): El método para bajar de peso en 14 días sin estrés y sin perderte la fiesta (Atria Espanol)”?

La Mojito Diet (Spanish Edition): El método para bajar de peso en 14 días sin estrés y sin perderte la fiesta (Atria Espanol)Concebida por el cardiólogo e internista Dr. Juan Rivera, quien entrenó en el Hospital de Johns Hopkins y ha ayudado a cientos de miles de individuos a bajar de peso, La Mojito Diet es un plan de 14 días que lo ayudará a perder libras, tener mayor movilidad y a obtener una mejor salud—todo mientras continúa disfrutando su vida.Al Dr. Juan Rivera le han dado todas las excusas: “No puedo dejar mis antojitos y gustazos”. “No soporto las punzadas de hambre”. “¡Vivimos en Miami, por el amor de Dios! ¡No me pida que sacrifique a mis mojitos!” Después de muchas de estas conversaciones, el Dr. Juan creó La Mojito Diet.Diseñado para ayudarte a ver resultados duraderos en tan solo 14 días, La Mojito Diet combina en dos pasos sencillos los mejores consejos disponibles sobre la pérdida de peso —reducir el consumo de carbohidratos e incorporar el ayuno intermitente— en este plan único y efectivo para quemar grasa y mejorar tu salud del corazón sin darte la ansiedad por comer carbohidratos o sentirte con hambre.Incluyendo motivadores consejos, inspiradores testimonios de éxito, 75 deliciosas recetas con sabor latino y un plan de alimentación, La Mojito Diet te brinda las herramientas que necesitas para para poder transformar tu salud y fácilmente conservar tu peso ideal con gusto.

-

How does La Boulange de Palo Alto compare to other coffee shops in Palo Alto?

Much more delicious pastries than Coupa, Philz, Cafe Venetia, or Prolific Oven have to offer. More French than Paris Baguette's pastries, amusingly (since PB is actually Korean-run), but comparable quality-wise. I'm not even counting Starbucks or Peets.Good selection of brunch and lunch items; it's more substantial than just a coffee shop, and the food quality is good. Coupa has a more extensive menu but a lot of that is variation within the same types of items (paninis, crepes, arepas, etc.). Paris Baguette has a short menu of sandwiches and salads prepared fresh and a lot of pre-packaged items, all of which are pretty tasty, but those feel like afterthought additions to the bakery.Lattes are better than at Cafe Venetia and much better than at Coupa, Paris Baguette, Prolific Oven, or Starbucks. Much. Coupa's and PB's are always burnt, although the latte art makes up for it. Prolific Oven and Starbucks are just mediocre although I don't know how to articulate their mediocrity. Philz doesn't have a menu of espresso drinks so it's hard to compare.No wifi of their own (!!!) but PalantirEvents is usually available and hopefully will remain so. Philz, Prolific Oven, Paris Baguette, Starbucks, and Peets always have wifi. Coupa and Cafe Venetia have wifi on weekdays. Closes early: 7pm. The others generally close sometime between 10-11pm.

-

To all the ladies out there who wear La Perla bras and panties? How much better fit and support does La Perla give than Victoria Secret?

La Perla gives a more luxurious feel compared to Victoria secret in my opinion; it regularly features elaborate lace work and intricate details that Victoria Secret can not offer. But that being said if you want to add cups to your bra (padding that makes it appear you have bigger breasts) than Victoria secret is the way to go. Although La Perla has push up bras and padded options, it really docent add size to the overall breast size appearance like Victoria secret does. It can though offer great cleavage, fit, and support. La Perla uses some of the finest materials and fabrics that can accentuate your body features thanks to their great designers.For panties Victoria Secret offers a wide range from comfort, to sporty, to lacy and beautiful. Where as La Perla mainly focuses on everyday and lacy styles.Overall if you want something that can be shown off and will be as visually appealing as it is comfortable then La Perla is your better option, but if you just want something you can wear around the house or for comfort Victoria Secret might be a better choice.

Create this form in 5 minutes!

How to create an eSignature for the planilla para la declaracin de la contribucin federal sobre el trabajo por cuenta propia incluyendo el crdito tributario

How to make an electronic signature for the Planilla Para La Declaracin De La Contribucin Federal Sobre El Trabajo Por Cuenta Propia Incluyendo El Crdito Tributario online

How to create an eSignature for the Planilla Para La Declaracin De La Contribucin Federal Sobre El Trabajo Por Cuenta Propia Incluyendo El Crdito Tributario in Chrome

How to make an electronic signature for signing the Planilla Para La Declaracin De La Contribucin Federal Sobre El Trabajo Por Cuenta Propia Incluyendo El Crdito Tributario in Gmail

How to create an eSignature for the Planilla Para La Declaracin De La Contribucin Federal Sobre El Trabajo Por Cuenta Propia Incluyendo El Crdito Tributario from your mobile device

How to create an electronic signature for the Planilla Para La Declaracin De La Contribucin Federal Sobre El Trabajo Por Cuenta Propia Incluyendo El Crdito Tributario on iOS devices

How to generate an electronic signature for the Planilla Para La Declaracin De La Contribucin Federal Sobre El Trabajo Por Cuenta Propia Incluyendo El Crdito Tributario on Android OS

People also ask

-

What is the Informacin Sobre El Formulario 1040 PRInternal Revenue Service?

The Informacin Sobre El Formulario 1040 PRInternal Revenue Service refers to guidance and details regarding the U.S. tax return form for Puerto Rico residents. It is essential for accurately reporting income and calculating taxes owed. Understanding this form can help ensure compliance with tax regulations.

-

How does airSlate SignNow help with the Informacin Sobre El Formulario 1040 PRInternal Revenue Service?

airSlate SignNow simplifies the process of signing and sending documents related to the Informacin Sobre El Formulario 1040 PRInternal Revenue Service. With our platform, you can easily collect signatures from multiple parties, ensuring that all necessary documentation is completed efficiently and securely.

-

What are the pricing options for airSlate SignNow related to the Informacin Sobre El Formulario 1040 PRInternal Revenue Service?

airSlate SignNow offers flexible pricing plans tailored to meet various business needs, including those related to the Informacin Sobre El Formulario 1040 PRInternal Revenue Service. You can choose from monthly or annual subscriptions, ensuring you only pay for what you need while gaining access to powerful eSigning features.

-

What features does airSlate SignNow provide for managing Informacin Sobre El Formulario 1040 PRInternal Revenue Service documents?

airSlate SignNow provides robust features for managing Informacin Sobre El Formulario 1040 PRInternal Revenue Service documents, including customizable templates, automated workflows, and real-time tracking. These tools enhance efficiency and help ensure that all forms are completed accurately and promptly.

-

Can I integrate airSlate SignNow with other software for Informacin Sobre El Formulario 1040 PRInternal Revenue Service?

Yes, airSlate SignNow seamlessly integrates with various software applications that can assist in managing Informacin Sobre El Formulario 1040 PRInternal Revenue Service. This includes popular platforms like Google Drive, Dropbox, and CRM systems, allowing for a smooth workflow.

-

What benefits does airSlate SignNow offer for businesses focusing on Informacin Sobre El Formulario 1040 PRInternal Revenue Service?

By using airSlate SignNow for managing Informacin Sobre El Formulario 1040 PRInternal Revenue Service, businesses benefit from increased efficiency, reduced paperwork, and enhanced compliance. Our solution streamlines the document signing process, saving time and resources.

-

Is airSlate SignNow secure for handling Informacin Sobre El Formulario 1040 PRInternal Revenue Service data?

Absolutely! airSlate SignNow prioritizes security, utilizing advanced encryption and compliance measures to protect sensitive data, including Informacin Sobre El Formulario 1040 PRInternal Revenue Service information. You can trust us to keep your documents safe and secure.

Get more for Informacin Sobre El Formulario 1040 PRInternal Revenue Service

Find out other Informacin Sobre El Formulario 1040 PRInternal Revenue Service

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist