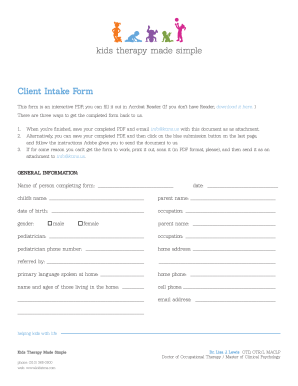

Client Intake Form Kids Therapy Made Simple

Understanding the Credit Form

The credit form is a vital document used for various financial transactions, including loan applications, credit requests, and payment processing. It serves as a formal request for credit or financial assistance from a lending institution or service provider. This form typically requires personal information, financial details, and the purpose of the credit request. Understanding the structure and requirements of the credit form can help ensure that all necessary information is accurately provided, facilitating a smoother approval process.

Steps to Complete the Credit Form

Completing the credit form involves several key steps to ensure accuracy and compliance. Start by gathering all necessary personal and financial information, including your Social Security number, income details, and employment history. Next, carefully fill out each section of the form, ensuring that all fields are completed as required. Double-check for any errors or omissions before submission. Finally, review the form for any additional documents that may need to accompany your submission, such as identification or proof of income.

Legal Use of the Credit Form

The legal use of the credit form is governed by various regulations that ensure consumer protection and fair lending practices. In the United States, laws such as the Fair Credit Reporting Act (FCRA) and the Equal Credit Opportunity Act (ECOA) provide guidelines on how credit forms should be handled. These regulations mandate that lenders must disclose the terms of credit and ensure that all applicants are treated fairly, regardless of their background. Understanding these legal frameworks can help users navigate the credit application process more effectively.

Required Documents for Submission

When submitting a credit form, certain documents are typically required to support your application. These may include:

- Proof of identity, such as a driver's license or passport

- Recent pay stubs or tax returns to verify income

- Bank statements to demonstrate financial stability

- Any additional documentation requested by the lender

Having these documents ready can expedite the review process and increase the likelihood of approval.

Examples of Using the Credit Form

The credit form can be utilized in various scenarios, such as applying for a personal loan, requesting a credit card, or seeking financing for a major purchase. For instance, individuals may fill out a credit form when applying for a mortgage to buy a home, providing detailed financial information to help lenders assess their creditworthiness. Additionally, businesses may use credit forms to apply for lines of credit to manage cash flow or invest in growth opportunities.

Digital vs. Paper Version of the Credit Form

With the rise of technology, the credit form is now available in both digital and paper formats. The digital version offers convenience, allowing users to fill out and submit the form online, which can speed up the processing time. Conversely, the paper version may still be required by some institutions or for specific applications. Understanding the differences between these formats can help users choose the best option for their needs.

Potential Penalties for Non-Compliance

Failure to comply with the requirements associated with the credit form can lead to various penalties, including denial of the credit application or potential legal consequences. It is essential to ensure that all information provided is accurate and complete to avoid complications. Additionally, misrepresentation or fraudulent information can result in severe repercussions, including damage to credit scores and legal action from lenders.

Quick guide on how to complete client intake form kids therapy made simple

Effortlessly Prepare Client Intake Form Kids Therapy Made Simple on Any Device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the appropriate format and securely save it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly and without issues. Manage Client Intake Form Kids Therapy Made Simple on any device using airSlate SignNow's Android or iOS applications and simplify your document-based tasks today.

How to Edit and eSign Client Intake Form Kids Therapy Made Simple with Ease

- Locate Client Intake Form Kids Therapy Made Simple and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize signNow sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which only takes a few seconds and bears the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

No more worries about lost or misplaced documents, tedious form searching, or errors requiring new document prints. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Client Intake Form Kids Therapy Made Simple and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a credit form and how can it be used in airSlate SignNow?

A credit form is a document that facilitates the application and processing of credit transactions. With airSlate SignNow, you can create, send, and eSign credit forms easily, ensuring a streamlined workflow for your financial operations. This powerful tool helps businesses manage credit applications efficiently.

-

Are there any costs associated with using credit forms in airSlate SignNow?

Yes, using credit forms within airSlate SignNow does come with a subscription fee based on the chosen plan. However, the solution is designed to be cost-effective, allowing businesses to manage documents without breaking the bank. Each plan offers unique features, making it easy to find one that fits your budget and needs.

-

What features does airSlate SignNow offer for processing credit forms?

airSlate SignNow provides a variety of features for handling credit forms, including customizable templates, automated workflows, and secure eSigning. These features enable businesses to streamline their credit application processes, reduce paperwork, and enhance efficiency. Additionally, the platform is user-friendly, which simplifies the creation of credit forms.

-

How does airSlate SignNow ensure the security of my credit forms?

Security is a top priority at airSlate SignNow. The platform employs advanced encryption, secure storage, and authentication protocols to protect your credit forms and sensitive information. This ensures a safe eSigning experience for all users, giving you peace of mind as you manage your credit documents.

-

Can I integrate credit forms created in airSlate SignNow with other applications?

Absolutely! airSlate SignNow offers seamless integrations with various third-party applications, including CRM systems and cloud storage solutions. This allows you to incorporate your credit forms into your existing workflows, enhancing productivity and collaboration across platforms.

-

How can airSlate SignNow help improve the turnaround time for credit forms?

With airSlate SignNow, the turnaround time for credit forms is signNowly improved through features like automated notifications and reminders. This means that once a credit form is sent for signature, your customers are promptly reminded to complete it, allowing for faster processing. This efficiency helps businesses serve their clients better and increase overall satisfaction.

-

What mobile capabilities does airSlate SignNow offer for credit forms?

airSlate SignNow is designed to work seamlessly on mobile devices, allowing users to create, send, and eSign credit forms from anywhere. This mobile flexibility ensures that you can manage your credit documentation even while on the go. The responsive design guarantees that all features are accessible and user-friendly on smartphones and tablets.

Get more for Client Intake Form Kids Therapy Made Simple

Find out other Client Intake Form Kids Therapy Made Simple

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word