Fha Loan Contingency Exhibit Form

What is the FHA Loan Contingency Exhibit

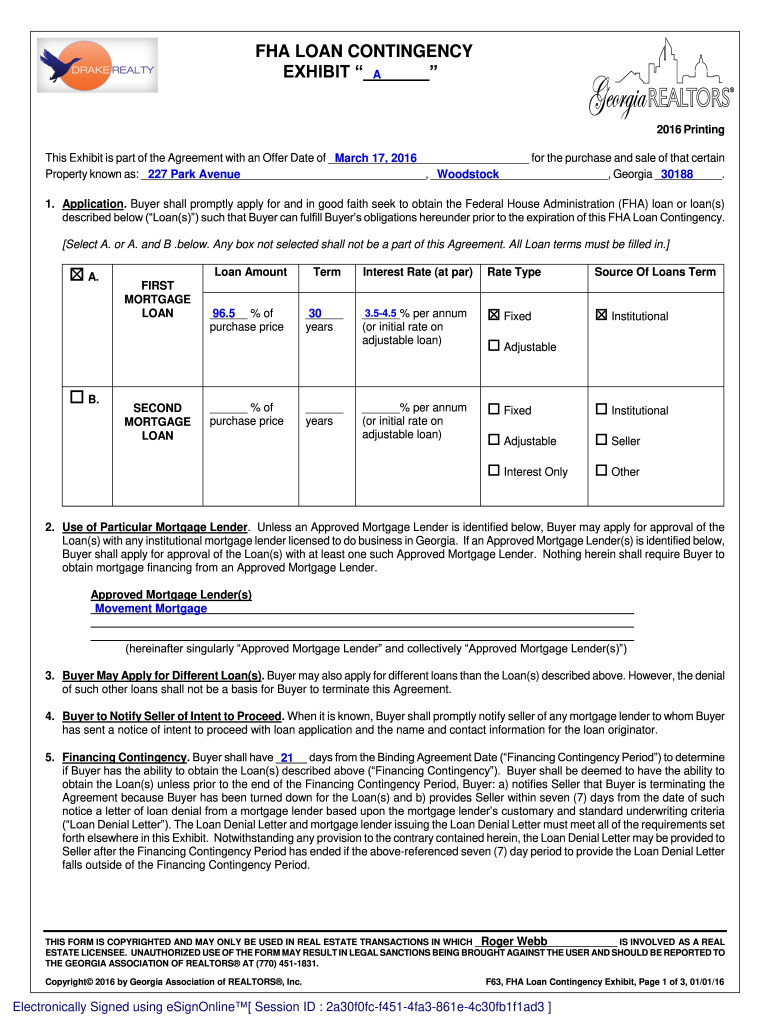

The FHA loan contingency exhibit is a critical component in real estate transactions involving Federal Housing Administration (FHA) loans. This document outlines the conditions under which a buyer can withdraw from a purchase agreement without penalty if specific requirements are not met. It serves to protect the buyer's interests, ensuring that they are not obligated to proceed with the purchase if financing falls through or if the property does not meet FHA standards. Understanding this exhibit is essential for both buyers and sellers in the FHA loan process.

Key Elements of the FHA Loan Contingency Exhibit

Several key elements must be included in the FHA loan contingency exhibit to ensure its effectiveness. These elements typically include:

- Financing Terms: Clear details about the loan amount, interest rate, and any other financing specifics.

- Property Condition: Requirements that the property must meet to qualify for FHA financing, including safety and livability standards.

- Timeframe: A specified period during which the buyer can secure financing and complete necessary inspections.

- Withdrawal Conditions: Circumstances under which the buyer can withdraw from the contract without facing penalties.

Incorporating these elements helps ensure that both parties understand their obligations and rights throughout the transaction.

Steps to Complete the FHA Loan Contingency Exhibit

Completing the FHA loan contingency exhibit involves several important steps:

- Gather Information: Collect all necessary details about the property and financing options.

- Fill Out the Exhibit: Accurately complete the exhibit, ensuring all required elements are included.

- Review with Professionals: Consult with real estate agents or legal advisors to verify that the exhibit meets all legal requirements.

- Obtain Signatures: Ensure that all parties involved in the transaction sign the exhibit to make it legally binding.

Following these steps can help facilitate a smoother transaction process and protect the interests of all parties involved.

Legal Use of the FHA Loan Contingency Exhibit

The FHA loan contingency exhibit is legally binding when completed correctly and signed by all parties. To ensure its legal validity, it must comply with federal and state laws governing real estate transactions. This includes adherence to the regulations set forth by the FHA and relevant local statutes. Proper execution of the exhibit protects buyers from potential financial loss and provides clarity regarding the terms of the purchase agreement.

Examples of Using the FHA Loan Contingency Exhibit

Practical examples of the FHA loan contingency exhibit can help illustrate its importance. For instance, if a buyer is interested in purchasing a home but discovers that the property requires significant repairs that exceed FHA standards, the buyer can invoke the contingency to withdraw from the contract. Another example is when a buyer is unable to secure financing within the specified timeframe due to changes in their financial situation. In both cases, the exhibit provides a clear path for the buyer to exit the agreement without penalty.

Quick guide on how to complete fha loan contingency exhibit

Complete Fha Loan Contingency Exhibit seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed materials, allowing you to easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Handle Fha Loan Contingency Exhibit on any device using airSlate SignNow's Android or iOS applications and simplify your document-driven processes today.

The easiest way to alter and electronically sign Fha Loan Contingency Exhibit hassle-free

- Find Fha Loan Contingency Exhibit and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Select pertinent sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Decide how you would like to send your form—via email, SMS, invitation link, or download it to your computer.

Eliminate the stress of lost or misfiled documents, tedious form searches, or errors requiring new document copies. airSlate SignNow meets all your document management needs with just a few clicks from your preferred device. Modify and electronically sign Fha Loan Contingency Exhibit to ensure clear communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fha loan contingency exhibit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an FHA loan contingency exhibit?

An FHA loan contingency exhibit is a document that outlines specific conditions under which a purchase agreement can be terminated or amended in relation to FHA loan approval. It protects both buyers and sellers by clarifying the requirements and timelines associated with financing through an FHA loan.

-

How does the FHA loan contingency exhibit benefit buyers?

The FHA loan contingency exhibit provides buyers with peace of mind by ensuring they are not legally bound to a purchase if they cannot secure financing through an FHA loan. This exhibit also gives buyers the opportunity to negotiate terms and understand their responsibilities during the loan process.

-

Are there any fees associated with the FHA loan contingency exhibit?

Typically, there are no direct fees associated with obtaining an FHA loan contingency exhibit itself. However, buyers should consider additional costs related to FHA loans and appraisals when negotiating the terms set forth in the exhibit.

-

Can airSlate SignNow facilitate the creation of an FHA loan contingency exhibit?

Yes, airSlate SignNow offers tools that enable users to easily create and customize an FHA loan contingency exhibit. Our platform provides templates and features that simplify the document preparation process, making it accessible for all users.

-

Is the FHA loan contingency exhibit necessary for all home buyers?

While the FHA loan contingency exhibit is critical for buyers utilizing FHA loans, it may not be necessary for all home buyers. Assessing your financing options and understanding your agreement's terms can determine the need for this exhibit.

-

How does the FHA loan contingency exhibit affect the home buying process?

The FHA loan contingency exhibit impacts the home buying process by setting clear expectations for both parties. It allows buyers to manage their financing timeline effectively while ensuring that sellers are aware of potential delays related to loan approval, making the overall experience smoother.

-

What happens if the FHA loan contingency exhibit is triggered?

If the FHA loan contingency exhibit is triggered, the contract allows for specific procedures to follow, such as renegotiation of terms or termination of the purchase agreement without penalty. This safeguard ensures that buyers do not lose their earnest money if financing fails.

Get more for Fha Loan Contingency Exhibit

- Catering contract click here love amp war in texas form

- Volunteer information form smyth county public schools scsb

- Highline christian church youth group permission and release highlinechristian form

- Sports agent contract template form

- Sport contract template form

- Sports bet contract template form

- Sports coach contract template form

- Sports contract template 787755879 form

Find out other Fha Loan Contingency Exhibit

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF