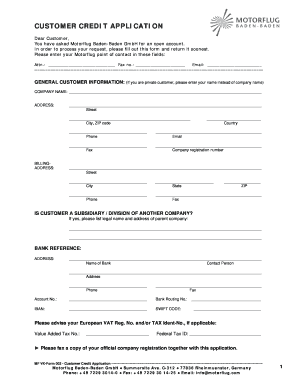

Customer Credit Application Form

What is the Customer Credit Application Form

The customer credit application form is a document used by businesses to assess the creditworthiness of potential customers. This form collects essential information, including personal identification details, financial history, and employment status. By evaluating this information, businesses can make informed decisions regarding credit limits and payment terms. The form is crucial for establishing a formal agreement between the customer and the business, ensuring transparency and accountability in financial transactions.

Steps to Complete the Customer Credit Application Form

Completing the customer credit application form involves several key steps:

- Gather necessary information: Collect personal details such as your name, address, Social Security number, and employment information.

- Provide financial details: Include information about your income, existing debts, and any assets you may have.

- Review terms and conditions: Read through the credit terms provided by the business to understand your obligations.

- Sign the form: Ensure you provide a valid signature, which may be required for legal validation.

- Submit the form: Choose your preferred submission method, whether online, by mail, or in person.

Legal Use of the Customer Credit Application Form

The customer credit application form must comply with various legal standards to be considered valid. In the United States, electronic signatures are recognized under the ESIGN Act and UETA, ensuring that digitally signed documents hold the same legal weight as traditional paper forms. It is essential to ensure that the form is completed accurately and that all necessary disclosures are made to avoid potential legal issues. Businesses must also adhere to privacy regulations, safeguarding the personal information provided by applicants.

Key Elements of the Customer Credit Application Form

Several key elements are vital to the customer credit application form:

- Personal information: Name, address, and contact details.

- Financial information: Income, expenses, and existing debts.

- Employment details: Current employer, job title, and length of employment.

- Credit history: Information regarding past credit accounts and payment history.

- Consent for credit checks: Authorization for the business to obtain credit reports from credit bureaus.

How to Use the Customer Credit Application Form

Using the customer credit application form is straightforward. First, download the new customer credit application form PDF or access it online. Fill out the required fields with accurate information, ensuring that all sections are completed. Once filled, review the form for any errors or omissions. After confirming that all information is correct, submit the form according to the specified submission method. Keep a copy for your records, as it may be needed for future reference or verification.

Required Documents

When completing the customer credit application form, certain documents may be required to support your application. Commonly required documents include:

- Proof of identity: A government-issued ID, such as a driver's license or passport.

- Proof of income: Recent pay stubs, tax returns, or bank statements.

- Credit history documentation: Any relevant information regarding previous credit accounts.

Quick guide on how to complete customer credit application form

Prepare Customer Credit Application Form effortlessly on any gadget

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal environmentally-friendly substitute to conventional printed and signed documents, allowing you to access the necessary format and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and efficiently. Manage Customer Credit Application Form on any device with airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to alter and eSign Customer Credit Application Form with ease

- Obtain Customer Credit Application Form and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to preserve your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form retrieval, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Customer Credit Application Form to ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the new customer credit application form pdf?

The new customer credit application form pdf is a document designed for businesses to assess the creditworthiness of potential customers. It simplifies the application process, making it easier to collect necessary information and documentation.

-

How can I access the new customer credit application form pdf?

You can easily access the new customer credit application form pdf through the airSlate SignNow platform. Simply sign up for an account, and you can create, customize, and download the application form in PDF format to meet your specific needs.

-

Is there a cost associated with using the new customer credit application form pdf?

While the new customer credit application form pdf itself is free to create, there may be costs associated with premium features and integrations on the airSlate SignNow platform. Check our pricing plans to find the best option for your business.

-

What are the benefits of using the new customer credit application form pdf?

Using the new customer credit application form pdf provides several benefits, including increased efficiency in processing applications and reduced errors associated with manual data entry. Additionally, it allows for electronic signatures, speeding up the overall approval process.

-

Can the new customer credit application form pdf be integrated with other software?

Yes, the new customer credit application form pdf can be seamlessly integrated with various business tools such as CRM systems and accounting software. This integration enhances workflow efficiency, allowing for easier data sharing and management.

-

How secure is the new customer credit application form pdf?

The new customer credit application form pdf is secured through airSlate SignNow's robust encryption and security protocols. This ensures that all sensitive customer information is protected during transmission and storage, giving you peace of mind.

-

Can I customize the new customer credit application form pdf?

Absolutely! You can customize the new customer credit application form pdf in airSlate SignNow to include your branding, specific questions, and any terms relevant to your business. This flexibility ensures the form suits your criteria perfectly.

Get more for Customer Credit Application Form

Find out other Customer Credit Application Form

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form