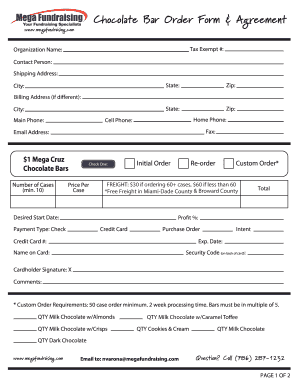

Chocolate Bar Order Form Amp Agreement

What is the schedule card?

The schedule card is a specific document used primarily for tax purposes in the United States. It helps taxpayers organize and report various types of income and deductions accurately. This form is essential for individuals who need to provide detailed information about their financial activities, ensuring compliance with IRS regulations. The schedule card can include various sections, such as income sources, tax credits, and deductions, allowing for a comprehensive overview of a taxpayer's financial situation.

How to use the schedule card

Using the schedule card involves several straightforward steps. First, gather all necessary financial documents, including W-2s, 1099s, and receipts for deductible expenses. Next, fill out the schedule card by entering relevant information in the designated fields. It's crucial to ensure accuracy, as errors can lead to delays or penalties. After completing the form, review it carefully for any mistakes. Finally, submit the schedule card along with your tax return by the appropriate deadline to ensure compliance with IRS requirements.

Steps to complete the schedule card

Completing the schedule card requires a systematic approach to ensure all information is accurate and complete. Follow these steps:

- Gather all necessary documents, including income statements and receipts.

- Fill in your personal information at the top of the schedule card, including your name and Social Security number.

- Detail your income sources in the designated sections, ensuring you include all relevant figures.

- List any deductions or credits you are eligible for, providing supporting information as needed.

- Double-check all entries for accuracy before finalizing the document.

- Submit the completed schedule card with your tax return by the deadline.

Legal use of the schedule card

The schedule card serves a critical legal function in the tax filing process. It is recognized by the IRS as a valid document for reporting income and deductions. To ensure its legal standing, it must be completed accurately and submitted on time. Failure to do so can result in penalties, including fines or audits. Additionally, maintaining copies of the schedule card and supporting documents is advisable for future reference and compliance verification.

Filing Deadlines / Important Dates

Filing deadlines for the schedule card align with the overall tax return submission dates set by the IRS. Typically, individual taxpayers must file their federal tax returns by April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It's essential to stay informed about any changes to these dates, as timely submission is crucial for avoiding penalties and ensuring compliance with tax laws.

Required Documents

To complete the schedule card accurately, several documents are required. These typically include:

- W-2 forms from employers, detailing annual earnings.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses, such as medical bills or charitable contributions.

- Any other relevant financial statements that support income or deductions claimed.

Penalties for Non-Compliance

Non-compliance with the requirements associated with the schedule card can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential audits by the IRS. It's important to ensure that the schedule card is completed accurately and submitted by the deadline to avoid these consequences. Understanding the potential penalties can motivate taxpayers to adhere to tax regulations diligently.

Quick guide on how to complete chocolate bar order form amp agreement

Complete Chocolate Bar Order Form Amp Agreement effortlessly on any gadget

Web-based document management has increasingly gained traction among organizations and individuals. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, allowing you to access the correct form and securely keep it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly without delays. Handle Chocolate Bar Order Form Amp Agreement on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to edit and eSign Chocolate Bar Order Form Amp Agreement without hassle

- Obtain Chocolate Bar Order Form Amp Agreement and then click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your updates.

- Choose how you prefer to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Leave behind lost or mislaid files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Chocolate Bar Order Form Amp Agreement and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a schedule card and how does it work?

A schedule card is a digital tool that allows users to organize and manage appointments or tasks effectively. With airSlate SignNow, you can create and share schedule cards seamlessly, enabling better collaboration and communication in your team.

-

How much does it cost to create a schedule card with airSlate SignNow?

AirSlate SignNow offers flexible pricing plans that cater to different business needs. Creating a schedule card is easy and cost-effective, ensuring you have access to the features you need without breaking your budget.

-

Can I customize my schedule card using airSlate SignNow?

Yes, airSlate SignNow allows you to customize your schedule card with various templates and branding options. This flexibility means you can create schedule cards that reflect your brand while providing important information to your clients or team members.

-

Is it easy to integrate schedule cards with other applications?

Absolutely! AirSlate SignNow offers seamless integrations with numerous applications, enabling you to connect your schedule card with your existing workflows. This makes it easier to manage your documents and appointments all in one place.

-

What features are included when creating a schedule card?

When creating a schedule card with airSlate SignNow, you'll have access to features like electronic signatures, document tracking, and template creation. These tools ensure that your scheduling process is efficient and user-friendly.

-

How can a schedule card benefit my business?

A schedule card enhances organization and communication within your business, allowing team members to coordinate their tasks efficiently. By using airSlate SignNow's schedule card, you can streamline processes, reduce missed appointments, and improve overall productivity.

-

Is airSlate SignNow secure for managing my schedule cards?

Yes, airSlate SignNow prioritizes security and compliance, ensuring your schedule cards and documents are protected. With advanced encryption and access control, you can confidently manage and share your sensitive information.

Get more for Chocolate Bar Order Form Amp Agreement

Find out other Chocolate Bar Order Form Amp Agreement

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format