Bill of Sale to a Motor Vehicle Harris County Tax Office Form

What is the bill of sale to a motor vehicle Harris County tax office?

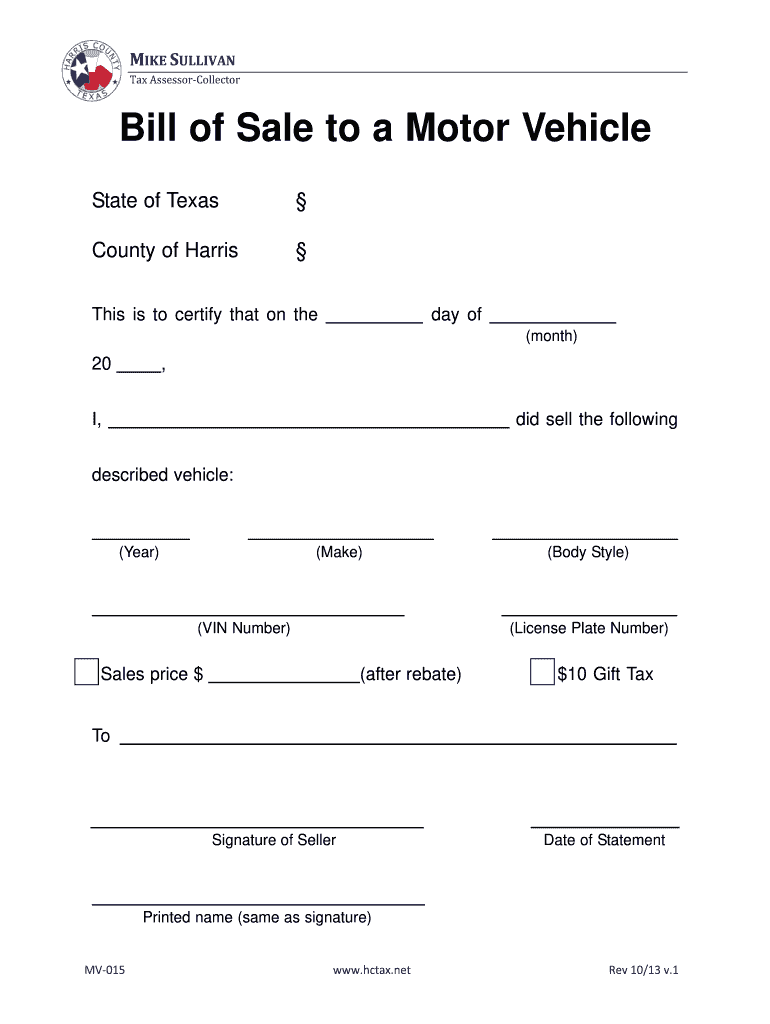

The bill of sale to a motor vehicle Harris County tax office form is a legal document that serves as proof of the transfer of ownership of a motor vehicle from one party to another. This document is essential for both buyers and sellers, as it provides a record of the transaction and protects the interests of both parties. In Harris County, this form must include specific details such as the vehicle's make, model, year, Vehicle Identification Number (VIN), and the names and addresses of the buyer and seller. It is crucial for ensuring that the transaction is recognized by the state and for facilitating the registration process with the local tax office.

Steps to complete the bill of sale to a motor vehicle Harris County tax office

Completing the bill of sale to a motor vehicle Harris County tax office form involves several key steps to ensure its validity and compliance with local regulations. Follow these steps:

- Gather necessary information, including the vehicle's make, model, year, and VIN.

- Collect personal details of both the buyer and seller, including full names and addresses.

- Clearly state the purchase price and any terms of the sale, such as payment methods.

- Both parties should review the document for accuracy before signing.

- Sign and date the bill of sale in the presence of a witness or a notary public, if required.

Key elements of the bill of sale to a motor vehicle Harris County tax office

To ensure that the bill of sale to a motor vehicle Harris County tax office form is legally binding, it must contain several key elements:

- Vehicle Information: Include the make, model, year, and VIN of the vehicle.

- Buyer and Seller Details: Full names and addresses of both parties involved in the transaction.

- Purchase Price: Clearly state the agreed-upon price for the vehicle.

- Signatures: Both the buyer and seller must sign the document to validate the transaction.

- Date of Sale: Indicate the date when the sale takes place.

Legal use of the bill of sale to a motor vehicle Harris County tax office

The legal use of the bill of sale to a motor vehicle Harris County tax office form is crucial for establishing ownership and protecting the rights of both the buyer and seller. This document serves as evidence in case of disputes regarding ownership or the condition of the vehicle. It is also necessary for the buyer to register the vehicle with the Harris County tax office and obtain a new title. Additionally, having a properly executed bill of sale can be beneficial for tax purposes, as it provides documentation of the transaction amount for potential deductions or assessments.

How to obtain the bill of sale to a motor vehicle Harris County tax office

Obtaining the bill of sale to a motor vehicle Harris County tax office form is a straightforward process. You can access this form through several methods:

- Visit the Harris County tax office website to download a printable version of the form.

- Request a physical copy at the Harris County tax office during business hours.

- Consult with a local dealership or legal professional who may provide a template or assistance in completing the form.

Digital vs. paper version of the bill of sale to a motor vehicle Harris County tax office

Both digital and paper versions of the bill of sale to a motor vehicle Harris County tax office form are legally acceptable, provided they meet the necessary requirements. The digital version offers convenience, allowing for easy completion and storage. It can be signed electronically, which may expedite the process. On the other hand, a paper version may be preferred by those who wish to have a physical copy for their records. Regardless of the format chosen, it is essential to ensure that all required information is accurately filled out and that both parties retain a copy of the signed document.

Quick guide on how to complete bill of sale to a motor vehicle harris county tax office

Effortlessly Prepare Bill Of Sale To A Motor Vehicle Harris County Tax Office on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly and without delays. Handle Bill Of Sale To A Motor Vehicle Harris County Tax Office on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Way to Edit and eSign Bill Of Sale To A Motor Vehicle Harris County Tax Office with Ease

- Locate Bill Of Sale To A Motor Vehicle Harris County Tax Office and click on Get Form to begin.

- Utilize the resources we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to share your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs within mere clicks from any device you prefer. Edit and eSign Bill Of Sale To A Motor Vehicle Harris County Tax Office and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a bill of sale in Harris County?

A bill of sale in Harris County is a legal document that outlines the terms of a transaction between a buyer and a seller. This document serves as proof of transfer of ownership for personal property, including vehicles and other signNow assets. Ensuring you have a properly formatted bill of sale is essential to fulfill legal requirements in Harris County.

-

How can I create a bill of sale for Harris County using airSlate SignNow?

You can easily create a bill of sale for Harris County using airSlate SignNow by utilizing our customizable templates. Simply choose the bill of sale template, input the necessary details, and our user-friendly platform will guide you through the eSigning process. This streamlines the creation and signing of your document, making it efficient and hassle-free.

-

What are the benefits of using airSlate SignNow for my bill of sale in Harris County?

Using airSlate SignNow for your bill of sale in Harris County offers numerous benefits, including ease of use, cost savings, and enhanced security. Our platform allows you to securely sign documents online, eliminating the need for paper and reducing time spent on transactions. Additionally, you can track the status of your bill of sale in real-time.

-

Is there a fee to eSign a bill of sale in Harris County with airSlate SignNow?

Yes, airSlate SignNow offers a subscription-based model, providing affordable options to eSign a bill of sale in Harris County. You can choose from various plans that best suit your needs, depending on the volume of documents you need to handle. Overall, using our platform is a cost-effective solution compared to traditional methods.

-

Can I integrate airSlate SignNow with other applications for handling my bill of sale in Harris County?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing you to manage your bill of sale in Harris County more effectively. By connecting with tools like Google Drive, Dropbox, or CRM platforms, you can enhance your workflow and document management process, making it easier to gather necessary details and collaborate.

-

What is the process for signing a bill of sale in Harris County using airSlate SignNow?

The process for signing a bill of sale in Harris County with airSlate SignNow is straightforward. After creating your document, you can send it to the other party for their eSignature. Our platform notifies both parties when the document is ready, making it simple to finalize transactions securely and efficiently.

-

Do I need an attorney to create a bill of sale in Harris County?

While it's not legally required to have an attorney create a bill of sale in Harris County, it can be beneficial for complex transactions. Using airSlate SignNow, you can easily generate a customized bill of sale that meets legal requirements without costly consultation fees. However, consulting a legal professional is advisable for high-value transactions.

Get more for Bill Of Sale To A Motor Vehicle Harris County Tax Office

- Rosacea diary form

- St marys maligaon form

- Return to work doctors note form

- Caseys adp 100316209 form

- Ira accumulation trust sample language secure act form

- Immunization record sheet form

- Assured shorthold tenancy agreement template 2 crm students form

- Cash assistance program for immigrants capi form

Find out other Bill Of Sale To A Motor Vehicle Harris County Tax Office

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple