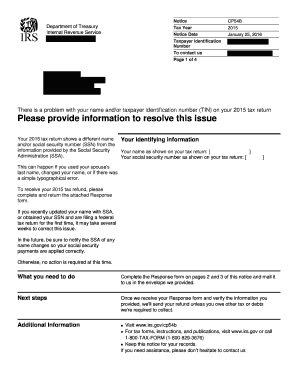

There is a Problem with Your Name Andor Taxpayer Identification Number TIN on Your Tax Return Irs Form

What makes the there is a problem with your name andor taxpayer identification number tin on your 2015 tax return irs form legally valid?

As the society ditches in-office working conditions, the execution of paperwork more and more happens electronically. The there is a problem with your name andor taxpayer identification number tin on your 2015 tax return irs form isn’t an any different. Working with it using digital means differs from doing this in the physical world.

An eDocument can be viewed as legally binding given that certain needs are met. They are especially crucial when it comes to stipulations and signatures associated with them. Entering your initials or full name alone will not guarantee that the institution requesting the form or a court would consider it accomplished. You need a reliable tool, like airSlate SignNow that provides a signer with a digital certificate. In addition to that, airSlate SignNow maintains compliance with ESIGN, UETA, and eIDAS - main legal frameworks for eSignatures.

How to protect your there is a problem with your name andor taxpayer identification number tin on your 2015 tax return irs form when filling out it online?

Compliance with eSignature laws is only a fraction of what airSlate SignNow can offer to make form execution legitimate and safe. Furthermore, it gives a lot of possibilities for smooth completion security wise. Let's quickly go through them so that you can be assured that your there is a problem with your name andor taxpayer identification number tin on your 2015 tax return irs form remains protected as you fill it out.

- SOC 2 Type II and PCI DSS certification: legal frameworks that are set to protect online user data and payment details.

- FERPA, CCPA, HIPAA, and GDPR: leading privacy regulations in the USA and Europe.

- Two-factor authentication: adds an extra layer of protection and validates other parties identities through additional means, such as an SMS or phone call.

- Audit Trail: serves to catch and record identity authentication, time and date stamp, and IP.

- 256-bit encryption: transmits the information safely to the servers.

Filling out the there is a problem with your name andor taxpayer identification number tin on your 2015 tax return irs form with airSlate SignNow will give greater confidence that the output template will be legally binding and safeguarded.

Quick guide on how to complete there is a problem with your name andor taxpayer identification number tin on your 2015 tax return irs

Accomplish There Is A Problem With Your Name Andor Taxpayer Identification Number TIN On Your Tax Return Irs effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can obtain the necessary form and securely archive it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage There Is A Problem With Your Name Andor Taxpayer Identification Number TIN On Your Tax Return Irs on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The simplest method to modify and eSign There Is A Problem With Your Name Andor Taxpayer Identification Number TIN On Your Tax Return Irs seamlessly

- Find There Is A Problem With Your Name Andor Taxpayer Identification Number TIN On Your Tax Return Irs and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign tool, which takes moments and carries the same legal authority as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred delivery method for the form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Adjust and eSign There Is A Problem With Your Name Andor Taxpayer Identification Number TIN On Your Tax Return Irs to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is cp54b in relation to airSlate SignNow?

Cp54b is a crucial feature of airSlate SignNow that optimizes document signing and processing efficiency. It allows businesses to streamline their workflow, making it easier to manage contracts and approvals. This ensures timely completion of important documents, enhancing overall productivity.

-

How can cp54b benefit my business?

The cp54b feature of airSlate SignNow signNowly enhances your business operations by automating document workflows. This not only saves time but also reduces the chances of errors associated with manual signing processes. By implementing cp54b, you can expect increased efficiency and faster turnaround times for contract approvals.

-

What is the pricing structure for cp54b features?

AirSlate SignNow offers competitive pricing plans that include the cp54b functionalities, catering to various business needs. Depending on your requirements, you can choose from different tiers that provide essential tools for document management and electronic signing. Check our pricing page for detailed information on plans that include cp54b.

-

Can cp54b integrate with other software tools?

Yes, cp54b in airSlate SignNow is designed to integrate seamlessly with various software applications. Whether you use CRM systems, project management tools, or cloud storage solutions, cp54b ensures that your document processes are connected and streamlined. This integration capability enhances overall productivity across your platforms.

-

Is cp54b suitable for small businesses?

Absolutely! The cp54b feature of airSlate SignNow is tailored to meet the needs of small businesses looking for efficient document management solutions. Its user-friendly interface and cost-effectiveness make it an ideal choice for startups and small enterprises aiming to optimize their workflows without incurring high expenses.

-

What types of documents can I manage using cp54b?

With cp54b in airSlate SignNow, you can manage a wide range of documents, including contracts, agreements, and forms. This feature enables you to upload, send, and get documents signed electronically, making it versatile for various business scenarios. Simplifying document management through cp54b is a game changer for many organizations.

-

What security measures are in place for cp54b?

AirSlate SignNow prioritizes security, and the cp54b feature includes several safeguards to protect your documents. This includes encryption of sensitive data, as well as compliance with major industry standards. Rest assured that with cp54b, your documents are handled with the utmost security throughout the signing process.

Get more for There Is A Problem With Your Name Andor Taxpayer Identification Number TIN On Your Tax Return Irs

- Medical history form lily med spa

- Cas 9 line template form

- Scatter plot correlation and line of best fit exam form

- Fidelity cancer screening reimbursement form

- Embalming case report pdf form

- Patient forms texas oncology

- Applicant reference check form west houston medical center

- Physicians written statement medical surveillance for asbestos form

Find out other There Is A Problem With Your Name Andor Taxpayer Identification Number TIN On Your Tax Return Irs

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free

- eSignature Pennsylvania Sales Invoice Template Secure