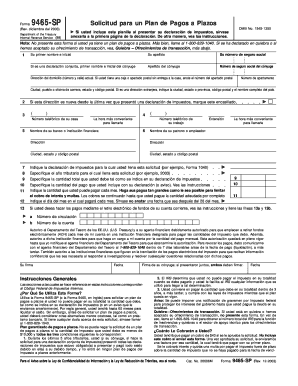

Form 9465SP Rev December Installment Agreement Request Spanish

Understanding the Vehicle Reimbursement Form

The vehicle reimbursement form is a critical document used by businesses to reimburse employees for expenses incurred while using their personal vehicles for work-related purposes. This form typically requires details such as the employee's name, the purpose of the trip, mileage driven, and any associated costs. Proper completion of this form ensures that reimbursements are processed accurately and in compliance with company policies.

Key Elements of the Vehicle Reimbursement Form

When filling out a vehicle reimbursement form, several key elements must be included to ensure its validity:

- Employee Information: Full name, department, and contact details.

- Trip Details: Date, purpose of the trip, and destination.

- Mileage: Total miles driven, calculated from the starting point to the destination.

- Expenses: Any additional costs, such as tolls or parking fees, should be itemized.

Steps to Complete the Vehicle Reimbursement Form

Completing the vehicle reimbursement form involves several straightforward steps:

- Gather all necessary information, including trip details and receipts for expenses.

- Fill in your personal information at the top of the form.

- Clearly outline each trip, including dates, mileage, and purpose.

- Itemize any additional expenses related to the trip.

- Review the completed form for accuracy before submission.

Legal Use of the Vehicle Reimbursement Form

The vehicle reimbursement form must adhere to legal standards to be considered valid. This includes ensuring that the information provided is accurate and that the form is signed by the employee and an authorized company representative. Compliance with tax regulations is also essential, as reimbursements may need to be reported as part of the employee's taxable income.

Filing Deadlines and Important Dates

It is important to be aware of any deadlines associated with submitting the vehicle reimbursement form. Each company may have specific time frames for submission, often requiring forms to be submitted within a certain period after the expenses were incurred. Adhering to these deadlines ensures timely reimbursement and compliance with company policies.

Form Submission Methods

The vehicle reimbursement form can typically be submitted through various methods, including:

- Online Submission: Many companies offer digital platforms for submitting forms electronically.

- Mail: Employees may also send completed forms via postal service.

- In-Person: Some organizations allow employees to submit forms directly to their finance or HR departments.

Quick guide on how to complete form 9465sp rev december 2003 installment agreement request spanish

Effortlessly Prepare Form 9465SP Rev December Installment Agreement Request Spanish on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute to conventional printed and signed documents, as you can locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 9465SP Rev December Installment Agreement Request Spanish on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Modify and eSign Form 9465SP Rev December Installment Agreement Request Spanish with Ease

- Locate Form 9465SP Rev December Installment Agreement Request Spanish and then click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal significance as a traditional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you would like to share your form, by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Edit and eSign Form 9465SP Rev December Installment Agreement Request Spanish to ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a vehicle reimbursement form?

A vehicle reimbursement form is a document used by businesses to reimburse employees for expenses related to the use of their personal vehicles for work purposes. This form typically includes details like mileage, purpose of the trip, and dates of travel. Using airSlate SignNow, you can easily create and send digital vehicle reimbursement forms for quick approval and processing.

-

How can airSlate SignNow help with vehicle reimbursement forms?

airSlate SignNow simplifies the process of creating, sending, and signing vehicle reimbursement forms. With our platform, you can customize forms to meet your company's unique needs and allow for electronic signatures, making it faster and more efficient for both employees and administrators. This streamlines the reimbursement process and helps reduce errors.

-

Is there a cost to use the vehicle reimbursement form feature?

Yes, while airSlate SignNow offers a range of pricing plans, the ability to create and manage vehicle reimbursement forms is included in all subscription tiers. This means you get access to all the features necessary for effective document management at an affordable price. Review our pricing options to find the best fit for your business.

-

Can I integrate vehicle reimbursement forms with other software?

Absolutely! airSlate SignNow supports integrations with various applications and software, allowing you to sync your vehicle reimbursement forms with your HR or accounting systems. This makes it simple to track expenses and manage reimbursements across platforms, enhancing your operational efficiency.

-

What are the benefits of using an electronic vehicle reimbursement form?

Using an electronic vehicle reimbursement form saves time and reduces paperwork. With airSlate SignNow, you can quickly send forms for signatures, track their status in real-time, and store them digitally for easy access. This not only speeds up the reimbursement process but also minimizes the risk of lost or misplaced documents.

-

How secure is my information when using airSlate SignNow for vehicle reimbursement forms?

Security is a top priority at airSlate SignNow. When you use our platform to manage vehicle reimbursement forms, your data is protected with industry-standard encryption and secure cloud storage. Our compliance with regulatory standards ensures that your sensitive information remains confidential and safe.

-

Can multiple users manage vehicle reimbursement forms in airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate and manage vehicle reimbursement forms effectively. You can assign roles and permissions to ensure the right people have access to edit or approve forms. This collaborative feature enhances workflow and ensures that all necessary stakeholders are involved in the process.

Get more for Form 9465SP Rev December Installment Agreement Request Spanish

Find out other Form 9465SP Rev December Installment Agreement Request Spanish

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now