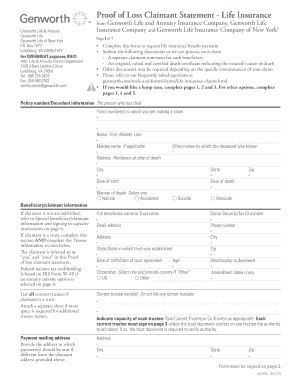

Proof of Loss Claimant Statement Life Insurance Genworth Form

What is the Proof of Loss Statement for Life Insurance?

The Proof of Loss Statement is a crucial document used in life insurance claims. It serves as a formal declaration by the claimant detailing the circumstances surrounding the loss, including the date of death and the relationship to the deceased. This statement is essential for the insurance carrier to process the claim efficiently. It typically includes information such as the policy number, the claimant's contact details, and any relevant documentation that supports the claim. Understanding this form is vital for ensuring that all necessary information is provided to facilitate a smooth claims process.

Steps to Complete the Proof of Loss Statement for Life Insurance

Completing the Proof of Loss Statement requires careful attention to detail. Here are the key steps to follow:

- Gather necessary information: Collect the policy number, the deceased's details, and any supporting documents, such as a death certificate.

- Fill out the form: Provide accurate information in each section of the form, ensuring that all required fields are completed.

- Review the form: Double-check all entries for accuracy and completeness to avoid delays in processing.

- Submit the form: Send the completed Proof of Loss Statement to the insurance company through the preferred method, whether online, by mail, or in person.

Key Elements of the Proof of Loss Statement for Life Insurance

Several key elements must be included in the Proof of Loss Statement to ensure its validity. These elements typically include:

- Claimant's information: Name, address, and relationship to the deceased.

- Policy details: The insurance policy number and the name of the insurance company.

- Details of the loss: Date of death, cause of death, and any other relevant circumstances.

- Supporting documentation: Attach copies of necessary documents, such as the death certificate and any medical records if applicable.

Legal Use of the Proof of Loss Statement for Life Insurance

The Proof of Loss Statement holds legal significance as it is often required by insurance companies to process claims. By submitting this form, the claimant affirms the truthfulness of the information provided, which can be subject to verification. It is essential to ensure that the statement is completed accurately and honestly, as any discrepancies may lead to delays or denial of the claim. Additionally, the form must comply with relevant state laws and regulations governing insurance claims.

Form Submission Methods for the Proof of Loss Statement

Submitting the Proof of Loss Statement can be done through various methods, depending on the insurance company's preferences. Common submission methods include:

- Online submission: Many insurance companies offer a secure online portal for submitting claims and related documents.

- Mail: The completed form can be sent via postal service to the designated claims department of the insurance company.

- In-person submission: Claimants may also choose to deliver the form directly to a local office of the insurance provider.

Examples of Using the Proof of Loss Statement for Life Insurance

Understanding how to utilize the Proof of Loss Statement effectively can enhance the claims process. For instance:

- A spouse filing a claim after the death of their partner will need to complete the form accurately, detailing their relationship and attaching the death certificate.

- A parent claiming benefits for a deceased child must provide the necessary documentation, including proof of guardianship if applicable.

- In cases involving multiple beneficiaries, each individual may need to submit their own Proof of Loss Statement to ensure all claims are processed correctly.

Quick guide on how to complete proof of loss claimant statement life insurance genworth

Prepare Proof Of Loss Claimant Statement Life Insurance Genworth effortlessly on any device

Online document management has gained popularity among companies and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed papers, as you can obtain the correct form and securely keep it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents quickly without delays. Manage Proof Of Loss Claimant Statement Life Insurance Genworth on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to change and eSign Proof Of Loss Claimant Statement Life Insurance Genworth with ease

- Obtain Proof Of Loss Claimant Statement Life Insurance Genworth and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight signNow parts of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Proof Of Loss Claimant Statement Life Insurance Genworth and ensure outstanding communication at every stage of your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an 'of loss statement form' used for?

An 'of loss statement form' is a financial document that helps businesses outline their losses within a specific time frame. This form is essential for understanding the financial health of a company and is often required for tax purposes or insurance claims. By utilizing airSlate SignNow, businesses can efficiently manage and send these forms to stakeholders.

-

How can airSlate SignNow help with the 'of loss statement form'?

airSlate SignNow simplifies the process of creating, sending, and eSigning your 'of loss statement form'. The platform allows you to customize your forms easily, ensuring all necessary information is captured accurately. Additionally, it provides robust security features to protect sensitive financial information.

-

Is there a free trial for using the 'of loss statement form' feature?

Yes, airSlate SignNow offers a free trial that allows you to test the full capabilities of the 'of loss statement form' functionality. This trial period enables you to experience how easy it is to create and manage your documents without any initial investment. Simply sign up to explore all the features.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes, including options for basic and advanced features for managing the 'of loss statement form'. The pricing is transparent and based on the number of users, ensuring you pay only for what you need. Discounts are often available for annual subscriptions.

-

Can I integrate airSlate SignNow with other software for my 'of loss statement form'?

Absolutely! airSlate SignNow provides seamless integrations with various software solutions such as CRM systems and accounting tools. This makes it easier for you to manage your 'of loss statement form' alongside other business processes, enhancing overall productivity and efficiency.

-

What features does airSlate SignNow offer for the 'of loss statement form'?

The platform offers numerous features for the 'of loss statement form', including customizable templates, eSignatures, and automated workflows. You can easily track the status of your forms and receive notifications when they've been viewed or signed. These features streamline the documentation process and reduce turnaround times.

-

Is my data secure when using the 'of loss statement form' on airSlate SignNow?

Yes, airSlate SignNow prioritizes data security, employing advanced encryption methods to protect your 'of loss statement form' and other sensitive documents. Compliance with industry standards ensures that your information is kept safe and confidential. You can trust our platform to handle your important data securely.

Get more for Proof Of Loss Claimant Statement Life Insurance Genworth

- Netherland visa application form pdf

- Berg balance test pdf form

- Recibo de pagamento autonomo pdf form

- Ap physics c mechanics multiple choice pdf form

- Isp form

- Printable pain management forms

- Pch health wa gov aumediaaffix patient identification label here and overleaf form

- Au incident notification queensland form

Find out other Proof Of Loss Claimant Statement Life Insurance Genworth

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors