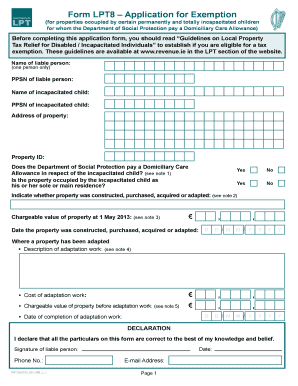

Form LPT8 Application for Exemption

What is the Form LPT8 Application For Exemption

The Form LPT8 Application for Exemption is a document used by individuals or entities seeking to apply for a specific exemption under applicable laws. This form allows applicants to request relief from certain obligations or fees, which may vary based on jurisdiction and the nature of the exemption sought. Understanding the purpose of this form is crucial for ensuring compliance with legal requirements and for successfully navigating the application process.

How to use the Form LPT8 Application For Exemption

Using the Form LPT8 Application for Exemption involves several key steps. First, ensure that you meet the eligibility criteria for the exemption you are applying for. Next, gather all necessary documentation that supports your application. Complete the form accurately, providing all required information. Once filled out, submit the form according to the specified submission methods, which may include online, mail, or in-person options.

Steps to complete the Form LPT8 Application For Exemption

Completing the Form LPT8 Application for Exemption requires careful attention to detail. Follow these steps:

- Review the eligibility criteria for the exemption.

- Collect supporting documents, such as identification or proof of income.

- Fill out the form, ensuring all sections are completed accurately.

- Double-check for any errors or omissions.

- Submit the form through the designated method.

Key elements of the Form LPT8 Application For Exemption

Several key elements are essential to the Form LPT8 Application for Exemption. These include:

- Applicant's personal information, including name and address.

- Details regarding the specific exemption being requested.

- Supporting documentation that validates the claim.

- Signature of the applicant, affirming the accuracy of the information provided.

Eligibility Criteria

To qualify for the Form LPT8 Application for Exemption, applicants must meet specific eligibility criteria. These criteria can include factors such as income level, residency status, and the nature of the exemption being sought. It is important to review the guidelines carefully to determine if you meet the necessary requirements before submitting your application.

Form Submission Methods (Online / Mail / In-Person)

The Form LPT8 Application for Exemption can typically be submitted through various methods. Applicants may have the option to submit the form online via a designated portal, by mailing a physical copy to the appropriate agency, or delivering it in person. Each submission method may have different processing times and requirements, so it is advisable to choose the method that best suits your needs and timeline.

Quick guide on how to complete form lpt8 application for exemption

Complete Form LPT8 Application For Exemption effortlessly on any device

Online document management has become increasingly favored by organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage Form LPT8 Application For Exemption on any device with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest method to modify and eSign Form LPT8 Application For Exemption without hassle

- Locate Form LPT8 Application For Exemption and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your adjustments.

- Choose how you want to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns of missing or lost documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from a device of your choosing. Edit and eSign Form LPT8 Application For Exemption and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What features does airSlate SignNow offer for managing documents in a home bedroom setting?

airSlate SignNow provides a range of features that streamline document management for various environments, including a home bedroom. Users can easily send, receive, and eSign documents using a user-friendly interface. The platform also supports document templates, reminders, and status tracking, ensuring you stay organized without clutter in your home bedroom.

-

How does airSlate SignNow improve efficiency in a home bedroom office?

By using airSlate SignNow, individuals working from their home bedroom can signNowly enhance their workflow. The electronic signing process eliminates the need for physical paperwork and printing, saving time and resources. This digital solution allows for quick approvals and seamless collaboration, maximizing productivity in your home bedroom environment.

-

What are the pricing options for airSlate SignNow tailored for home bedroom users?

airSlate SignNow offers various pricing plans that accommodate different needs, including individual users in a home bedroom. These plans are designed to be affordable while providing the essential features required for efficient document signing and management. You can choose a plan based on your expected volume of work, ensuring cost-effectiveness for your home bedroom setup.

-

Can airSlate SignNow integrate with other applications commonly used in a home bedroom?

Yes, airSlate SignNow seamlessly integrates with popular applications that many users utilize in their home bedrooms. Whether it's cloud storage services, email clients, or productivity tools, these integrations enhance your document workflow. This interoperability helps maintain a smooth operational flow while keeping your home bedroom organized.

-

What are the benefits of using airSlate SignNow for a small business run from home bedroom?

For small business owners operating from their home bedroom, airSlate SignNow offers numerous benefits, including cost savings and enhanced professionalism. It allows for straightforward electronic signatures, reducing the time spent on document tasks. This not only improves efficiency but also creates a polished image for clients, all within the comfort of your home bedroom.

-

Is airSlate SignNow secure for handling sensitive documents in a home bedroom?

Absolutely! Security is a top priority for airSlate SignNow, especially for users managing sensitive documents in a home bedroom. With advanced encryption protocols and compliance with industry standards, your documents are protected against unauthorized access. You can trust that your information remains safe while you work in your home bedroom.

-

How can I get started with airSlate SignNow from my home bedroom?

Getting started with airSlate SignNow from your home bedroom is simple and straightforward. You can sign up online by selecting the plan that fits your needs and follow the onboarding process that guides you through the platform's features. Once set up, you can immediately begin sending and eSigning documents right from your home bedroom.

Get more for Form LPT8 Application For Exemption

Find out other Form LPT8 Application For Exemption

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe