Abuse or Molestation InsuranceSexual Misconduct NAS Insurance Form

What is molestation insurance?

Molestation insurance, often referred to as abuse or sexual misconduct insurance, is a type of liability coverage designed to protect organizations and individuals from claims related to sexual abuse or misconduct. This insurance is particularly relevant for institutions that work with vulnerable populations, such as schools, daycares, and non-profit organizations. It provides financial protection against legal fees, settlements, and judgments that may arise from allegations of molestation or abuse.

How to obtain molestation insurance

Obtaining molestation insurance involves several steps. First, organizations should assess their specific needs based on their operations and the populations they serve. Next, they should research different insurance providers that specialize in this type of coverage. It is essential to compare policies, coverage limits, and exclusions to ensure adequate protection. After selecting a provider, organizations will need to complete an application, which may require detailed information about their operations, staff training, and risk management practices. Finally, organizations should review the policy terms carefully before signing to ensure they understand their coverage and obligations.

Key elements of molestation insurance

When considering molestation insurance, several key elements should be understood:

- Coverage Limits: This defines the maximum amount the insurer will pay for claims. Organizations should choose limits that reflect their potential exposure.

- Exclusions: Policies may contain specific exclusions that outline situations or types of claims that are not covered. Understanding these is crucial for effective risk management.

- Legal Defense Costs: Many policies cover legal defense costs, which can be substantial in cases of alleged abuse. This coverage is vital for protecting an organization's financial health.

- Claims-Made vs. Occurrence Policies: Claims-made policies cover claims only if the policy is active when the claim is made, while occurrence policies cover claims based on when the incident occurred, regardless of when the claim is filed.

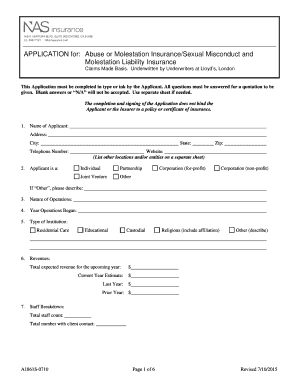

Steps to complete the molestation insurance application

Completing the application for molestation insurance typically involves the following steps:

- Gather Documentation: Collect necessary documentation, including organizational policies, training records, and safety protocols.

- Complete the Application: Fill out the application form with accurate information regarding the organization's operations, staff, and risk management strategies.

- Submit the Application: Send the completed application to the chosen insurance provider along with any required documentation.

- Review the Proposal: Once the insurer reviews the application, they will provide a proposal outlining coverage options and premiums.

- Finalize the Policy: After reviewing the proposal, organizations can negotiate terms if necessary and finalize the policy by signing the agreement and making the initial payment.

Legal use of molestation insurance

Molestation insurance must be utilized in compliance with applicable laws and regulations. Organizations should ensure that their policies meet state-specific requirements and adhere to industry standards. It is essential to maintain accurate records of all training and safety protocols, as these can be crucial in defending against claims. Additionally, organizations should regularly review and update their insurance coverage to reflect any changes in operations or regulations.

State-specific rules for molestation insurance

Each state may have different regulations regarding molestation insurance, including mandatory coverage requirements and specific legal standards for claims. Organizations should consult with legal experts or insurance professionals familiar with their state’s laws to ensure compliance. Understanding these regulations can help organizations avoid potential legal pitfalls and ensure that they have adequate protection in place.

Quick guide on how to complete abuse or molestation insurancesexual misconduct nas insurance

Easily Prepare Abuse Or Molestation InsuranceSexual Misconduct NAS Insurance on Any Device

Managing documents online has gained traction among businesses and individuals. It presents a perfect eco-friendly replacement for conventional printed and signed documents, allowing you to acquire the necessary form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any hold-ups. Handle Abuse Or Molestation InsuranceSexual Misconduct NAS Insurance on any device using airSlate SignNow’s Android or iOS applications and streamline any document-driven process today.

How to Modify and eSign Abuse Or Molestation InsuranceSexual Misconduct NAS Insurance with Ease

- Locate Abuse Or Molestation InsuranceSexual Misconduct NAS Insurance and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or an invitation link, or download it to your computer.

Say goodbye to misplaced files, cumbersome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Abuse Or Molestation InsuranceSexual Misconduct NAS Insurance and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is molestation insurance and why is it important?

Molestation insurance is a type of liability insurance designed to protect businesses and organizations from claims related to abuse or molestation. It is vital for institutions like schools, camps, and childcare facilities, as it helps safeguard against financial losses due to lawsuits and settlements.

-

How much does molestation insurance typically cost?

The cost of molestation insurance varies based on factors such as the size of the organization, the coverage limits, and the specific risks involved. On average, premiums can range from a few hundred to several thousand dollars annually, depending on your requirements.

-

What features should I look for in molestation insurance?

When selecting molestation insurance, look for features such as comprehensive coverage for legal fees, settlements, and counseling services. Additionally, consider options for increased coverage limits and endorsements based on your organization's operations and environment.

-

How can molestation insurance benefit my organization?

Having molestation insurance provides financial protection and peace of mind for your organization. It shows commitment to safeguarding the welfare of your clients, and may enhance your reputation, making it easier to attract clients and partners.

-

Do I need molestation insurance if I already have general liability insurance?

While general liability insurance covers a range of claims, it typically does not include coverage for molestation claims. Therefore, it is crucial to have specialized molestation insurance to ensure comprehensive protection against specific risks associated with abuse.

-

Can molestation insurance cover incidents occurring off-site?

Yes, many policies for molestation insurance can cover incidents that occur off-site, as long as they are related to your organization's activities. Check the specifics of your policy to ensure you have the necessary coverage for off-site events.

-

How do I choose the right provider for molestation insurance?

When selecting a provider for molestation insurance, consider their experience in the nonprofit or service sector, customer reviews, and financial stability. It's also beneficial to work with brokers who specialize in nonprofit or liability insurance to ensure tailored solutions.

Get more for Abuse Or Molestation InsuranceSexual Misconduct NAS Insurance

Find out other Abuse Or Molestation InsuranceSexual Misconduct NAS Insurance

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now