Ca Statement Income Ontario Form

What is the Ca Statement Income Ontario

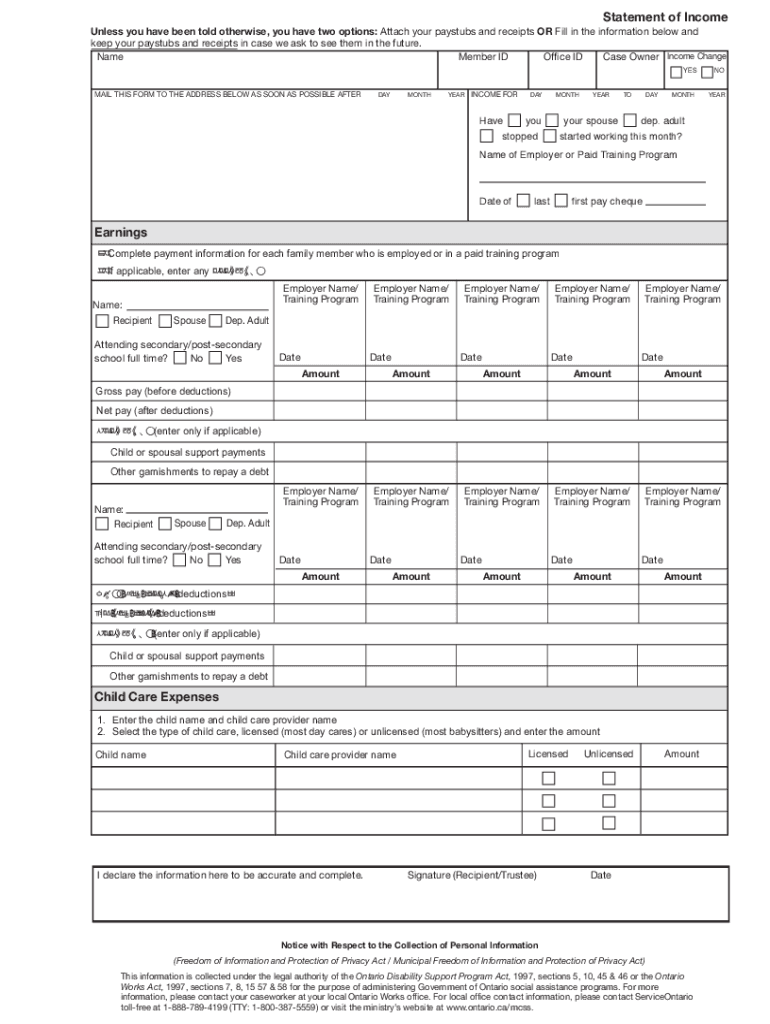

The Ca Statement Income Ontario is a financial document used to report income for individuals receiving assistance from Ontario Works. This form provides a detailed account of the income received during a specified period, which is essential for determining eligibility for social assistance programs. It includes various sources of income, such as employment earnings, pensions, and other benefits, ensuring that recipients receive the correct amount of support based on their financial situation.

How to obtain the Ca Statement Income Ontario

To obtain the Ca Statement Income Ontario, individuals can request it through their local Ontario Works office. Typically, the office will provide guidance on the process, which may include filling out specific forms or providing identification. It is important to ensure that the request is made within the appropriate timeframe to avoid delays in receiving assistance. Additionally, some individuals may have the option to download the form online from official government websites.

Steps to complete the Ca Statement Income Ontario

Completing the Ca Statement Income Ontario involves several key steps:

- Gather necessary documents: Collect all relevant income information, including pay stubs, tax returns, and any other income sources.

- Fill out the form: Accurately enter all required information, ensuring that income amounts are clearly stated and supported by documentation.

- Review for accuracy: Double-check all entries to ensure there are no mistakes that could affect eligibility.

- Submit the form: Follow the submission guidelines provided by your Ontario Works office, whether online, by mail, or in person.

Legal use of the Ca Statement Income Ontario

The Ca Statement Income Ontario serves as a legally binding document when completed and submitted correctly. It is crucial for recipients to provide truthful and accurate information, as any discrepancies may lead to penalties or loss of benefits. The form must comply with relevant laws and regulations governing social assistance in Ontario, ensuring that it is used appropriately within the framework of the Ontario Works program.

Key elements of the Ca Statement Income Ontario

Key elements of the Ca Statement Income Ontario include:

- Personal Information: Name, address, and identification details of the individual.

- Income Details: Comprehensive listing of all income sources, including amounts and dates received.

- Signature: A declaration that the information provided is accurate, requiring the signature of the individual completing the form.

- Submission Date: The date when the form is submitted, which is important for record-keeping and compliance.

Examples of using the Ca Statement Income Ontario

Examples of using the Ca Statement Income Ontario include:

- Individuals applying for Ontario Works benefits must submit this form to demonstrate their financial need.

- Recipients may need to update their income information periodically to ensure continued eligibility for assistance.

- It can be used to verify income when applying for other social services or benefits.

Quick guide on how to complete ca statement income ontario

Complete Ca Statement Income Ontario effortlessly on any device

Digital document management has become increasingly favored among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow provides all the resources you need to create, modify, and electronically sign your documents quickly without delays. Manage Ca Statement Income Ontario on any device with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign Ca Statement Income Ontario easily

- Find Ca Statement Income Ontario and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Edit and electronically sign Ca Statement Income Ontario and guarantee excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a CA Statement Income Ontario?

A CA Statement Income Ontario is a financial summary that outlines the income and related deductions for individuals and businesses in Ontario. It is vital for tax filing and helps in understanding your overall financial position. Utilizing an efficient solution like airSlate SignNow can streamline the documentation required for these statements.

-

How can airSlate SignNow help with CA Statement Income Ontario documents?

AirSlate SignNow provides a user-friendly platform for creating, sending, and eSigning your CA Statement Income Ontario documents. The platform ensures your documents are compliant and secure, simplifying the process of managing your income statements. This results in quicker approvals and improved efficiency.

-

What features does airSlate SignNow offer for managing CA Statement Income Ontario?

AirSlate SignNow offers features such as eSigning, document templates, and secure storage that are perfect for managing CA Statement Income Ontario. You can easily customize templates for income statements and track their status in real-time. Additionally, the platform helps in maintaining compliance with provincial regulations.

-

Is airSlate SignNow cost-effective for businesses filing CA Statement Income Ontario?

Yes, airSlate SignNow is a cost-effective solution for businesses that need to handle CA Statement Income Ontario documents. With tiered pricing plans, you can choose the one that best fits your needs without compromising on quality or features. This affordability makes it ideal for both small and large enterprises.

-

Can airSlate SignNow integrate with accounting software for CA Statement Income Ontario?

Absolutely! AirSlate SignNow can easily integrate with various accounting software, simplifying the process of generating and managing your CA Statement Income Ontario. This integration helps in automatically importing necessary data, reducing errors and saving you valuable time. You can seamlessly connect your accounting tools and enhance your productivity.

-

What are the benefits of eSigning CA Statement Income Ontario with airSlate SignNow?

ESigning your CA Statement Income Ontario with airSlate SignNow offers several benefits such as enhanced security, quicker turnaround times, and a fully digital workflow. The platform's legally binding eSignature feature ensures your documents are valid and compliant. This accelerates your business processes and can lead to faster financial decisions.

-

How secure is airSlate SignNow for handling CA Statement Income Ontario documents?

AirSlate SignNow takes security seriously, employing advanced encryption and authentication methods to protect your CA Statement Income Ontario documents. All data is securely stored and complies with industry standards, ensuring that your sensitive information remains confidential. You can confidently manage your financial documents knowing they're in safe hands.

Get more for Ca Statement Income Ontario

- General maintenance test questions and answers pdf form

- Ohp 6610 community partner assistance consent form

- Fattura proforma pdf

- Murray and roberts application form

- Capital blue cross enrollment form

- A wagon of shoes summary form

- Printable ptax 300 h form

- Portal ct govform207f1217pdfform 207f ct gov connecticuts official state website

Find out other Ca Statement Income Ontario

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template