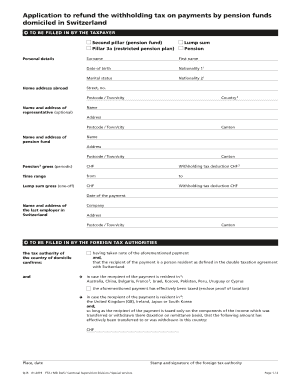

Form Q is Application to Refund the Withholding Tax on Payments by Pension Funds Domiciled in Switzerland

What is the Form Q IS Application To Refund The Withholding Tax On Payments By Pension Funds Domiciled In Switzerland

The Form Q IS is specifically designed for individuals and entities seeking to reclaim withholding tax on payments made by pension funds that are based in Switzerland. This form is essential for ensuring that taxpayers can recover excess taxes that may have been withheld on their income or investment returns. Understanding the purpose of this form is crucial for anyone involved in international finance or investments linked to Swiss pension funds.

Steps to complete the Form Q IS Application To Refund The Withholding Tax On Payments By Pension Funds Domiciled In Switzerland

Completing the Form Q IS involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including proof of the withholding tax paid and identification details. Next, fill out the form with precise information, including your personal details and the specifics of the payments received. It is important to review the form for any errors before submission. Finally, submit the completed form to the appropriate tax authority, either electronically or by mail, depending on the guidelines provided.

Eligibility Criteria

To qualify for a refund using the Form Q IS, applicants must meet specific eligibility criteria. Generally, this includes being a taxpayer who has had withholding tax deducted from payments made by Swiss pension funds. Additionally, the applicant must provide evidence that supports the claim for a refund, such as documentation of the payments and the tax withheld. Understanding these criteria is vital to ensure a successful application process.

Required Documents

When completing the Form Q IS, several documents are necessary to support your application. These typically include:

- Proof of withholding tax paid, such as tax statements or receipts.

- Identification documents, including a tax identification number.

- Any relevant correspondence related to the pension fund payments.

- Bank statements showing the payments received from the pension funds.

Having these documents ready will facilitate a smoother application process and increase the likelihood of a successful refund.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the use of the Form Q IS. It is important to familiarize yourself with these guidelines to ensure compliance with U.S. tax laws. The IRS outlines the procedures for claiming refunds, including any deadlines and necessary forms that may need to accompany the Q IS application. Adhering to these guidelines helps prevent delays or issues with your refund application.

Filing Deadlines / Important Dates

Timely submission of the Form Q IS is crucial for a successful refund claim. The deadlines for filing can vary, so it is essential to stay informed about important dates. Generally, applications should be submitted within a specific time frame following the payment date to ensure eligibility for a refund. Keeping track of these deadlines will help ensure that your application is processed efficiently.

Application Process & Approval Time

The application process for the Form Q IS involves several stages, from submission to approval. Once the form is submitted, it undergoes a review by the relevant tax authority. The approval time can vary based on the complexity of the application and the volume of submissions being processed. Typically, applicants can expect to receive updates on the status of their application within a few weeks to several months. Understanding this timeline can help manage expectations regarding the refund process.

Quick guide on how to complete form q is application to refund the withholding tax on payments by pension funds domiciled in switzerland

Effortlessly Complete Form Q IS Application To Refund The Withholding Tax On Payments By Pension Funds Domiciled In Switzerland on Any Device

The management of online documents has become increasingly popular among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, enabling you to easily access the required forms and securely store them online. airSlate SignNow provides all the tools necessary for you to create, modify, and electronically sign your documents quickly without any delays. Handle Form Q IS Application To Refund The Withholding Tax On Payments By Pension Funds Domiciled In Switzerland on any device using the airSlate SignNow apps available for Android or iOS, and enhance any document-centered operation today.

Effortlessly Modify and Electronically Sign Form Q IS Application To Refund The Withholding Tax On Payments By Pension Funds Domiciled In Switzerland

- Locate Form Q IS Application To Refund The Withholding Tax On Payments By Pension Funds Domiciled In Switzerland and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and possesses the same legal validity as a traditional signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choosing. Edit and electronically sign Form Q IS Application To Refund The Withholding Tax On Payments By Pension Funds Domiciled In Switzerland to maintain outstanding communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is tax withholding and how does it affect my business?

Tax withholding refers to the portion of an employee's earnings that an employer sends directly to the government for tax purposes. Managing tax withholding is crucial for compliance and helps avoid penalties. Using airSlate SignNow can simplify the process by allowing you to eSign and manage tax-related documents efficiently.

-

How does airSlate SignNow assist with tax withholding documentation?

airSlate SignNow allows businesses to easily send, receive, and eSign tax withholding documents. This streamlines the documentation process, ensuring accurate records are maintained for each employee. With our platform, you can manage these documents in one secure location, reducing the risk of errors.

-

What features does airSlate SignNow offer for tax withholding compliance?

Our platform provides features such as customizable templates for tax withholding forms, secure storage, and audit trails. These tools ensure your business remains compliant with tax laws while reducing administrative overhead. You can also track the status of documents to ensure timely submissions.

-

Is there a fee for using airSlate SignNow for tax withholding documents?

airSlate SignNow offers competitive pricing that includes access to features beneficial for managing tax withholding. Depending on your business size and needs, we have flexible plans tailored to fit your budget. Reviewing our pricing options will help you understand how cost-effective our solution can be.

-

Can I integrate airSlate SignNow with my existing tax software?

Yes, airSlate SignNow can easily integrate with various tax software and accounting programs to streamline your tax withholding processes. This ensures that your documents are synced seamlessly with your financial systems. Our integration capabilities enhance productivity by minimizing the need for duplicate data entry.

-

How does eSigning help with tax withholding processes?

eSigning with airSlate SignNow accelerates the tax withholding documentation process by enabling remote signing from anywhere. This convenience allows for quicker turnaround times on required forms, which is vital during tax season. It also provides a secure way to sign documents while maintaining compliance.

-

What advantages does airSlate SignNow offer over traditional tax withholding methods?

Using airSlate SignNow for tax withholding offers increased efficiency, security, and accessibility compared to traditional methods. You can eliminate paper-based processes, reduce the risk of error with electronic signatures, and access documents anytime, aiding in timely compliance. This modern approach saves you time and money.

Get more for Form Q IS Application To Refund The Withholding Tax On Payments By Pension Funds Domiciled In Switzerland

- Harris county application for residence homestead exemption form 1113 0114

- Form c f x see rule 40 pdf download

- Hdfc bank letterhead pdf form

- Planwithease com forms

- Cutler bay permit application form

- Taxpayer annual local earned income tax return 80532352 form

- Plinth completion certificate format

- Nhl standard player contract form

Find out other Form Q IS Application To Refund The Withholding Tax On Payments By Pension Funds Domiciled In Switzerland

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free