Competition Mail Claim for Rebate Recipient Created Tax Form

What is a recipient created tax invoice?

A recipient created tax invoice (RCTI) is a document that allows the recipient of goods or services to issue an invoice on behalf of the supplier. This arrangement is often used in situations where the supplier does not provide an invoice, simplifying the billing process for both parties. In the United States, RCTIs are commonly used in various industries to streamline transactions and ensure compliance with tax regulations. It is essential that both the supplier and recipient agree to this arrangement, as it can affect tax reporting and obligations.

Key elements of a recipient created tax invoice

When creating a recipient created tax invoice, certain key elements must be included to ensure its validity and compliance with tax laws. These elements typically include:

- Supplier's details: Name, address, and tax identification number.

- Recipient's details: Name, address, and tax identification number.

- Description of goods or services: A clear description of what is being invoiced.

- Invoice date: The date the invoice is issued.

- Invoice number: A unique identifier for tracking purposes.

- Tax amount: The applicable tax amount based on the transaction.

Including these elements helps ensure that the invoice is legally binding and meets the requirements set forth by the IRS.

Steps to complete a recipient created tax invoice

Completing a recipient created tax invoice involves several straightforward steps:

- Agreement: Ensure both parties agree to use an RCTI.

- Gather information: Collect necessary details from both the supplier and recipient.

- Draft the invoice: Include all required elements, such as names, addresses, and tax amounts.

- Review: Double-check the invoice for accuracy.

- Send the invoice: Provide the completed invoice to the supplier for their records.

Following these steps can help facilitate a smooth transaction and maintain compliance with tax regulations.

Legal use of a recipient created tax invoice

For a recipient created tax invoice to be legally valid, it must comply with specific legal requirements. This includes ensuring that both parties have agreed to the use of RCTIs and that the invoice contains all necessary information. Additionally, the recipient must ensure that they are registered for tax purposes and that the invoice aligns with IRS guidelines. Proper documentation and record-keeping are crucial to avoid any potential disputes or compliance issues.

IRS guidelines for recipient created tax invoices

The IRS provides guidelines that govern the use of recipient created tax invoices. These guidelines emphasize the importance of maintaining accurate records and ensuring that both parties are aware of their tax obligations. The recipient must report the tax amount collected on their tax return, while the supplier should also keep a copy of the RCTI for their records. Following these guidelines helps ensure compliance and reduces the risk of audits or penalties.

Required documents for a recipient created tax invoice

When preparing a recipient created tax invoice, certain documents may be required to support the transaction. These documents can include:

- Purchase orders or contracts that outline the terms of the sale.

- Previous invoices or receipts related to the transaction.

- Any correspondence between the supplier and recipient regarding the agreement to use RCTIs.

Having these documents on hand can help clarify any questions that may arise during the invoicing process and ensure compliance with tax regulations.

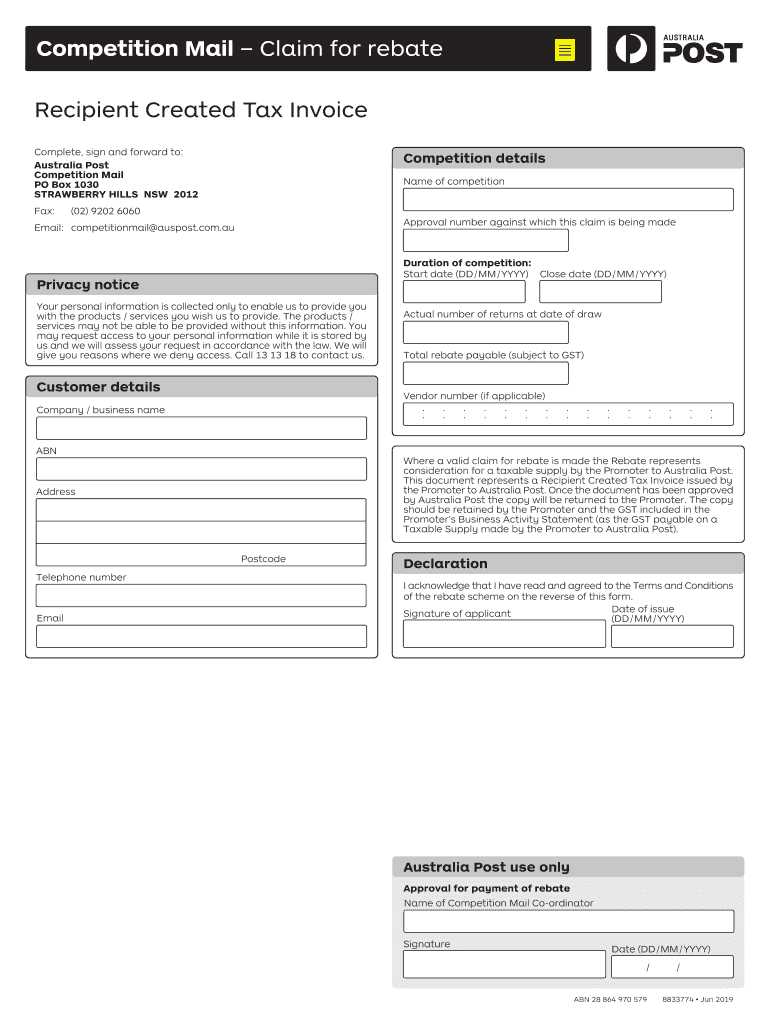

Quick guide on how to complete competition mail claim for rebate recipient created tax

Easily Prepare Competition Mail Claim For Rebate Recipient Created Tax on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed documents, as you can easily access the right form and securely keep it online. airSlate SignNow provides all the necessary tools to quickly create, modify, and electronically sign your documents without delays. Manage Competition Mail Claim For Rebate Recipient Created Tax across any platform using airSlate SignNow's Android or iOS applications and enhance your document-centered workflow today.

How to Edit and Electronically Sign Competition Mail Claim For Rebate Recipient Created Tax Effortlessly

- Find Competition Mail Claim For Rebate Recipient Created Tax and click on Get Form to begin.

- Use the tools provided to fill out your form.

- Highlight important sections of your documents or conceal sensitive information with the specialized tools offered by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to send your form via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Competition Mail Claim For Rebate Recipient Created Tax while ensuring excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Australia Post invoice and how does it work?

An Australia Post invoice is an electronic method of billing that allows businesses to prepare and send invoices digitally. With airSlate SignNow, you can easily create, sign, and manage these invoices, streamlining your billing process. This modern approach not only saves time but also enhances accuracy, ensuring your invoices are delivered promptly.

-

How can I integrate Australia Post invoice with my current system?

Integrating Australia Post invoice with your existing systems is simple with airSlate SignNow's extensive API. You can connect your accounting software or CRM to automate the invoice generation and distribution process. This ensures seamless data exchange, making it easier for you to manage invoices automatically.

-

What are the benefits of using airSlate SignNow for my Australia Post invoice?

Using airSlate SignNow for your Australia Post invoice means you get a user-friendly platform that allows for quick document preparation and eSigning. Additionally, it enhances efficiency by reducing manual tasks, and you benefit from features like real-time tracking and secure storage. These advantages can help improve your cash flow and overall business operations.

-

Is there a cost associated with sending an Australia Post invoice through airSlate SignNow?

Yes, sending an Australia Post invoice through airSlate SignNow involves subscription pricing, which is designed to be cost-effective for businesses of all sizes. Depending on your needs, you can choose a plan that offers the best value, ensuring you have the necessary features without overspending. Transparency in pricing helps you manage your budget effectively.

-

Can I customize my Australia Post invoice with airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize your Australia Post invoice with your branding, including logos, colors, and preferred formatting. This personalization not only enhances your professional image but also creates a consistent branding experience for your clients. Tailored invoices can lead to better responses from recipients.

-

How secure is the information in my Australia Post invoice?

The security of your Australia Post invoice information is a top priority at airSlate SignNow. We implement advanced encryption methods and follow best practices to protect your data during transmission and storage. Your confidential information remains safe, giving you peace of mind while you manage your invoices digitally.

-

Can I track the status of my Australia Post invoice with airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for your Australia Post invoice, allowing you to see when it has been viewed, signed, and completed. This feature helps you stay on top of your billing process and reduces the uncertainty of outstanding invoices. Efficient tracking can signNowly improve your cash flow management.

Get more for Competition Mail Claim For Rebate Recipient Created Tax

- Welcome to kindergarten letter form

- Tbear graphic organizer form

- Navmc 11000 form

- Sample reference letter for condo association form

- Httpsir ptcbio comstatic files9b67142f 514d 4 form

- Microsoft word wire transfer request form2016

- Hold harmless agreement indemnification agreemen form

- Departamento de asuntos del consumidor de californ form

Find out other Competition Mail Claim For Rebate Recipient Created Tax

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice