Individual Life Insurance Application for Reinstatement Voya Form

Understanding the Individual Life Insurance Application for Reinstatement

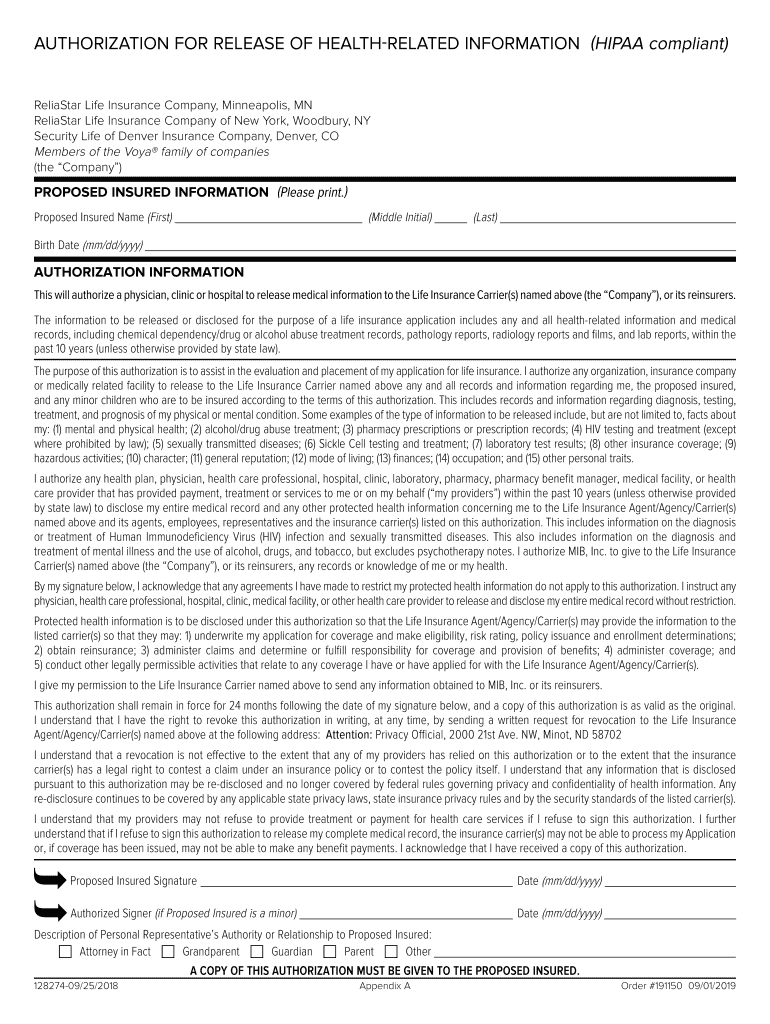

The Individual Life Insurance Application for Reinstatement is a crucial document for policyholders seeking to restore their lapsed life insurance coverage. This application serves as a formal request to the insurance company, allowing individuals to provide necessary information regarding their health and financial status since the policy lapsed. It is essential to understand that reinstatement is not guaranteed; the insurer will evaluate the application based on their underwriting guidelines and the applicant's current circumstances.

Steps to Complete the Individual Life Insurance Application for Reinstatement

Completing the Individual Life Insurance Application for Reinstatement involves several key steps to ensure accuracy and compliance with the insurer's requirements:

- Gather necessary personal information, including your policy number and identification details.

- Review the health questions carefully, as they may require details about any medical conditions or treatments received since the policy lapsed.

- Provide any additional documentation requested by the insurance company, such as medical records or proof of income.

- Sign and date the application to confirm the accuracy of the information provided.

- Submit the completed application through the preferred method specified by the insurer, which may include online submission, mailing, or in-person delivery.

Key Elements of the Individual Life Insurance Application for Reinstatement

Several critical components are included in the Individual Life Insurance Application for Reinstatement. These elements are designed to provide the insurer with a comprehensive view of the applicant's current situation:

- Policy Information: Details about the lapsed policy, including the policy number and coverage amount.

- Personal Information: Full name, address, date of birth, and contact information of the applicant.

- Health History: Questions regarding medical history, including any recent diagnoses, treatments, or medications.

- Financial Information: Information about the applicant's financial status, which may include income details and any changes since the policy lapsed.

Legal Use of the Individual Life Insurance Application for Reinstatement

The Individual Life Insurance Application for Reinstatement must comply with various legal standards to ensure that the reinstatement process is valid and binding. This includes adherence to state regulations governing insurance practices and the requirement for full disclosure of health information. Failure to provide accurate information can lead to denial of the application or future claims being contested.

Required Documents for the Individual Life Insurance Application for Reinstatement

When submitting the Individual Life Insurance Application for Reinstatement, certain documents may be required to support the application. Commonly requested documents include:

- Proof of identity, such as a government-issued ID.

- Medical records or reports from healthcare providers.

- Financial statements or proof of income.

- Any previous correspondence with the insurance company regarding the policy.

Form Submission Methods for the Individual Life Insurance Application for Reinstatement

Submitting the Individual Life Insurance Application for Reinstatement can typically be done through various methods, depending on the insurer's preferences:

- Online Submission: Many insurers offer a secure online portal for submitting applications directly.

- Mail: Applicants can print the completed application and send it via postal mail to the insurance company.

- In-Person: Some applicants may choose to deliver their application in person at the insurer's local office.

Quick guide on how to complete individual life insurance application for reinstatement voya

Complete Individual Life Insurance Application For Reinstatement Voya effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers a perfect eco-friendly substitute to traditional printed and signed documents, as you can locate the necessary form and securely save it online. airSlate SignNow equips you with all the resources you need to create, alter, and eSign your documents quickly without delays. Handle Individual Life Insurance Application For Reinstatement Voya on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Individual Life Insurance Application For Reinstatement Voya without hassle

- Locate Individual Life Insurance Application For Reinstatement Voya and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and holds the same legal authority as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your choice. Adjust and eSign Individual Life Insurance Application For Reinstatement Voya to guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a claim letter and how can airSlate SignNow help?

A claim letter is a formal document used to request compensation or resolution regarding a particular issue. With airSlate SignNow, you can easily create, send, and eSign your claim letter, ensuring that all parties can quickly and securely review and approve the document.

-

Are there any costs associated with creating a claim letter using airSlate SignNow?

airSlate SignNow offers a cost-effective solution for all your document needs, including claim letters. You can choose from various pricing plans based on your business needs, allowing you to create and manage claim letters without breaking the bank.

-

What features does airSlate SignNow provide for claim letters?

airSlate SignNow provides a variety of features for claim letters, including customizable templates, secure eSignature capabilities, and document tracking. These features ensure your claim letters are professionally formatted and efficiently handled.

-

Can I integrate airSlate SignNow with other tools for managing claim letters?

Yes, airSlate SignNow seamlessly integrates with popular applications like Google Drive, Dropbox, and Salesforce. This means you can streamline the process of creating and sharing your claim letters across various platforms.

-

How does airSlate SignNow ensure the security of my claim letter?

AirSlate SignNow prioritizes the security of your documents, including claim letters, using advanced encryption protocols and secure cloud storage. Your claim letters are protected from unauthorized access and are compliant with industry standards.

-

Can I track the status of my claim letter once sent?

Absolutely! With airSlate SignNow, you can track the status of your claim letter in real time. You will receive notifications when the document is viewed, signed, or requires further action, helping you stay informed at every step.

-

What types of businesses can benefit from using airSlate SignNow for claim letters?

Businesses of all sizes and industries can benefit from using airSlate SignNow for claim letters. Whether you’re in healthcare, finance, or customer service, our solution simplifies the claims process, making it easier to manage and resolve issues.

Get more for Individual Life Insurance Application For Reinstatement Voya

- Fax order form

- Metrobank ada form pru life

- Va form 2237

- Real estate seller disclosure law 68 pa c s a section 7301 form

- Scottish legal aid board aampa application procedures slab org form

- Physiotherapy self referral form 654099562

- No known loss letter insurance template form

- California schedule p 541 form

Find out other Individual Life Insurance Application For Reinstatement Voya

- Electronic signature Maryland Roommate Rental Agreement Template Later

- Electronic signature Utah Storage Rental Agreement Easy

- Electronic signature Washington Home office rental agreement Simple

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free