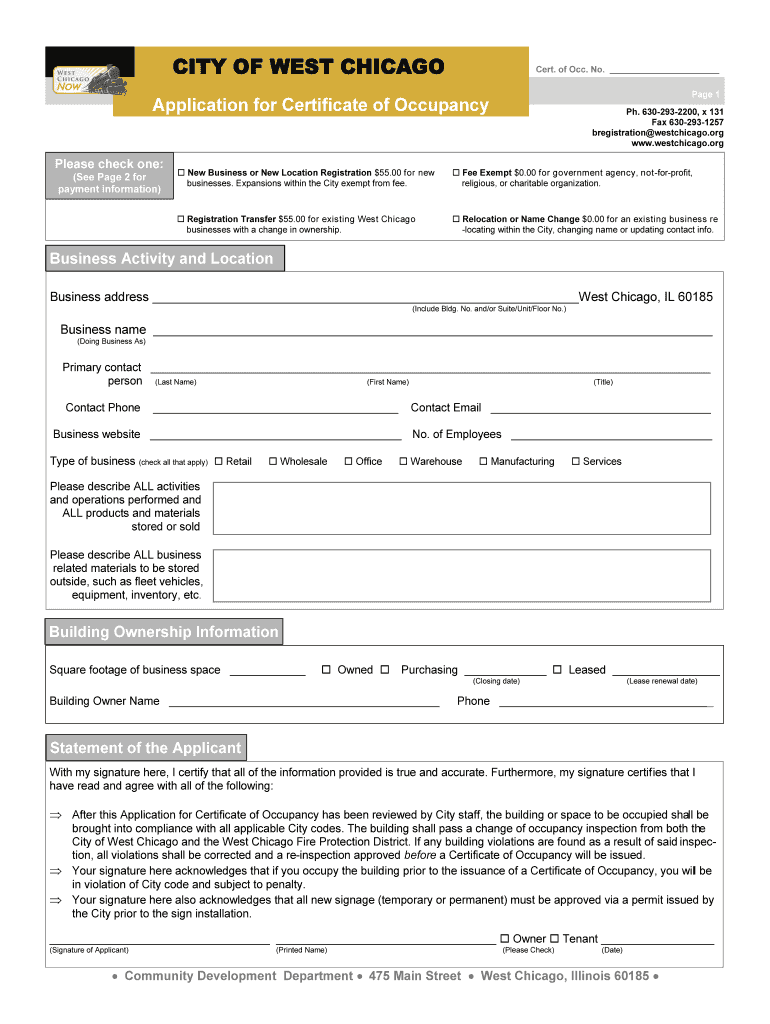

Of Occ Form

IRS Guidelines

The IRS provides essential guidelines for tax services, ensuring that individuals and businesses comply with federal tax laws. Understanding these guidelines is crucial for accurate tax filing and avoiding penalties. The IRS outlines specific requirements for various forms, including the necessary documentation and deadlines. Taxpayers should familiarize themselves with the IRS website or consult a tax professional to stay updated on any changes in regulations or procedures.

Filing Deadlines / Important Dates

Adhering to filing deadlines is vital for maintaining compliance with tax obligations. The IRS sets specific dates for the submission of various tax forms, including individual and business taxes. For instance, the deadline for filing individual tax returns is typically April 15, while businesses may have different deadlines depending on their structure. Missing these deadlines can result in penalties and interest on unpaid taxes, making it essential to mark these dates on your calendar.

Required Documents

When preparing to file taxes, gathering the necessary documents is a critical step. Required documents may include W-2 forms from employers, 1099 forms for freelance work, and receipts for deductible expenses. Additionally, taxpayers should have their Social Security numbers, bank account information for direct deposits, and previous year tax returns readily available. Organizing these documents ahead of time can streamline the filing process and reduce the risk of errors.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have multiple options for submitting their tax forms, which can vary based on personal preference and convenience. Online submission is increasingly popular, allowing for quicker processing and immediate confirmation of receipt. Alternatively, forms can be mailed to the IRS, though this method may take longer for processing. For those who prefer face-to-face interaction, in-person submission at designated IRS offices is also available. Each method has its own advantages, and taxpayers should choose the one that best suits their needs.

Penalties for Non-Compliance

Understanding the penalties for non-compliance with tax regulations is essential for all taxpayers. Failing to file a tax return on time can lead to substantial penalties, which may increase the longer the return is overdue. Additionally, underreporting income or failing to pay taxes owed can result in further fines and interest charges. Being aware of these potential consequences can motivate taxpayers to stay compliant and proactive in their tax responsibilities.

Taxpayer Scenarios (e.g., self-employed, retired, students)

Different taxpayer scenarios can significantly impact tax obligations and available deductions. Self-employed individuals must navigate unique tax requirements, including estimated tax payments and self-employment tax. Retirees may benefit from various tax credits and deductions related to retirement income. Students often have access to educational tax credits that can alleviate some financial burdens. Understanding how these scenarios affect tax services can help individuals maximize their tax benefits and ensure compliance.

Quick guide on how to complete of occ

Effortlessly Prepare Of Occ on Any Device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle Of Occ on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The Simplest Method to Modify and eSign Of Occ with Ease

- Obtain Of Occ and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and eSign Of Occ to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are airSlate SignNow's tax services?

airSlate SignNow offers comprehensive tax services that enable businesses to efficiently manage and eSign all necessary tax-related documents. With our platform, users can streamline document workflows, ensuring compliance and accuracy in their tax submissions. Our tax services are designed to reduce the hassle of paperwork and enhance productivity.

-

How much do tax services cost with airSlate SignNow?

Pricing for airSlate SignNow's tax services varies based on the subscription plan you choose. We provide flexible pricing options to fit different business needs and budgets. To find the best plan for your tax services requirements, visit our pricing page for detailed information.

-

What features do airSlate SignNow's tax services include?

Our tax services come with features like secure electronic signatures, document templates specifically for tax forms, and automated workflows to simplify tax document management. Additionally, users can track document status and receive notifications, ensuring timely completion of tax-related tasks. These features are designed to enhance the efficiency of your tax processes.

-

How can airSlate SignNow improve my business's tax management?

airSlate SignNow enhances tax management by automating document processes, reducing manual errors, and ensuring quick turnaround times. With our user-friendly interface, businesses can quickly prepare, send, and sign tax documents, saving valuable time during tax season. This allows you to focus on growing your business while we handle your tax services.

-

Are airSlate SignNow's tax services compliant with regulations?

Yes, airSlate SignNow is designed to comply with relevant regulations and standards concerning electronic signatures and document storage. Our platform ensures that your tax documents are handled securely and in accordance with legal requirements. We prioritize compliance to provide you with peace of mind while using our tax services.

-

Can I integrate airSlate SignNow's tax services with other software?

Absolutely! airSlate SignNow's tax services can be seamlessly integrated with various software solutions, including accounting platforms and CRMs. These integrations streamline your workflow by connecting all necessary tools for efficient tax management. Our open API makes it easy to establish these connections.

-

What benefits do I gain from using airSlate SignNow for tax services?

By using airSlate SignNow for your tax services, you gain access to an intuitive platform that simplifies document management and eSigning. Our tool boosts productivity by automating repetitive tasks and provides secure document storage. Ultimately, you will experience improved efficiency and reduced stress during tax preparation.

Get more for Of Occ

- Yacht crew list template form

- Appointment letter confidential 15th cms info systems form

- 977 b waiver form

- Skydiving sponsor form skydive hibaldstow sponsor form

- Blumberg forms staples

- Labour market impact assessment form

- Anticoagulation flowsheet form

- Sv 116 order on request to continue hearing form

Find out other Of Occ

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document