Tax Preparers E&O and Liability InsuranceTrusted Choice Form

What is the Tax Preparers E&O and Liability Insurance Trusted Choice

The Tax Preparers E&O and Liability Insurance Trusted Choice is a specialized insurance policy designed to protect tax preparers from errors and omissions that may occur during their professional services. This insurance provides coverage for claims made by clients who allege negligence, mistakes, or failure to perform professional duties. It is essential for tax preparers to have this coverage to safeguard their business and personal assets from potential legal actions.

How to Obtain the Tax Preparers E&O and Liability Insurance Trusted Choice

To obtain the Tax Preparers E&O and Liability Insurance Trusted Choice, tax preparers should follow a systematic approach:

- Research various insurance providers that offer this specific coverage.

- Request quotes from multiple insurers to compare premiums and coverage options.

- Review the policy details, including limits, exclusions, and any additional coverage options.

- Complete the application process, providing necessary documentation and information about your business.

- Finalize the purchase by selecting the best policy that meets your needs.

Steps to Complete the Tax Preparers E&O and Liability Insurance Trusted Choice

Completing the Tax Preparers E&O and Liability Insurance Trusted Choice involves several key steps:

- Gather all relevant business information, including your qualifications and experience.

- Fill out the application form accurately, ensuring all details are correct.

- Submit any required supporting documents, such as proof of prior insurance or client contracts.

- Review the policy once issued to ensure it reflects the agreed terms.

- Maintain communication with your insurer for any updates or changes in your business operations.

Legal Use of the Tax Preparers E&O and Liability Insurance Trusted Choice

The legal use of the Tax Preparers E&O and Liability Insurance Trusted Choice is crucial for compliance with professional standards. This insurance not only protects tax preparers from financial loss but also enhances their credibility with clients. It is important to understand the legal implications of the policy, including the coverage limits and the types of claims that are covered. Tax preparers should ensure they are familiar with their obligations under the policy and maintain accurate records of their work to support any claims if they arise.

Key Elements of the Tax Preparers E&O and Liability Insurance Trusted Choice

Key elements of the Tax Preparers E&O and Liability Insurance Trusted Choice include:

- Coverage Limits: The maximum amount the insurer will pay for a claim.

- Deductibles: The amount the policyholder must pay out of pocket before insurance coverage kicks in.

- Exclusions: Specific situations or claims that are not covered by the policy.

- Claims Process: The procedure for filing a claim, including timelines and required documentation.

IRS Guidelines Related to Tax Preparers E&O and Liability Insurance Trusted Choice

The IRS provides guidelines that emphasize the importance of professional liability insurance for tax preparers. While not mandated, having E&O insurance can demonstrate a commitment to professionalism and client protection. Tax preparers should be aware of how their insurance policy aligns with IRS requirements and best practices to avoid penalties and ensure compliance with federal regulations.

Quick guide on how to complete tax preparers eampampampo and liability insurancetrusted choice

Effortlessly Create Tax Preparers E&O And Liability InsuranceTrusted Choice on Any Gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, as you can easily obtain the right format and safely store it online. airSlate SignNow provides all the tools necessary for you to design, modify, and electronically sign your documents swiftly and without delays. Manage Tax Preparers E&O And Liability InsuranceTrusted Choice on any gadget using airSlate SignNow's Android or iOS applications, and simplify any document-related procedure today.

The simplest method to alter and electronically sign Tax Preparers E&O And Liability InsuranceTrusted Choice effortlessly

- Locate Tax Preparers E&O And Liability InsuranceTrusted Choice and click on Get Form to begin.

- Employ the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure private information with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Decide how you want to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of missing or lost documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and electronically sign Tax Preparers E&O And Liability InsuranceTrusted Choice while ensuring outstanding communication at any phase of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Tax Preparers E&O And Liability InsuranceTrusted Choice?

Tax Preparers E&O And Liability InsuranceTrusted Choice is a specialized insurance designed to protect tax professionals from claims arising due to errors or omissions in their work. This insurance provides a safety net that helps in managing risks associated with tax preparation services, giving you peace of mind while you serve your clients.

-

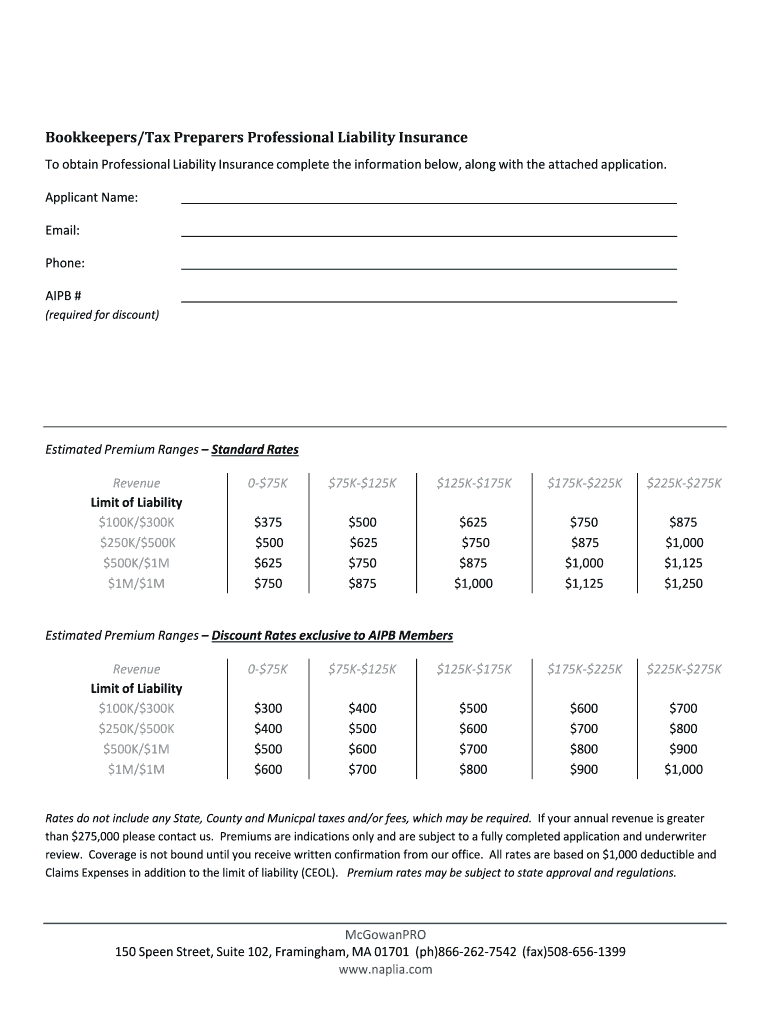

How much does Tax Preparers E&O And Liability InsuranceTrusted Choice cost?

The cost of Tax Preparers E&O And Liability InsuranceTrusted Choice can vary based on several factors, including the size of your practice and the level of coverage you choose. On average, pricing can range from a few hundred to several thousand dollars annually. It's best to consult with an insurance provider to get personalized quotes.

-

What benefits do I get with Tax Preparers E&O And Liability InsuranceTrusted Choice?

With Tax Preparers E&O And Liability InsuranceTrusted Choice, you gain financial protection against unforeseen circumstances that could arise from your tax work. This coverage not only helps in legal defense but may also cover damages awarded in lawsuits. Ultimately, it safeguards your business's reputation and ensures continuity.

-

Does Tax Preparers E&O And Liability InsuranceTrusted Choice cover all types of tax-related services?

Yes, Tax Preparers E&O And Liability InsuranceTrusted Choice typically covers a wide range of tax-related services, including individual and corporate tax preparation, consulting, and filing. However, it’s essential to review specific policy details to ensure it meets your practice's needs for comprehensive protection.

-

Can I integrate Tax Preparers E&O And Liability InsuranceTrusted Choice with my existing business tools?

Tax Preparers E&O And Liability InsuranceTrusted Choice is primarily an insurance product and does not directly integrate with business tools. However, having this insurance is crucial for businesses using e-signature solutions like airSlate SignNow, as it protects them while utilizing these technologies for efficient document management.

-

How can I apply for Tax Preparers E&O And Liability InsuranceTrusted Choice?

Applying for Tax Preparers E&O And Liability InsuranceTrusted Choice is a straightforward process. You can start by signNowing out to insurance providers that specialize in this type of coverage. They will guide you through the application process, which usually involves completing a questionnaire about your services and practices.

-

What should I look for in a Tax Preparers E&O And Liability InsuranceTrusted Choice policy?

When selecting a policy for Tax Preparers E&O And Liability InsuranceTrusted Choice, consider coverage limits, exclusions, and the insurer's reputation. Look for comprehensive coverage that aligns with the specific risks of tax preparation. Additionally, check for any options for additional endorsements that may benefit your practice.

Get more for Tax Preparers E&O And Liability InsuranceTrusted Choice

Find out other Tax Preparers E&O And Liability InsuranceTrusted Choice

- eSignature Oregon Housekeeping Contract Computer

- eSignature Montana Home Loan Application Online

- eSignature New Hampshire Home Loan Application Online

- eSignature Minnesota Mortgage Quote Request Simple

- eSignature New Jersey Mortgage Quote Request Online

- Can I eSignature Kentucky Temporary Employment Contract Template

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online