Appeals CITT TCCE Form

What is the Appeals CITT TCCE

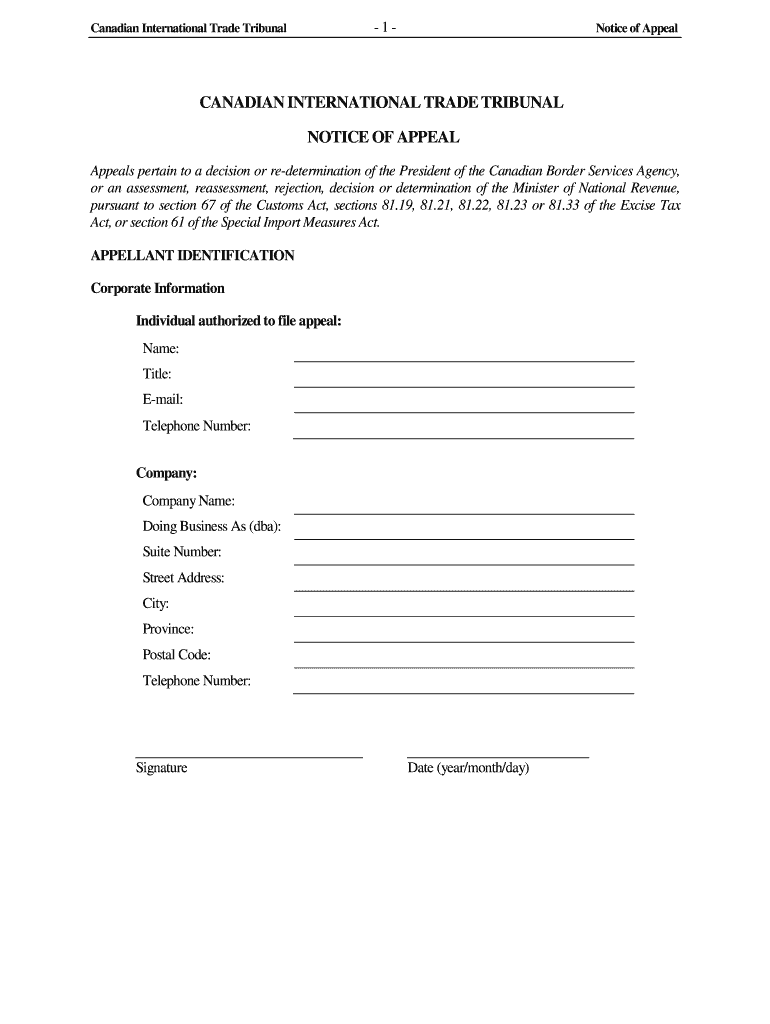

The Appeals CITT TCCE form is a specific document used in the context of tax appeals within the United States. This form is essential for individuals or businesses seeking to challenge decisions made by tax authorities regarding assessments or other tax-related matters. The form serves as a formal request for reconsideration and outlines the reasons for the appeal, providing a structured way to present the case to the appropriate tax appeal body.

How to use the Appeals CITT TCCE

Using the Appeals CITT TCCE form involves several key steps. First, ensure that you have all necessary information and documentation related to your tax assessment. This includes previous correspondence with tax authorities and any supporting evidence for your appeal. Next, accurately fill out the form, clearly stating your reasons for the appeal and attaching any relevant documents. Once completed, submit the form through the designated channels, which may include online submission or mailing it to the appropriate office.

Steps to complete the Appeals CITT TCCE

Completing the Appeals CITT TCCE form requires attention to detail. Follow these steps for a successful submission:

- Gather all relevant documents, including your tax return and any notices received from the tax authority.

- Carefully read the instructions provided with the form to understand the requirements.

- Fill out the form, ensuring that all information is accurate and complete.

- Clearly articulate your reasons for the appeal in the designated section.

- Attach any supporting documents that bolster your case.

- Review the completed form for any errors before submission.

- Submit the form as instructed, keeping a copy for your records.

Legal use of the Appeals CITT TCCE

The legal use of the Appeals CITT TCCE form is governed by specific regulations that dictate how appeals must be filed and processed. It is crucial to adhere to these legal frameworks to ensure that your appeal is considered valid. The form must be submitted within the stipulated timeframes and must include all required information. Failure to comply with these legal requirements may result in the dismissal of the appeal.

Required Documents

When submitting the Appeals CITT TCCE form, certain documents are typically required to support your appeal. These may include:

- Copies of any notices or letters from the tax authority regarding the assessment.

- Your tax return for the year in question.

- Any additional documentation that supports your claims, such as financial records or correspondence.

Ensuring that all required documents are included can significantly impact the outcome of your appeal.

Filing Deadlines / Important Dates

Filing deadlines for the Appeals CITT TCCE form are critical to the appeal process. It is essential to submit the form within the time limits set by the tax authority to avoid automatic dismissal of your appeal. These deadlines can vary based on the type of appeal and the jurisdiction, so it is advisable to check the specific dates relevant to your situation. Marking these dates on your calendar can help ensure you meet all necessary timelines.

Quick guide on how to complete appeals citt tcce

Complete Appeals CITT TCCE effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It serves as a perfect eco-friendly alternative to conventional printed and signed documents, as you can access the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without interruptions. Manage Appeals CITT TCCE on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest method to alter and eSign Appeals CITT TCCE effortlessly

- Locate Appeals CITT TCCE and then click Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then select the Done button to save your alterations.

- Decide how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choosing. Edit and eSign Appeals CITT TCCE and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Appeals CITT TCCE and how does it relate to airSlate SignNow?

Appeals CITT TCCE refers to the processes involved in appealing decisions related to the Canadian International Trade Tribunal. With airSlate SignNow, you can streamline the documentation process for Appeals CITT TCCE, ensuring that all necessary forms are signed and filed efficiently.

-

How can airSlate SignNow help with Appeals CITT TCCE documentation?

airSlate SignNow offers templates and eSigning capabilities specifically designed for Appeals CITT TCCE documentation. This can save you time and reduce errors, making it easier to submit timely and accurate appeals.

-

What are the pricing options for using airSlate SignNow for Appeals CITT TCCE?

airSlate SignNow provides flexible pricing plans tailored to your business needs, starting from a basic plan that covers essential features for Appeals CITT TCCE. Additional plans include more advanced functionality to accommodate larger businesses or specific requirements.

-

Does airSlate SignNow integrate with other tools for Appeals CITT TCCE?

Yes, airSlate SignNow integrates with various third-party applications and platforms, enhancing your workflow for Appeals CITT TCCE. These integrations allow for seamless data sharing, ensuring your documents are always up-to-date and correctly processed.

-

What features of airSlate SignNow can enhance my Appeals CITT TCCE process?

Key features of airSlate SignNow include customizable templates, automated workflows, and secure eSignature capabilities. These features work together to simplify the Appeals CITT TCCE process, making it more efficient and user-friendly.

-

Is airSlate SignNow secure for handling Appeals CITT TCCE documents?

Absolutely! airSlate SignNow prioritizes security with robust encryption and compliance with industry standards. When handling Appeals CITT TCCE documents, you can trust that your information is safe and protected against unauthorized access.

-

Can I access airSlate SignNow on mobile for Appeals CITT TCCE?

Yes, airSlate SignNow offers a mobile-friendly platform, enabling you to manage your Appeals CITT TCCE documents on the go. This convenient access ensures that you can sign, send, and track your documents anytime, anywhere.

Get more for Appeals CITT TCCE

Find out other Appeals CITT TCCE

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate