Cdtfa 531 A2 Form

What is the CDTFA 531 A2?

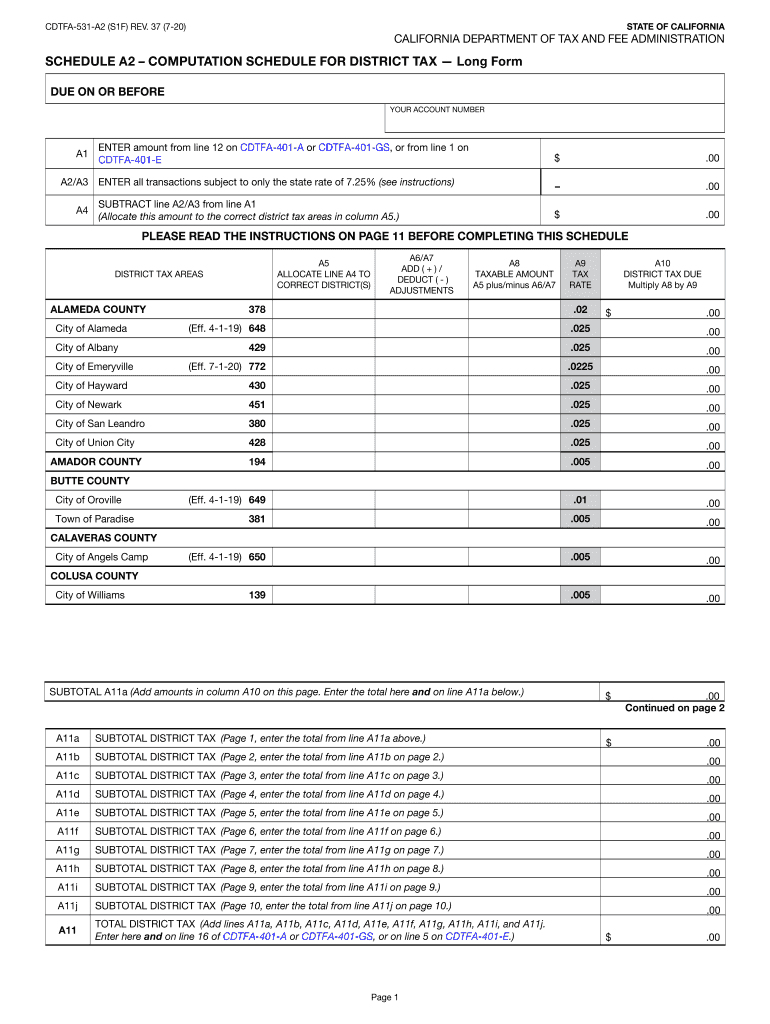

The CDTFA 531 A2 form is a crucial document used by businesses in California to report and pay certain taxes. This form is specifically designed for taxpayers who need to make adjustments to their tax liabilities. It serves as a means for businesses to communicate with the California Department of Tax and Fee Administration (CDTFA) regarding their tax obligations. Understanding the purpose and requirements of the CDTFA 531 A2 is essential for ensuring compliance with state tax laws.

How to Use the CDTFA 531 A2

Using the CDTFA 531 A2 form involves several key steps. First, gather all necessary information related to your tax liabilities. This includes details about your business operations, previous tax filings, and any adjustments that need to be made. Once you have this information, fill out the form accurately, ensuring that all sections are completed. After completing the form, you can submit it electronically or by mail, depending on your preference and the specific instructions provided by the CDTFA.

Steps to Complete the CDTFA 531 A2

Completing the CDTFA 531 A2 form requires careful attention to detail. Follow these steps for successful completion:

- Review the form to understand its structure and required information.

- Gather your business records, including previous tax returns and any relevant documentation.

- Fill out the form, ensuring that all fields are completed accurately.

- Double-check your entries for accuracy and completeness.

- Submit the form electronically or by mail, following the submission guidelines provided by the CDTFA.

Legal Use of the CDTFA 531 A2

The CDTFA 531 A2 form must be used in accordance with California tax laws. It is legally binding when completed correctly and submitted on time. To ensure its legal validity, businesses should adhere to the guidelines set forth by the CDTFA, including maintaining accurate records and providing truthful information. Non-compliance with these regulations can lead to penalties or legal consequences.

Required Documents for the CDTFA 531 A2

When preparing to submit the CDTFA 531 A2 form, it is essential to have the following documents ready:

- Previous tax returns related to the tax period in question.

- Documentation supporting any adjustments being made.

- Records of sales and purchases relevant to the reporting period.

- Any correspondence with the CDTFA regarding your tax obligations.

Form Submission Methods

The CDTFA 531 A2 form can be submitted through various methods, providing flexibility for businesses. Options include:

- Online submission via the CDTFA's official website, which is often the fastest method.

- Mailing a hard copy of the completed form to the appropriate CDTFA office.

- In-person submission at a local CDTFA office, if preferred.

Quick guide on how to complete cdtfa 531 a2

Complete Cdtfa 531 A2 effortlessly on any device

Web-based document organization has become increasingly favored by companies and individuals. It offers a perfect environmentally-friendly alternative to conventional printed and signed documents, as you can easily find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly and without delays. Manage Cdtfa 531 A2 on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Cdtfa 531 A2 effortlessly

- Locate Cdtfa 531 A2 and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign tool, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text (SMS), or invitation link, or download it to your computer.

Say goodbye to missing or incorrectly filed documents, tedious form searches, or errors that require new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Modify and eSign Cdtfa 531 A2 and ensure excellent communication at any point in the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process to schedule a cdtfa using airSlate SignNow?

To schedule a cdtfa through airSlate SignNow, simply log into your account and navigate to the scheduling section. There, you can select your desired time and date, and input the necessary details. This streamlined process ensures that you can efficiently manage your document signing.

-

How much does it cost to schedule a cdtfa with airSlate SignNow?

The pricing for airSlate SignNow varies depending on the subscription plan you choose. Each plan offers a range of features that enhance your experience, including the ability to schedule a cdtfa easily. You can opt for a free trial to explore the platform before committing to a plan.

-

What features does airSlate SignNow offer when I schedule a cdtfa?

When you schedule a cdtfa with airSlate SignNow, you gain access to features like automated reminders, secure eSigning, and document tracking. These features not only simplify the scheduling process but also enhance document management efficiency for your business. Each tool is designed to optimize your workflow.

-

Can I integrate airSlate SignNow with other applications to schedule a cdtfa?

Yes, airSlate SignNow offers seamless integrations with various applications, enabling you to schedule a cdtfa conveniently. You can connect it with popular tools like CRM systems and project management software, which enhance your overall productivity and streamline processes. Integration options allow for a customized workflow.

-

What are the benefits of using airSlate SignNow for scheduling a cdtfa?

Using airSlate SignNow to schedule a cdtfa offers numerous benefits, including time-saving features and enhanced collaboration. The platform's user-friendly interface makes it easy for users of all experience levels to handle documentation. Moreover, the efficiency gained can lead to faster turnaround times in business operations.

-

Is airSlate SignNow secure for scheduling a cdtfa?

Absolutely, security is a top priority at airSlate SignNow. When you schedule a cdtfa, your documents are protected through military-grade encryption and secure storage. This commitment to security ensures that your sensitive information remains confidential and safe from unauthorized access.

-

What types of documents can I send when I schedule a cdtfa?

When scheduling a cdtfa with airSlate SignNow, you can send a wide range of documents, including contracts, agreements, and forms. The platform supports various file formats, allowing you to customize your document needs while ensuring compliance. This versatility enhances your document management capabilities.

Get more for Cdtfa 531 A2

- Blank budget form

- Spe certificate renewal application form

- Guia de contrato individual de trabajo por tiempo form

- Wv dhhr application for benefits form

- Apeas ii online form

- Form aaa 1075 chesterfield county public schools student

- Triple take form pdf university of california santa cruz ue ucsc

- April jones blair paint company order form

Find out other Cdtfa 531 A2

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure