Blank Budget Form

What is the Blank Budget

The blank budget is a financial planning tool used to outline expected income and expenses over a specific period. It serves as a framework for individuals and organizations to manage their finances effectively. By detailing anticipated costs and revenues, the blank budget helps users identify potential financial gaps and make informed decisions. This form is particularly useful for both personal and business financial planning, allowing users to allocate resources efficiently and track their financial progress.

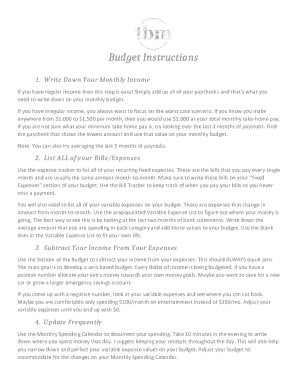

How to Use the Blank Budget

Using the blank budget involves several straightforward steps. First, gather all necessary financial information, including income sources and anticipated expenses. Next, fill out the blank budget form by categorizing income and expenses into relevant sections. It's essential to be realistic and thorough to ensure an accurate financial picture. Once completed, review the budget regularly to track actual spending against your projections. This practice helps identify areas where adjustments may be needed to stay on track financially.

Key Elements of the Blank Budget

The blank budget typically includes several key elements that are crucial for effective financial planning. These elements often comprise:

- Income Sources: All expected income, including salaries, bonuses, and other earnings.

- Fixed Expenses: Regular, unchanging costs such as rent, utilities, and loan payments.

- Variable Expenses: Costs that can fluctuate, like groceries, entertainment, and travel.

- Savings Goals: Amounts set aside for future needs, emergencies, or investments.

- Net Income: The difference between total income and total expenses, indicating financial health.

Steps to Complete the Blank Budget

Completing the blank budget involves a systematic approach to ensure accuracy and effectiveness. Follow these steps:

- Gather Financial Information: Collect all relevant documents, including pay stubs, bills, and bank statements.

- Identify Income: List all sources of income, ensuring to include all potential earnings.

- Detail Expenses: Categorize and estimate both fixed and variable expenses based on historical data.

- Set Savings Goals: Determine how much you want to save and allocate funds accordingly.

- Calculate Net Income: Subtract total expenses from total income to assess your financial standing.

- Review and Adjust: Regularly revisit the budget to make necessary adjustments based on actual spending and income changes.

Legal Use of the Blank Budget

The blank budget can be used legally for various purposes, including personal finance management and business planning. When used in a business context, it may be required for loan applications, grant proposals, or financial audits. Ensuring that the budget is accurate and reflective of true financial conditions is essential, as discrepancies can lead to legal complications. Additionally, maintaining proper documentation and records related to the budget can help support its legal validity.

Examples of Using the Blank Budget

There are numerous scenarios where a blank budget can be effectively utilized. For individuals, it can assist in planning for major purchases, such as a home or vehicle, by outlining savings and expenses. For businesses, a blank budget can help in projecting future revenues and expenses, guiding investment decisions and operational strategies. Non-profit organizations may also use it to allocate funds for programs and services, ensuring that financial resources are aligned with their mission.

Quick guide on how to complete blank budget

Complete Blank Budget effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct format and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly without holdups. Handle Blank Budget on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The simplest way to modify and electronically sign Blank Budget with ease

- Obtain Blank Budget and then click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize important sections of your documents or conceal sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes just moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you would like to send your form, whether by email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form navigation, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and electronically sign Blank Budget while ensuring seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the blank budget

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a blank budget and how can it be used with airSlate SignNow?

A blank budget is a flexible financial planning tool that allows businesses to outline expenses and revenues without predefined categories. With airSlate SignNow, you can easily create, send, and eSign a blank budget template, making it convenient for your team to visualize budget allocations and manage funds effectively.

-

How does airSlate SignNow help in budgeting processes?

airSlate SignNow streamlines budgeting processes by enabling users to create and manage blank budget documents efficiently. You can leverage its collaboration features, allowing multiple stakeholders to review, edit, and eSign the budget documents, thus enhancing transparency and reducing approval times.

-

Is there a cost associated with using a blank budget template on airSlate SignNow?

Yes, while you can create a blank budget template for free, there is a subscription fee for accessing premium features on airSlate SignNow. These features allow for unlimited document sending, advanced integration options, and enhanced security measures, ensuring your budgeting processes are efficient and effective.

-

What features does airSlate SignNow offer for managing a blank budget?

AirSlate SignNow provides several features to manage a blank budget, including document templates, eSignature capabilities, and real-time collaboration tools. Users can easily customize their blank budget templates, track changes made by team members, and store documents securely in the cloud.

-

Can I integrate airSlate SignNow with other budgeting tools?

Yes, airSlate SignNow supports integration with various budgeting tools and software, enhancing its functionality. By integrating these tools, you can import/export your blank budget templates seamlessly, allowing for better data management and financial oversight.

-

How does using a blank budget benefit my organization?

Using a blank budget allows your organization to adapt financial plans flexibly without the constraints of preset categories. This adaptability can lead to better financial decision-making and ensure that resources are allocated more effectively through airSlate SignNow's intuitive platform.

-

Is airSlate SignNow suitable for small businesses to manage their budgets?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, making it perfect for small businesses looking to manage their blank budget effectively. Its cost-effective solution, along with user-friendly features, ensures that small business owners can handle their budgeting needs without hassle.

Get more for Blank Budget

- Affidavit of current marital status ua local 1 form

- Supplementation to and clarification of contract for the sale of real property form

- Borrowed vehicle agreement allrisks form

- Coast guard morale well being and recreation manual form

- Agreement to broadcast by radio ncaa athletic championship form

- Important please read carefully and reply using the form

- Denial of individual charge account form

- Enclosed herewith is a copy of the bill which i have been sending to form

Find out other Blank Budget

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors