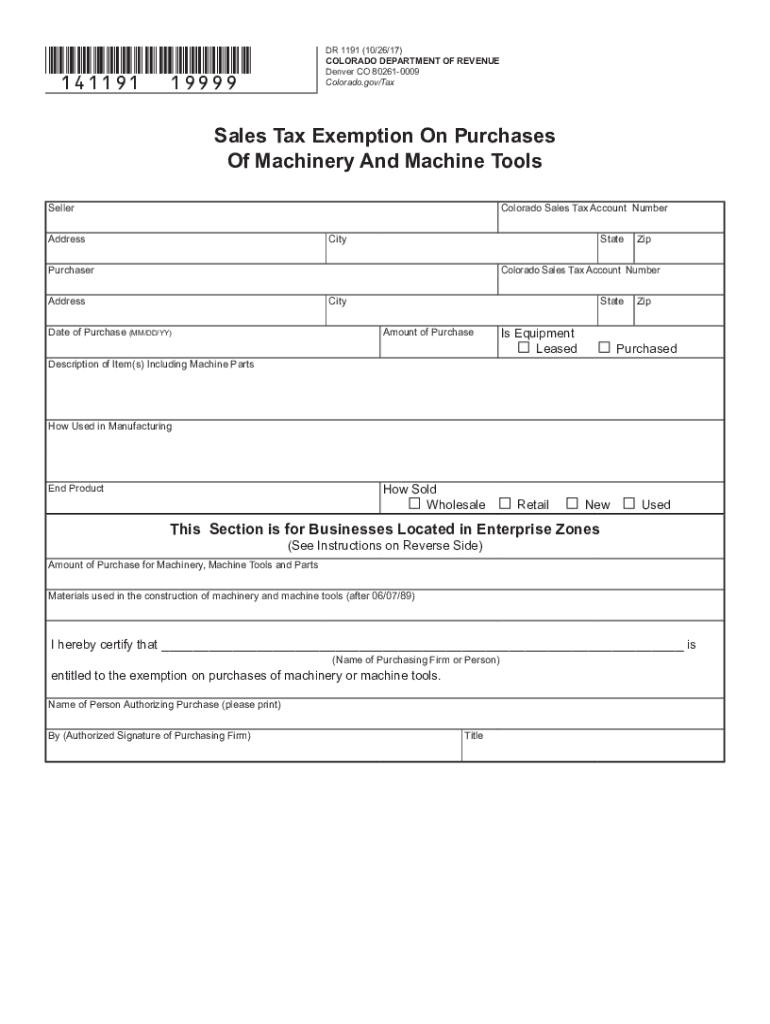

Co Dr1191 Tax Exemption Form

What is the Colorado DR 1191 Tax Exemption

The Colorado DR 1191 Tax Exemption is a specific form used by businesses and individuals in Colorado to claim exemptions from certain taxes. This form is particularly relevant for those who qualify under specific criteria set forth by the state. The exemptions can apply to various types of transactions, including sales and use taxes, making it crucial for eligible entities to understand their rights and responsibilities under this exemption.

How to Use the Colorado DR 1191 Tax Exemption

Using the Colorado DR 1191 Tax Exemption involves completing the form accurately and submitting it to the appropriate tax authority. Taxpayers must ensure they meet the eligibility criteria outlined by the state. Once the form is filled out, it should be presented at the point of sale or submitted to the tax office, depending on the transaction type. Proper usage of this exemption can lead to significant savings for qualifying businesses.

Steps to Complete the Colorado DR 1191 Tax Exemption

Completing the Colorado DR 1191 Tax Exemption requires several key steps:

- Gather necessary information, including business details and the nature of the exemption.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for accuracy and completeness to avoid delays.

- Submit the form to the appropriate authority or present it at the time of purchase.

Eligibility Criteria for the Colorado DR 1191 Tax Exemption

Eligibility for the Colorado DR 1191 Tax Exemption is determined by specific criteria set by the state. Generally, individuals or businesses must demonstrate that they meet the qualifications for the exemption, which may include being a non-profit organization, government entity, or specific types of businesses engaged in exempt activities. It is essential to review the guidelines carefully to ensure compliance and proper qualification.

Required Documents for the Colorado DR 1191 Tax Exemption

When applying for the Colorado DR 1191 Tax Exemption, certain documents are typically required to support the claim. These may include:

- Proof of eligibility, such as a non-profit status letter or government identification.

- Documentation of the transactions for which the exemption is being claimed.

- Any additional forms or information as specified by the Colorado Department of Revenue.

Penalties for Non-Compliance with the Colorado DR 1191 Tax Exemption

Failure to comply with the regulations surrounding the Colorado DR 1191 Tax Exemption can result in significant penalties. These may include fines, back taxes owed, and interest on unpaid amounts. It is crucial for taxpayers to understand the implications of non-compliance and to ensure that all forms are submitted correctly and on time to avoid such penalties.

Quick guide on how to complete co dr1191 tax exemption

Complete Co Dr1191 Tax Exemption effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents quickly and without delays. Manage Co Dr1191 Tax Exemption on any device using the airSlate SignNow apps for Android or iOS and streamline your document-related processes today.

How to modify and eSign Co Dr1191 Tax Exemption with ease

- Locate Co Dr1191 Tax Exemption and then click Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional handwritten signature.

- Review the information and then click the Done button to save your updates.

- Decide how you prefer to share your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Co Dr1191 Tax Exemption to ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the colorado dr1191 exemption?

The colorado dr1191 exemption is a tax exemption certificate used in Colorado to qualify for certain tax benefits. It allows eligible entities to make tax-exempt purchases for specific products and services. Understanding this exemption is crucial for businesses looking to maximize their tax savings.

-

How can airSlate SignNow assist with colorado dr1191 exemption documentation?

airSlate SignNow simplifies the process of managing colorado dr1191 exemption documentation by providing an easy-to-use platform for sending and eSigning important forms. With our software, businesses can quickly create, send, and securely manage their exemption certificates. This streamlining helps ensure compliance and saves valuable time.

-

What features does airSlate SignNow offer for managing the colorado dr1191 exemption?

airSlate SignNow offers several features to help manage the colorado dr1191 exemption efficiently, including customizable templates, automated workflows, and real-time tracking. These features facilitate seamless document management and enhance overall efficiency, allowing businesses to focus on their core operations without the hassle of paperwork.

-

Is airSlate SignNow cost-effective for handling colorado dr1191 exemption forms?

Yes, airSlate SignNow is a cost-effective solution for managing colorado dr1191 exemption forms. Our competitive pricing structures cater to various business sizes, ensuring you get the necessary tools without breaking the bank. Investing in our solution can ultimately lead to signNow savings by improving document accuracy and reducing processing times.

-

Can airSlate SignNow integrate with other software for the colorado dr1191 exemption process?

Absolutely! airSlate SignNow integrates seamlessly with various software applications to facilitate the colorado dr1191 exemption process. Whether it's connecting to your existing ERP system or accounting software, our integrations ensure that your document processes remain streamlined and efficient across platforms.

-

What are the benefits of using airSlate SignNow for the colorado dr1191 exemption?

Using airSlate SignNow for the colorado dr1191 exemption offers numerous benefits, including increased efficiency, enhanced security, and improved document tracking. Our platform allows businesses to send, receive, and manage exemption forms in a digital environment, reducing errors and ensuring faster processing times. These advantages support your business in maintaining compliance with tax regulations.

-

Is it easy to get started with airSlate SignNow for colorado dr1191 exemption?

Yes, getting started with airSlate SignNow for managing the colorado dr1191 exemption is simple and user-friendly. Our platform features intuitive navigation and comprehensive tutorials that guide you through the process, allowing you to create and send your exemption forms in just a few clicks. You can be up and running in no time!

Get more for Co Dr1191 Tax Exemption

- 4 month well child check template form

- Cub scout permission slip form

- Fmla checklist form

- Mcallen isd field trip parent permission form

- Medication administration training test form

- Month to month lease agreement form

- Medarbetarportalen gu form

- Management systems action planning template management systems action planning template form

Find out other Co Dr1191 Tax Exemption

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe