Philadelphia Form

What is the Philadelphia Form

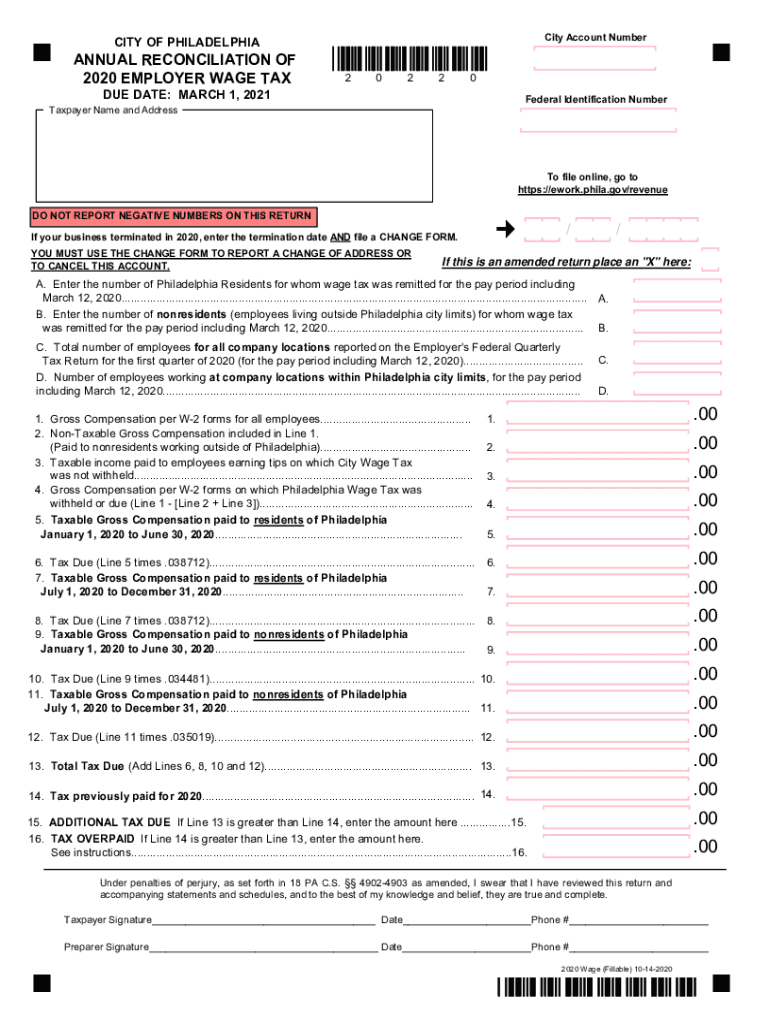

The Philadelphia Form, often referred to as the reconciliation wage city form, is a crucial document for employers operating within the city of Philadelphia. This form is primarily used to reconcile the wage tax withheld from employees throughout the year. It ensures that the correct amount of tax has been collected and reported to the city, aligning with local tax regulations. Understanding the purpose of this form is essential for compliance and accurate financial reporting.

Steps to Complete the Philadelphia Form

Completing the Philadelphia Form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial records, including payroll data and tax withholding information. Next, accurately fill out the form by entering the total wages paid, the amount of city wage tax withheld, and any adjustments that may apply. It is important to double-check all entries for accuracy. Finally, submit the form by the designated deadline to avoid penalties.

Legal Use of the Philadelphia Form

The Philadelphia Form serves as a legally binding document when properly completed and submitted. It is essential for employers to adhere to the guidelines set forth by the city to ensure compliance with local tax laws. The form must be signed by an authorized representative of the business, which adds to its legal validity. Failure to use the form correctly can result in penalties and additional scrutiny from tax authorities.

Filing Deadlines / Important Dates

Timely filing of the Philadelphia Form is critical to avoid penalties. Employers should be aware of the specific deadlines for submission, which typically align with the end of the fiscal year or specific quarterly reporting periods. Keeping track of these dates ensures that employers remain compliant with local tax regulations and avoid unnecessary fines.

Required Documents

To complete the Philadelphia Form accurately, several documents are typically required. These include payroll records, previous tax filings, and any relevant correspondence from the city regarding tax obligations. Having all necessary documentation at hand will streamline the completion process and help ensure that the form is filled out correctly.

Form Submission Methods (Online / Mail / In-Person)

Employers have several options for submitting the Philadelphia Form. The form can be filed online through the city’s official tax portal, which offers a convenient and efficient way to ensure timely submission. Alternatively, employers can choose to mail the completed form or submit it in person at designated city offices. Each method has its own advantages, and employers should select the one that best fits their needs.

Quick guide on how to complete philadelphia form

Prepare Philadelphia Form effortlessly on any device

Web-based document management has become increasingly popular among companies and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents promptly without any delays. Manage Philadelphia Form on any device using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

The simplest way to modify and electronically sign Philadelphia Form with ease

- Obtain Philadelphia Form and then click Get Form to begin.

- Use the tools we offer to fill out your form.

- Select relevant portions of the documents or conceal sensitive information using the tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Decide how you would like to deliver your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing out new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Philadelphia Form and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is reconciliation wage city?

Reconciliation wage city refers to the process of aligning payroll records with employee payments to ensure accuracy. By utilizing tools like airSlate SignNow, businesses can streamline the reconciliation process, making it easier to manage and validate wage data within a city.

-

How does airSlate SignNow assist in reconciliation wage city?

airSlate SignNow provides an intuitive platform that allows businesses to effectively manage and sign payroll documents. This tool can help automate the reconciliation wage city process, ensuring that all necessary sign-offs are captured quickly and securely.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to meet different business needs. These plans provide access to features that enhance the reconciliation wage city process, ensuring that users can find an affordable solution that fits their budget.

-

Can airSlate SignNow integrate with other payroll software for reconciliation wage city?

Yes, airSlate SignNow integrates seamlessly with popular payroll software to enhance the reconciliation wage city experience. This integration ensures that all payroll data remains consistent and accessible, simplifying the entire reconciliation process.

-

What features does airSlate SignNow offer for document management in reconciliation wage city?

airSlate SignNow offers a range of features including electronic signatures, templates, and workflow automation that are essential for efficient document management. These features play a crucial role in facilitating the reconciliation wage city, ensuring that all documents are properly handled and processed.

-

Why should businesses choose airSlate SignNow for reconciliation wage city?

Businesses should choose airSlate SignNow for its user-friendly interface and cost-effective solutions that enhance the reconciliation wage city process. The platform allows for quick document completion, which can save time and reduce errors commonly associated with payroll processing.

-

Is there customer support available for users of airSlate SignNow?

Yes, airSlate SignNow provides robust customer support to assist users with any queries related to the reconciliation wage city process. Their support team is knowledgeable and ready to help troubleshoot issues, ensuring users get the most out of their service.

Get more for Philadelphia Form

Find out other Philadelphia Form

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online