Form or 530, Oregon Quarterly Tax Return for Tobacco Distributors, 150 605 004

What is the Form OR 530, Oregon Quarterly Tax Return For Tobacco Distributors

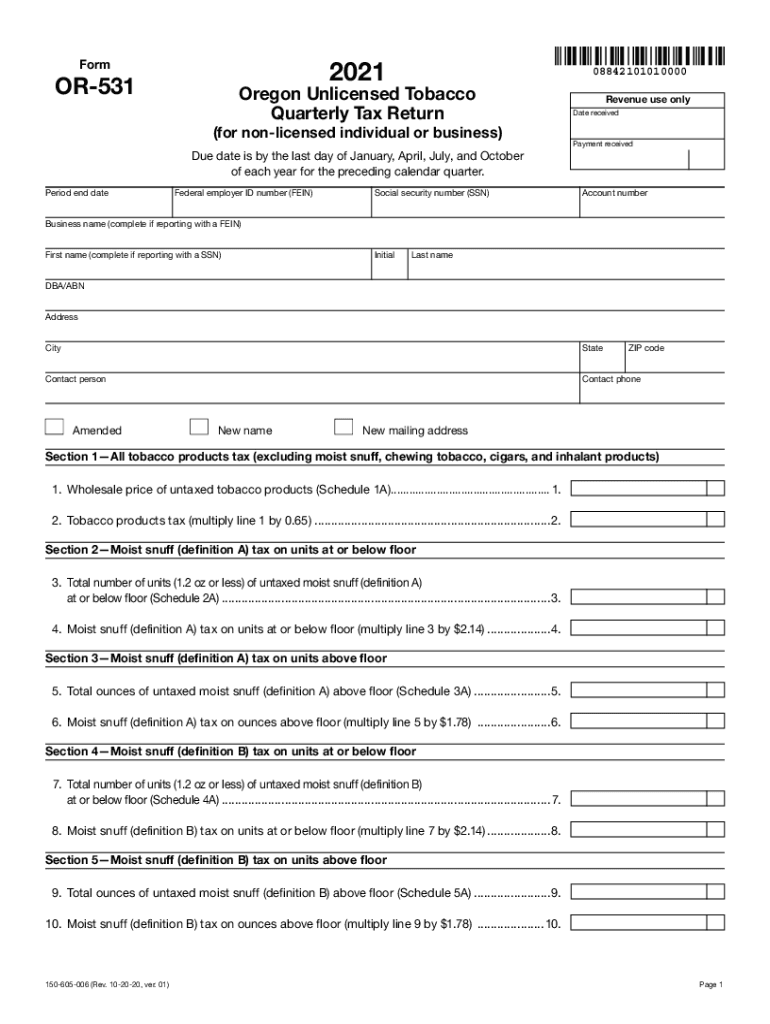

The Form OR 530 is a crucial document for tobacco distributors in Oregon, specifically designed for reporting quarterly tobacco taxes. This form is essential for compliance with state regulations and ensures that distributors meet their tax obligations. It captures vital information regarding the amount of tobacco distributed, sales figures, and tax calculations. Understanding the purpose and requirements of this form is fundamental for any business involved in the tobacco industry in Oregon.

How to use the Form OR 530, Oregon Quarterly Tax Return For Tobacco Distributors

Using the Form OR 530 involves several steps to ensure accurate reporting and compliance. Distributors must first gather all necessary sales data for the quarter, including quantities of tobacco products sold. Once the data is collected, the form can be filled out with the required information, such as distributor details and tax calculations. After completing the form, it should be submitted to the appropriate state agency by the specified deadline to avoid penalties. Familiarity with the form's structure and requirements is essential for smooth filing.

Steps to complete the Form OR 530, Oregon Quarterly Tax Return For Tobacco Distributors

Completing the Form OR 530 involves a systematic approach:

- Gather necessary sales records and tax documents for the quarter.

- Fill in the distributor's information, including name, address, and tax identification number.

- Report the total quantity of tobacco products distributed during the quarter.

- Calculate the total tax owed based on the quantity reported.

- Review the completed form for accuracy and completeness.

- Submit the form by the deadline, either online or by mail.

Filing Deadlines / Important Dates

Timely filing of the Form OR 530 is critical to avoid penalties. The deadlines for submitting this form are typically set quarterly. Distributors should be aware of these key dates:

- First Quarter: Due by April 30

- Second Quarter: Due by July 31

- Third Quarter: Due by October 31

- Fourth Quarter: Due by January 31 of the following year

Penalties for Non-Compliance

Failure to file the Form OR 530 on time or inaccuracies in reporting can lead to significant penalties. These may include:

- Late filing fees, which can accumulate over time.

- Interest on unpaid taxes, increasing the total amount owed.

- Potential legal action for persistent non-compliance.

It is essential for tobacco distributors to maintain accurate records and adhere to filing deadlines to avoid these consequences.

Legal use of the Form OR 530, Oregon Quarterly Tax Return For Tobacco Distributors

The Form OR 530 must be used in accordance with Oregon state laws governing tobacco distribution. Legal compliance ensures that distributors are not only fulfilling their tax obligations but also adhering to regulations that govern the sale and distribution of tobacco products. This includes maintaining accurate records, timely filing, and reporting all necessary information as required by the state. Understanding the legal implications of this form is vital for any distributor operating in Oregon.

Quick guide on how to complete 2021 form or 530 oregon quarterly tax return for tobacco distributors 150 605 004

Effortlessly Complete Form OR 530, Oregon Quarterly Tax Return For Tobacco Distributors, 150 605 004 on Any Device

Managing documents online has gained traction among companies and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Administer Form OR 530, Oregon Quarterly Tax Return For Tobacco Distributors, 150 605 004 on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Easiest Way to Edit and Electronically Sign Form OR 530, Oregon Quarterly Tax Return For Tobacco Distributors, 150 605 004 Without Stress

- Find Form OR 530, Oregon Quarterly Tax Return For Tobacco Distributors, 150 605 004 and then click Get Form to begin.

- Utilize the tools provided to complete your document.

- Select important sections of your documents or conceal sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your edits.

- Decide how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, time-consuming form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Form OR 530, Oregon Quarterly Tax Return For Tobacco Distributors, 150 605 004 while ensuring superb communication during any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow's approach to managing tobacco tax or compliance documentation?

airSlate SignNow provides a streamlined solution for managing tobacco tax or compliance documentation. Our platform allows businesses to create, send, and eSign necessary documents securely, ensuring you stay compliant with regulations. Simply integrate our tools into your workflow to minimize errors and enhance efficiency.

-

How does airSlate SignNow help with the calculation of tobacco tax or fees?

While airSlate SignNow does not calculate tobacco tax or fees directly, it plays a vital role in managing the necessary paperwork for these transactions. By enabling eSignature on agreements related to these taxes, businesses can ensure timely processing and accurate record-keeping. This helps maintain compliance without the hassle of manual processes.

-

What are the pricing plans for airSlate SignNow for tobacco tax or document management?

airSlate SignNow offers competitive pricing plans tailored for businesses managing tobacco tax or documentation. Our plans range from basic to premium features, accommodating the needs of small to large enterprises. Visit our pricing page for a detailed breakdown to find the best fit for your compliance needs.

-

Can airSlate SignNow integrate with accounting software for tobacco tax or reporting?

Yes, airSlate SignNow integrates seamlessly with various accounting software tools, making it easier to manage tobacco tax or reporting. These integrations facilitate better tracking and management of financial information related to tobacco tax or compliance. Utilize our API to connect with your existing tools effortlessly.

-

What features does airSlate SignNow provide for tobacco tax or documentation?

airSlate SignNow provides robust features such as customizable templates, automated workflows, and secure cloud storage for tobacco tax or documentation. These features ensure that all your critical documents are organized, accessible, and compliant with current regulations. Enhance your document management process with our user-friendly interface.

-

How secure is airSlate SignNow when dealing with tobacco tax or eSignatures?

Security is a top priority at airSlate SignNow. We employ industry-standard encryption and authentication practices to protect your tobacco tax or eSignature transactions. With our platform, you can rest assured that your sensitive information is safeguarded against unauthorized access and data bsignNowes.

-

What benefits does airSlate SignNow offer for businesses handling tobacco tax or forms?

airSlate SignNow streamlines the process of handling tobacco tax or forms, saving businesses time and reducing paperwork. By digitizing document workflows, organizations can enhance efficiency and accuracy in compliance tasks. This results in improved productivity and allows your team to focus on core business functions.

Get more for Form OR 530, Oregon Quarterly Tax Return For Tobacco Distributors, 150 605 004

- Roland morris form

- Police information check section

- National public registry form

- Documenten documents postnl form

- Drapery measurement worksheet 100093902 form

- Dhhs 5010 north carolina state laboratory public health form

- The calpers longterm care programnotice of reconsi form

- Veh 002 application form to licence a new or used

Find out other Form OR 530, Oregon Quarterly Tax Return For Tobacco Distributors, 150 605 004

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP