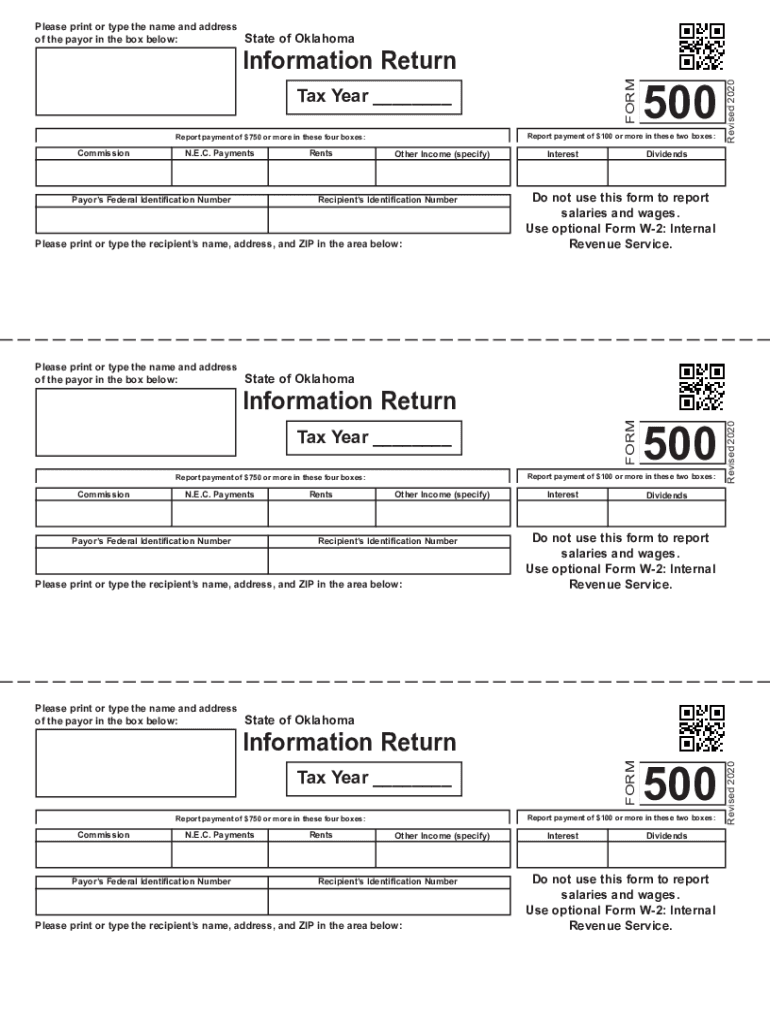

Oklahoma Tax Commission Return Form

What is the Oklahoma Tax Commission Return

The Oklahoma Tax Commission Return is a form used by residents of Oklahoma to report their income and calculate their tax liability for the year. This return is essential for individuals and businesses to comply with state tax laws. It ensures that taxpayers accurately declare their income, claim deductions, and pay any taxes owed to the state. The form is designed to gather necessary financial information, including wages, self-employment income, and other sources of revenue.

Steps to complete the Oklahoma Tax Commission Return

Completing the Oklahoma Tax Commission Return involves several important steps to ensure accuracy and compliance. First, gather all relevant financial documents, such as W-2s, 1099s, and records of any other income. Next, determine your filing status, which can affect your tax rate and eligibility for certain deductions. Then, fill out the return by entering your income, claiming applicable deductions, and calculating your tax liability. Finally, review the completed form for any errors before submitting it to the Oklahoma Tax Commission.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the Oklahoma Tax Commission Return to avoid penalties. Generally, the deadline for filing individual income tax returns is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, taxpayers should be mindful of any extensions that may be available and the associated deadlines for submitting any payments owed.

Required Documents

To successfully complete the Oklahoma Tax Commission Return, certain documents are necessary. These include:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Records of any other income sources

- Documentation for deductions, such as mortgage interest statements and medical expenses

- Previous year’s tax return for reference

Having these documents ready will streamline the process and help ensure accurate reporting.

Form Submission Methods

The Oklahoma Tax Commission Return can be submitted through various methods, providing flexibility for taxpayers. Individuals can file their returns online using the Oklahoma Tax Commission's e-filing system, which is efficient and secure. Alternatively, taxpayers may choose to mail their completed forms to the appropriate address listed on the return. In-person submissions are also possible at designated tax offices, allowing for direct assistance if needed.

Legal use of the Oklahoma Tax Commission Return

The Oklahoma Tax Commission Return is legally binding when completed and submitted according to state regulations. It is essential for taxpayers to ensure that all information provided is accurate and truthful, as any discrepancies can lead to penalties or audits. The return must be signed, either electronically or physically, to validate its authenticity. Compliance with the filing requirements helps maintain the integrity of the tax system and ensures that taxpayers fulfill their obligations.

Quick guide on how to complete oklahoma tax commission return

Complete Oklahoma Tax Commission Return seamlessly on any device

Digital document management has become increasingly favored by both businesses and individuals. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly and without delays. Manage Oklahoma Tax Commission Return on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to alter and eSign Oklahoma Tax Commission Return with ease

- Obtain Oklahoma Tax Commission Return and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight signNow sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign feature, which takes just moments and carries the same legal standing as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Choose your preferred method of sharing your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of missing or lost documents, tedious form searches, and errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from a device of your choosing. Modify and eSign Oklahoma Tax Commission Return and guarantee excellent communication throughout every phase of the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the significance of the 2020 Oklahoma tax return?

The 2020 Oklahoma tax return is an essential document for individuals and businesses to report their income and calculate their tax liabilities for the year. Accurate filings can help avoid penalties and ensure compliance with state tax laws. It is crucial to gather all necessary documents and deductions to optimize your tax return.

-

How can airSlate SignNow assist with filing my 2020 Oklahoma tax return?

airSlate SignNow streamlines the process of preparing and submitting your 2020 Oklahoma tax return by enabling you to electronically sign documents securely. Our user-friendly platform allows for rapid document collaboration, ensuring you and your tax preparer can work efficiently together. This can signNowly reduce the time you spend on tax filing.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of both individuals and businesses. Plans vary based on features, and you can choose a plan that best suits your needs for managing documents, including those related to the 2020 Oklahoma tax return. Visit our website to explore detailed pricing options and find the best fit for your requirements.

-

What features does airSlate SignNow provide for tax document management?

airSlate SignNow provides features such as secure e-signature integrations, document templates, and automated workflows to help manage your tax documents efficiently. These capabilities make it easier for users to prepare and submit their 2020 Oklahoma tax return. Additionally, the platform ensures that all documents are stored securely and are easily accessible.

-

Is airSlate SignNow compliant with Oklahoma state tax regulations?

Yes, airSlate SignNow is fully compliant with state regulations, including those specific to the 2020 Oklahoma tax return. We prioritize security and adhere to industry standards to keep your sensitive tax information safe. This compliance ensures that your e-signatures and document submissions are valid and recognized by state authorities.

-

Can I integrate airSlate SignNow with my accounting software for my 2020 Oklahoma tax return?

Absolutely! airSlate SignNow seamlessly integrates with a variety of accounting software, allowing for smooth document flow and management related to your 2020 Oklahoma tax return. This integration simplifies data sharing and streamlines your filing process, making it easier to keep track of your tax documents and reduce administrative burdens.

-

What benefits can I expect from using airSlate SignNow for my tax documents?

Using airSlate SignNow for your tax documents offers numerous benefits, including enhanced security, improved efficiency, and reduced turnaround times for signing and submitting your 2020 Oklahoma tax return. Our intuitive platform allows you to track document status in real time, ensuring a hassle-free experience. Additionally, users save time and resources, which can be redirected towards other business activities.

Get more for Oklahoma Tax Commission Return

Find out other Oklahoma Tax Commission Return

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document