China Bank Downloadable Forms

Understanding the China Bank Downloadable Forms

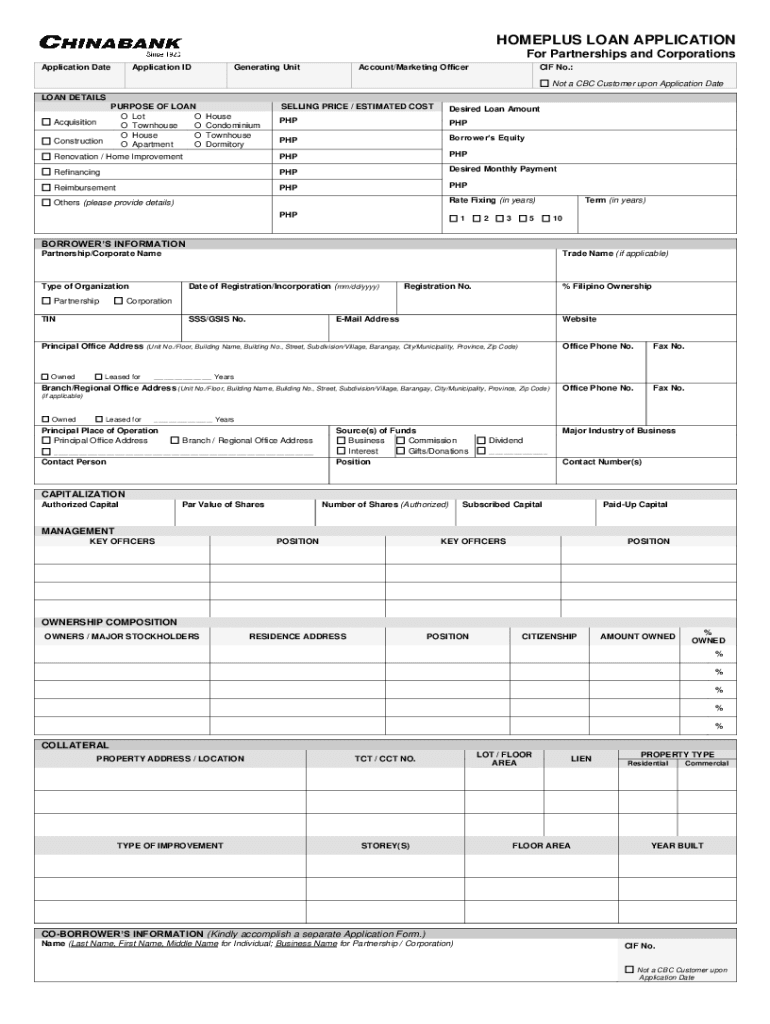

The China Bank downloadable forms are essential documents that facilitate various banking processes, including loan applications. These forms are designed to be user-friendly and accessible, allowing customers to manage their banking needs efficiently. Users can download these forms directly from the China Bank website, ensuring they have the most current versions available for their transactions.

Steps to Complete the China Bank Downloadable Forms

Completing the China Bank downloadable forms requires careful attention to detail. Here are the steps to follow:

- Download the Form: Access the China Bank website to find the specific form you need, such as the chinabank homeplus loan application.

- Fill Out the Form: Provide accurate information in all required fields. Ensure that your personal details, financial information, and any other necessary data are complete.

- Review Your Information: Double-check all entries for accuracy. Mistakes can delay processing or lead to application rejection.

- Sign the Document: Use a reliable eSignature tool, such as airSlate SignNow, to sign the document electronically, ensuring compliance with legal standards.

- Submit the Form: Follow the submission guidelines provided by China Bank, whether online, by mail, or in person.

Legal Use of the China Bank Downloadable Forms

The legal validity of the China Bank downloadable forms, including the chinabank homeplus loan application, is crucial for ensuring that transactions are binding and enforceable. To maintain legal compliance, it is important to adhere to eSignature laws such as ESIGN and UETA. These laws affirm that electronic signatures hold the same weight as traditional handwritten signatures when executed correctly.

Eligibility Criteria for the China Bank Homeplus Loan

Before applying for the chinabank homeplus loan, it is essential to understand the eligibility criteria. Generally, applicants must:

- Be a legal resident of the United States.

- Meet minimum income requirements as specified by China Bank.

- Have a satisfactory credit history.

- Provide necessary documentation, including proof of identity and income.

Application Process & Approval Time for the China Bank Homeplus Loan

The application process for the chinabank homeplus loan involves several stages:

- Application Submission: Complete and submit the chinabank homeplus loan application form along with required documents.

- Review Process: China Bank will review your application, which may take several days depending on the volume of applications.

- Approval Notification: Once reviewed, you will receive a notification regarding the approval status of your loan application.

- Disbursement: If approved, funds will be disbursed according to the terms outlined in your loan agreement.

How to Use the China Bank Downloadable Forms

Using the China Bank downloadable forms effectively requires understanding their purpose and how to fill them out correctly. Each form is tailored for specific banking needs, such as loan applications or account changes. After downloading the appropriate form, follow the instructions provided to ensure you complete it accurately. Utilizing a digital signing tool can enhance the process by allowing you to sign and submit forms securely online, making it convenient and efficient.

Quick guide on how to complete china bank downloadable forms

Effortlessly Complete China Bank Downloadable Forms on Any Device

Digital document management has become increasingly favored by both companies and individuals. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, allowing you to locate the correct form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents quickly and without delays. Handle China Bank Downloadable Forms on any platform using airSlate SignNow's Android or iOS applications and elevate any document-centric task today.

How to Edit and Electronically Sign China Bank Downloadable Forms with Ease

- Obtain China Bank Downloadable Forms and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or redact confidential information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and electronically sign China Bank Downloadable Forms and ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the chinabank homeplus loan?

The chinabank homeplus loan is a flexible financing solution offered by China Bank that allows you to purchase, build, or renovate your home. This loan product provides competitive interest rates and customizable terms, making it an excellent choice for homebuyers and homeowners looking to improve their living space.

-

What are the eligibility requirements for the chinabank homeplus loan?

To qualify for the chinabank homeplus loan, applicants must be at least 21 years old and a Filipino citizen or a foreigner with a valid Philippine visa. Additionally, applicants should have a stable income, good credit history, and the capability to provide the necessary documents to support their application.

-

What are the benefits of the chinabank homeplus loan?

The chinabank homeplus loan offers several benefits, including competitive interest rates, flexible repayment periods, and no prepayment penalties. With this loan, you can easily finance your home renovation or purchase, thus achieving your dream living space while managing your finances effectively.

-

How can I apply for the chinabank homeplus loan?

You can apply for the chinabank homeplus loan by visiting your nearest China Bank branch or by accessing their online application portal. Be prepared to provide necessary documents such as proof of income, identification, and other relevant paperwork to streamline your application process.

-

What documents are needed for the chinabank homeplus loan application?

To complete your chinabank homeplus loan application, you'll generally need to provide identification, proof of income (such as pay slips or tax returns), and property documents if applicable. It’s best to check with China Bank for a comprehensive list of required documents based on your specific situation.

-

How does the chinabank homeplus loan compare to other home loans?

The chinabank homeplus loan competes favorably with other home loans due to its tailored features and competitive interest rates. Customers appreciate its flexible repayment options and customer service support, allowing users to make informed decisions throughout their financing journey.

-

What is the typical processing time for the chinabank homeplus loan?

The processing time for the chinabank homeplus loan typically ranges from a few days to a few weeks, depending on the completeness of your application and verification of documents. China Bank aims to expedite the loan approval process to help you start your home project as soon as possible.

Get more for China Bank Downloadable Forms

Find out other China Bank Downloadable Forms

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself