Ct Uc2 Form PDF 2004-2026

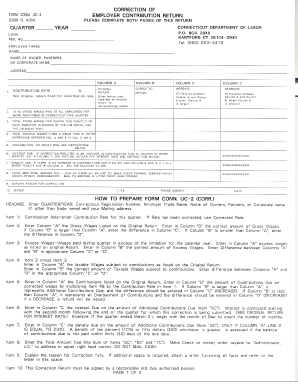

What is the Connecticut UC-5A Form?

The Connecticut UC-5A form, also known as the Employee Quarterly Earnings Report, is a crucial document used by employers in Connecticut to report employee wages and contributions to the state’s unemployment compensation system. This form is essential for maintaining compliance with state regulations and ensuring that employees receive the appropriate benefits. Employers must accurately complete this form to reflect the earnings of their employees for each quarter.

Steps to Complete the Connecticut UC-5A Form

Completing the Connecticut UC-5A form involves several key steps to ensure accuracy and compliance:

- Gather all necessary employee wage information for the reporting period.

- Enter the employer's identification details, including the business name and address.

- List each employee's name, Social Security number, and total wages earned during the quarter.

- Calculate the total wages and contributions owed to the unemployment fund.

- Review the form for any errors or omissions before submission.

Legal Use of the Connecticut UC-5A Form

The Connecticut UC-5A form serves a legal purpose in documenting employee earnings and contributions to the unemployment insurance system. By filing this form, employers fulfill their legal obligations under Connecticut law, ensuring that they contribute to the unemployment fund that supports workers in times of need. Accurate filing is essential to avoid potential penalties and ensure compliance with state regulations.

Filing Deadlines for the Connecticut UC-5A Form

Employers must adhere to specific filing deadlines for the Connecticut UC-5A form to remain compliant. Typically, the form is due on the last day of the month following the end of each quarter. For example, the deadlines are:

- First Quarter: April 30

- Second Quarter: July 31

- Third Quarter: October 31

- Fourth Quarter: January 31

Form Submission Methods for the Connecticut UC-5A

The Connecticut UC-5A form can be submitted through various methods, offering flexibility for employers. The submission options include:

- Online submission through the Connecticut Department of Labor's website.

- Mailing a paper copy of the completed form to the appropriate state office.

- In-person submission at designated state offices, if necessary.

Key Elements of the Connecticut UC-5A Form

Understanding the key elements of the Connecticut UC-5A form is vital for accurate completion. Important components include:

- Employer identification information.

- Employee details, including names and Social Security numbers.

- Total wages paid to each employee during the reporting period.

- Contributions owed to the unemployment compensation fund.

Penalties for Non-Compliance with the Connecticut UC-5A Form

Failure to file the Connecticut UC-5A form accurately and on time can result in penalties for employers. Potential consequences include:

- Monetary fines for late or inaccurate submissions.

- Increased scrutiny from state authorities.

- Potential legal action for continued non-compliance.

Quick guide on how to complete ct uc2 form pdf

Complete Ct Uc2 Form Pdf effortlessly on any device

Online document management has become widely embraced by organizations and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can locate the appropriate form and securely archive it online. airSlate SignNow equips you with all the resources necessary to create, alter, and electronically sign your documents swiftly without delays. Handle Ct Uc2 Form Pdf on any device using airSlate SignNow's Android or iOS applications and simplify any document-centric process today.

How to modify and electronically sign Ct Uc2 Form Pdf seamlessly

- Locate Ct Uc2 Form Pdf and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important parts of the documents or conceal sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and electronically sign Ct Uc2 Form Pdf and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ct uc2 form pdf

Create this form in 5 minutes!

How to create an eSignature for the ct uc2 form pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is UC 2 filing, and how does airSlate SignNow simplify this process?

UC 2 filing refers to the submission of certain documentation related to unemployment claims. airSlate SignNow simplifies UC 2 filing by providing an easy-to-use platform for electronic signatures and secure document management, ensuring that your submissions are accurate and timely.

-

Is there a cost associated with using airSlate SignNow for UC 2 filing?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Businesses can benefit from a cost-effective solution for UC 2 filing, enabling them to streamline their document workflows without breaking the bank.

-

What features does airSlate SignNow offer for simplifying UC 2 filing?

airSlate SignNow provides several features that enhance the UC 2 filing process, including customizable templates, secure electronic signatures, and real-time tracking of document status. These features help ensure that all submissions are efficient and compliant.

-

Can I integrate airSlate SignNow with other tools for UC 2 filing?

Absolutely! airSlate SignNow offers integrations with various applications and platforms that can facilitate UC 2 filing. This allows users to seamlessly connect their document workflows with tools they already use, improving efficiency and productivity.

-

How does airSlate SignNow enhance the security of UC 2 filing?

Security is paramount when it comes to UC 2 filing, and airSlate SignNow safeguards your documents through advanced encryption and secure access controls. This ensures that sensitive information remains protected throughout the entire filing process.

-

Can multiple users access airSlate SignNow for UC 2 filing?

Yes, airSlate SignNow allows multiple users to collaborate on documents, making UC 2 filing a team effort. This feature facilitates better communication and coordination among team members involved in the filing process.

-

What are the benefits of using airSlate SignNow for UC 2 filing compared to traditional methods?

Using airSlate SignNow for UC 2 filing offers numerous benefits, including faster processing times, reduced paperwork, and improved accuracy. These advantages help organizations to efficiently manage their claims while ensuring compliance and reducing errors.

Get more for Ct Uc2 Form Pdf

Find out other Ct Uc2 Form Pdf

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple