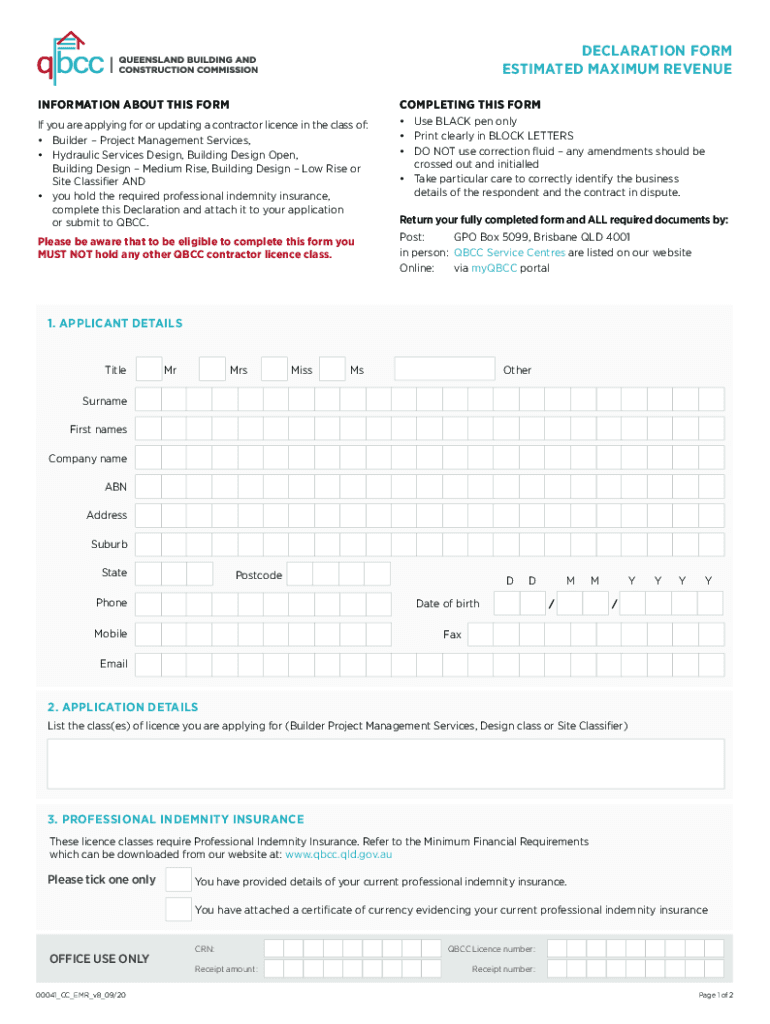

APPLICATION to CHANGE MAXIMUM REVENUE FORM

What is the estimated maximum revenue declaration?

The estimated maximum revenue declaration is a formal document that businesses submit to indicate their anticipated revenue for a specific period. This declaration is often required for various regulatory and compliance purposes, including tax assessments and financial planning. By providing an accurate estimate, businesses can ensure they meet their obligations and avoid potential penalties.

How to use the estimated maximum revenue declaration

Using the estimated maximum revenue declaration involves several steps. First, businesses need to gather relevant financial data, including historical revenue figures and market analysis. Once the necessary information is compiled, the declaration can be filled out, ensuring that all sections are completed accurately. After completion, the document should be submitted to the appropriate regulatory body, either online or by mail, depending on the requirements.

Steps to complete the estimated maximum revenue declaration

Completing the estimated maximum revenue declaration requires careful attention to detail. Here are the steps to follow:

- Gather financial records and data from previous years.

- Analyze market trends and forecasts to estimate future revenue.

- Fill out the declaration form, ensuring all fields are completed.

- Review the form for accuracy and completeness.

- Submit the form by the required deadline, following the specified submission method.

Legal use of the estimated maximum revenue declaration

The legal use of the estimated maximum revenue declaration is crucial for compliance with federal and state regulations. This document serves as a binding statement of a business's financial expectations and may be subject to audits. To ensure its legality, businesses should adhere to all relevant guidelines and maintain accurate records that support the figures reported in the declaration.

Required documents for the estimated maximum revenue declaration

When preparing the estimated maximum revenue declaration, certain documents are typically required. These may include:

- Previous year’s financial statements.

- Tax returns from the last few years.

- Market analysis reports.

- Budget forecasts and projections.

Filing deadlines for the estimated maximum revenue declaration

Filing deadlines for the estimated maximum revenue declaration can vary based on the specific requirements of the regulatory body. It is essential for businesses to be aware of these deadlines to avoid late submission penalties. Generally, these deadlines align with fiscal year-end dates or specific tax filing periods, so keeping a calendar of important dates is advisable.

Quick guide on how to complete application to change maximum revenue form

Effortlessly complete APPLICATION TO CHANGE MAXIMUM REVENUE FORM on any device

The management of online documents has become increasingly favored by both businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly and without delays. Handle APPLICATION TO CHANGE MAXIMUM REVENUE FORM on any device using airSlate SignNow apps for Android or iOS and simplify any document-related process today.

The easiest way to edit and electronically sign APPLICATION TO CHANGE MAXIMUM REVENUE FORM with ease

- Find APPLICATION TO CHANGE MAXIMUM REVENUE FORM and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow has specifically designed for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign APPLICATION TO CHANGE MAXIMUM REVENUE FORM to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an estimated maximum revenue declaration?

An estimated maximum revenue declaration is a financial report that outlines an organization's projected income potential based on various factors and existing data. This declaration helps businesses strategize their financial planning and assess their growth potential. By generating this document with airSlate SignNow, companies can efficiently capture necessary signatures and streamline the approval process.

-

How can airSlate SignNow assist with the estimated maximum revenue declaration process?

airSlate SignNow simplifies the estimated maximum revenue declaration process by allowing users to create, send, and eSign documents seamlessly. Our platform minimizes administrative burdens, enabling faster collaboration and approvals. With automated workflows, document tracking, and secure signing, businesses can enhance their efficiency in handling revenue declarations.

-

Is airSlate SignNow cost-effective for generating an estimated maximum revenue declaration?

Yes, airSlate SignNow offers a cost-effective solution for generating an estimated maximum revenue declaration without compromising on features. Our pricing plans are designed to accommodate businesses of all sizes, providing essential tools to streamline document workflows at an affordable rate. This ensures that companies can manage their declarations efficiently without overspending.

-

What features does airSlate SignNow offer for eSigning an estimated maximum revenue declaration?

Our platform includes several features tailored for eSigning an estimated maximum revenue declaration, such as customizable templates, advanced security options, and real-time tracking. airSlate SignNow also supports multiple signature options, ensuring compliance and authenticity in every document. This enables businesses to finalize their declarations quickly and securely.

-

Can I integrate airSlate SignNow with other applications to manage my estimated maximum revenue declaration?

Absolutely! airSlate SignNow supports integrations with various apps and platforms, making it easy for businesses to manage their estimated maximum revenue declaration. You can connect with popular tools like CRMs, project management software, and cloud storage solutions to create a seamless workflow. This enhances overall productivity and ensures all relevant information is readily accessible.

-

What are the benefits of using airSlate SignNow for my estimated maximum revenue declaration?

Using airSlate SignNow for your estimated maximum revenue declaration provides numerous benefits, including improved efficiency, reduced paper usage, and enhanced collaboration. Businesses can reduce turnaround times signNowly and ensure timely approvals with automated workflows. Additionally, our platform's audit trails offer visibility and security, making it easier to maintain compliance.

-

How secure is the process of signing an estimated maximum revenue declaration with airSlate SignNow?

The security of your documents is a top priority at airSlate SignNow. We use advanced encryption methods and comply with industry standards to protect your estimated maximum revenue declaration and any sensitive data it contains. Our platform also features authentication options, ensuring that only authorized personnel can access and sign important documents.

Get more for APPLICATION TO CHANGE MAXIMUM REVENUE FORM

- Student volunteer service application and approval form

- M107a 18365883 form

- College reading test form a 473272033

- Spiritual gifts test printable form

- Get form jv 710

- Letter of instructionprint formreset formsharehold

- Mold addendum first choice realty nwcleanair form

- Richiesta di rigenerazione password per il servizio tim mail form

Find out other APPLICATION TO CHANGE MAXIMUM REVENUE FORM

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF