Commuter Form

What is the Commuter Form

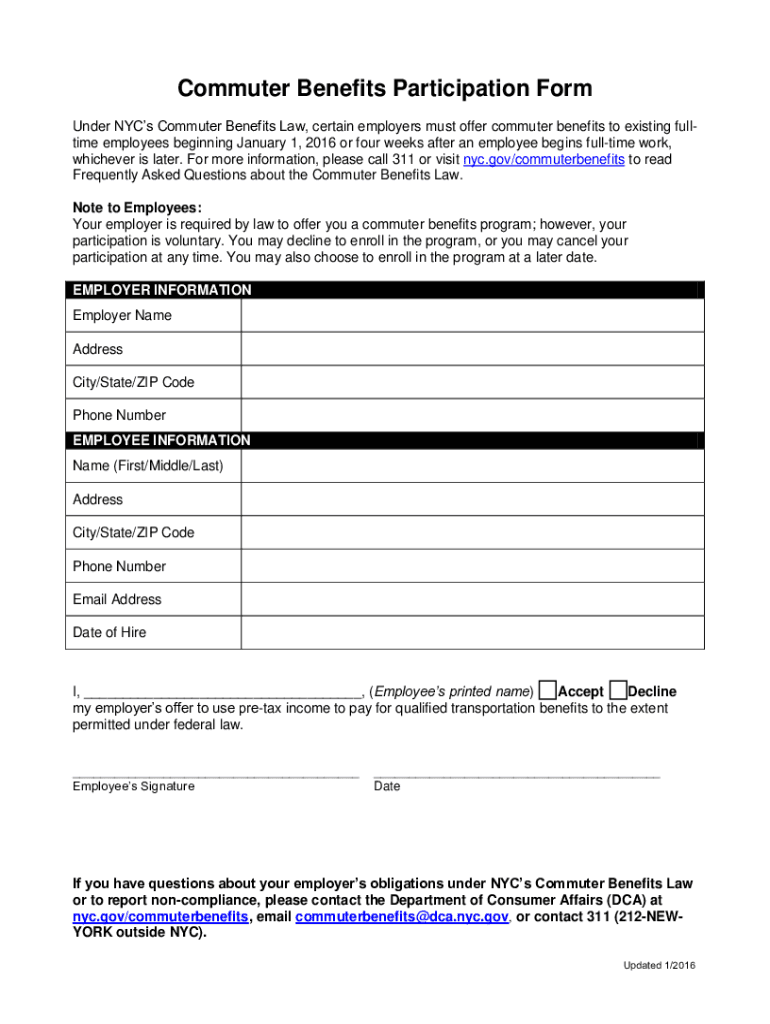

The New York commuter benefits form is a document that allows employees to participate in a pre-tax commuter benefits program. This program enables employees to use pre-tax dollars to pay for eligible commuting expenses, such as public transportation and parking costs. By using the commuter form, employees can reduce their taxable income, leading to potential savings on federal, state, and local taxes.

How to use the Commuter Form

To use the commuter benefits participation form, employees must first obtain the form from their employer or a designated benefits administrator. Once the form is acquired, employees should fill it out with their personal information, including their name, address, and details about their commuting expenses. After completing the form, employees should submit it to their employer for approval. This process ensures that the employer can properly manage the pre-tax deductions from the employee's paycheck.

Steps to complete the Commuter Form

Completing the New York commuter benefits participation form involves several straightforward steps:

- Obtain the commuter form from your employer or benefits administrator.

- Fill in your personal information, including your name, address, and employee ID.

- Detail your commuting expenses, specifying whether they are for public transportation or parking.

- Review the form for accuracy and completeness.

- Submit the form to your employer for processing.

Legal use of the Commuter Form

The New York commuter benefits participation form is legally binding when completed according to the guidelines set forth by the Internal Revenue Service (IRS) and state regulations. To ensure legal compliance, it is essential to provide accurate information and retain copies of submitted forms for personal records. Employers must also adhere to regulations regarding the management of pre-tax commuter benefits to avoid potential penalties.

Eligibility Criteria

To be eligible for the New York commuter benefits program, employees must meet specific criteria, including being a full-time or part-time employee of a participating employer. Additionally, the commuting expenses must be for qualified transportation modes, such as buses, subways, or parking facilities. Employers may have their own eligibility requirements, so employees should check with their HR department for details.

Form Submission Methods

The New York commuter benefits participation form can typically be submitted in various ways, depending on the employer's policies. Common submission methods include:

- Online submission through the employer's benefits portal.

- Mailing a printed copy of the form to the HR department.

- In-person submission during designated HR hours.

Required Documents

When completing the New York commuter benefits participation form, employees may need to provide additional documentation to support their claims. This may include:

- Receipts for commuting expenses.

- Proof of employment, such as a pay stub or employee ID.

- Any other documents requested by the employer for verification.

Quick guide on how to complete commuter form

Effortlessly Prepare Commuter Form on Any Device

Digital document management has gained traction among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Commuter Form on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign Commuter Form without hassle

- Obtain Commuter Form and then click Get Form to begin.

- Utilize the tools we supply to complete your document.

- Emphasize important sections of your documents or black out sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Commuter Form to ensure smooth communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are NY commuter benefits?

NY commuter benefits are tax-free benefits provided by employers to employees for commuting expenses. These benefits can help reduce transportation costs, making commuting more affordable for employees residing in New York. By utilizing airSlate SignNow, businesses can easily manage these benefits and ensure compliance with NY regulations.

-

How can airSlate SignNow help with NY commuter benefits?

airSlate SignNow offers a streamlined solution for managing NY commuter benefits through electronic signatures and document management. This makes it easier for businesses to distribute, collect, and store necessary documentation related to employee transit benefits. Ultimately, it simplifies the process of providing these benefits while ensuring compliance.

-

Are there any costs associated with implementing NY commuter benefits through airSlate SignNow?

While airSlate SignNow provides a cost-effective solution for managing NY commuter benefits, there may be associated costs with the employee transportation plans themselves. However, companies can save signNowly on taxes when offering these benefits, making it a financially sound option. For specific pricing information, businesses should contact airSlate directly.

-

What features does airSlate SignNow offer for managing NY commuter benefits?

airSlate SignNow includes features such as electronic signatures, document templates, and secure storage tailored for NY commuter benefits. These functionalities allow businesses to efficiently administer benefits, track submissions, and facilitate compliance. Additionally, its user-friendly interface contributes to an effective onboarding experience for employees.

-

Can airSlate SignNow integrate with payroll systems for NY commuter benefits?

Yes, airSlate SignNow seamlessly integrates with various payroll systems, helping businesses manage NY commuter benefits efficiently. These integrations allow for automated updates to employee records and ensure accurate processing of tax-free benefits. By using airSlate SignNow, businesses can streamline their payroll processes while offering commuter benefits.

-

What are the tax advantages of using NY commuter benefits?

Utilizing NY commuter benefits through airSlate SignNow can provide signNow tax advantages for both employers and employees. Employers can deduct the costs of providing these benefits from their taxable income, while employees can enjoy tax-free transportation reimbursements. This dual benefit can lead to increased savings and a more satisfied workforce.

-

How does airSlate SignNow ensure compliance with NY commuter benefits regulations?

airSlate SignNow stays up-to-date with NY regulations pertaining to commuter benefits, ensuring that businesses remain compliant. The platform's document management system and electronic signatures help maintain accurate records and streamline compliance reporting. This means businesses can focus on providing benefits without the worry of regulatory issues.

Get more for Commuter Form

Find out other Commuter Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF