ADFS 2 0 Forms and Integrated Authentication on One Server

Understanding Australia Voluntary Contributions

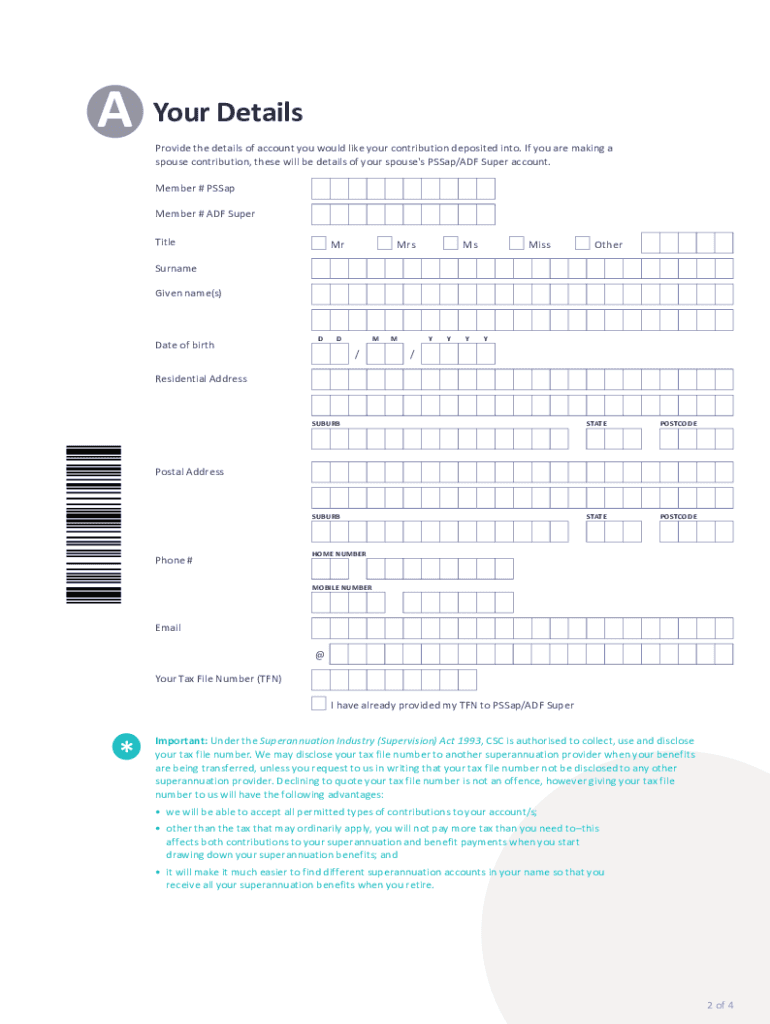

Australia voluntary contributions refer to additional payments made by individuals towards their superannuation funds beyond the mandatory employer contributions. These contributions can enhance retirement savings and offer potential tax benefits. Individuals can choose to make these contributions at their discretion, which can be particularly beneficial for those looking to increase their retirement nest egg.

How to Make Australia Voluntary Contributions

To make voluntary contributions to your superannuation fund, follow these steps:

- Determine your contribution amount based on your financial situation and retirement goals.

- Choose the method of contribution, such as direct deposit, salary sacrifice, or one-off payments.

- Complete any necessary forms required by your superannuation fund to ensure the contributions are allocated correctly.

- Monitor your contributions to stay within the annual cap limits set by the Australian Taxation Office (ATO).

Tax Implications of Australia Voluntary Contributions

Making voluntary contributions can provide tax advantages. Contributions made from after-tax income may be eligible for a tax offset, while those made before-tax can reduce taxable income. It is essential to understand the caps on contributions to avoid excess tax penalties. The ATO provides guidelines on the contribution limits and the associated tax rates, which should be reviewed before making contributions.

Eligibility Criteria for Australia Voluntary Contributions

Eligibility to make voluntary contributions generally includes:

- Being an Australian resident for tax purposes.

- Having a superannuation account with a registered fund.

- Meeting age requirements, as contributions may be restricted for individuals over a certain age unless specific conditions are met.

Common Mistakes to Avoid with Australia Voluntary Contributions

When making voluntary contributions, individuals should be cautious of several common pitfalls:

- Exceeding the contribution caps, which can lead to additional tax liabilities.

- Failing to keep track of contribution records, which may complicate tax reporting.

- Not consulting with a financial advisor to align contributions with overall retirement strategy.

Benefits of Australia Voluntary Contributions

There are several advantages to making voluntary contributions to superannuation:

- Increased retirement savings, providing greater financial security in retirement.

- Potential tax benefits, which can enhance overall financial planning.

- Flexibility in contribution amounts, allowing individuals to adjust based on their financial circumstances.

Quick guide on how to complete adfs 20 forms and integrated authentication on one server

Effortlessly Prepare ADFS 2 0 Forms And Integrated Authentication On One Server on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage ADFS 2 0 Forms And Integrated Authentication On One Server on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related task today.

How to Modify and Electronically Sign ADFS 2 0 Forms And Integrated Authentication On One Server with Ease

- Find ADFS 2 0 Forms And Integrated Authentication On One Server and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from your chosen device. Edit and electronically sign ADFS 2 0 Forms And Integrated Authentication On One Server and guarantee exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are Australia voluntary contributions?

Australia voluntary contributions refer to additional contributions made by individuals to their superannuation funds beyond the mandatory employer contributions. These contributions can provide tax benefits and help boost retirement savings. Understanding how Australia voluntary contributions work can signNowly impact your financial planning for retirement.

-

How can airSlate SignNow help with Australia voluntary contributions documentation?

airSlate SignNow provides a streamlined platform for electronically signing and managing documents related to Australia voluntary contributions. With easy-to-use features, you can securely sign forms and keep a digital record of your submissions. This ensures that you have everything you need for tax and regulatory compliance.

-

What are the benefits of using airSlate SignNow for Australia voluntary contributions?

Using airSlate SignNow for Australia voluntary contributions simplifies the document signing process, making it fast and efficient. Our platform enhances security and provides a complete audit trail for all transactions. Moreover, it reduces paperwork and saves time, allowing you to focus on growing your retirement savings.

-

Is airSlate SignNow cost-effective for managing Australia voluntary contributions?

Yes, airSlate SignNow offers a cost-effective solution for managing all your Australia voluntary contributions and related documentation. Our competitive pricing plans accommodate various business sizes, ensuring that you get value for your investment. Plus, the efficiency gained can lead to signNow savings over time.

-

Are there any integrations available with airSlate SignNow for handling Australia voluntary contributions?

airSlate SignNow offers seamless integrations with various financial and accounting platforms, making it easier to manage Australia voluntary contributions. This ensures that your contributions are tracked and documented effectively across different systems. By integrating with your existing tools, there’s less disruption in your workflow.

-

Can airSlate SignNow handle multiple users for Australia voluntary contributions?

Absolutely! airSlate SignNow accommodates multiple users, which is particularly beneficial for businesses managing Australia voluntary contributions on behalf of their employees. This feature lets you assign roles, track document status, and ensure that all necessary approvals are collected efficiently.

-

What types of documents can be signed for Australia voluntary contributions using airSlate SignNow?

With airSlate SignNow, you can electronically sign a variety of documents related to Australia voluntary contributions, including superannuation forms and contribution requests. Our platform supports multiple document formats, ensuring that you can manage everything from one central location. Convenience and compliance are key benefits of our electronic signing solution.

Get more for ADFS 2 0 Forms And Integrated Authentication On One Server

Find out other ADFS 2 0 Forms And Integrated Authentication On One Server

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online