Shellpoint Mortgage Payoff Request Fax Number 2021-2026

Key elements of the Shellpoint Mortgage Payoff Request

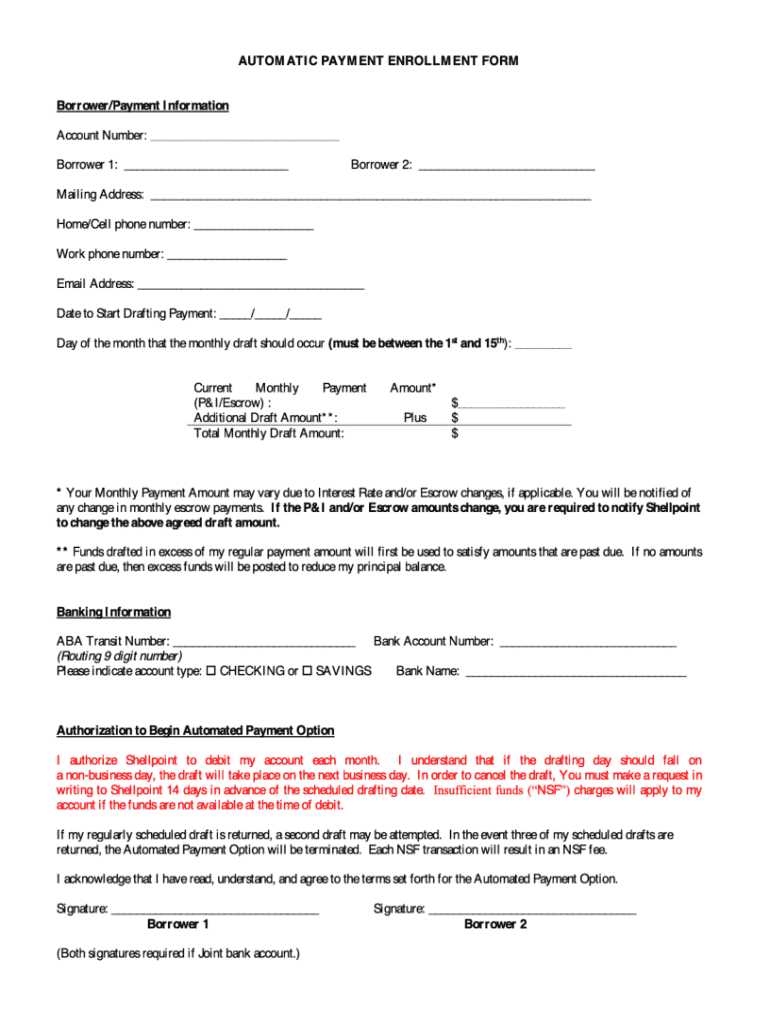

The Shellpoint mortgage payoff request is a crucial document for homeowners looking to pay off their mortgage. Understanding its key elements helps ensure that the request is completed accurately and efficiently. The primary components include:

- Borrower Information: This section requires the borrower's full name, address, and contact information.

- Loan Information: Details such as the loan number and property address are essential for identifying the mortgage account.

- Payoff Amount: The request should specify the exact amount needed to pay off the mortgage, including any interest or fees.

- Signature: The borrower must provide a signature to authorize the request, confirming their intent to pay off the mortgage.

- Third-Party Authorization: If a third party is involved in the transaction, their information and authorization must be included.

Steps to complete the Shellpoint Mortgage Payoff Request

Completing the Shellpoint mortgage payoff request involves several straightforward steps to ensure accuracy and compliance. Follow these steps to facilitate the process:

- Gather Information: Collect all necessary information, including personal details, loan information, and any relevant third-party authorizations.

- Fill Out the Form: Accurately complete the payoff request form, ensuring all sections are filled out correctly.

- Review for Accuracy: Double-check the information provided to avoid any errors that could delay the process.

- Sign the Document: Ensure that the borrower signs the form, as this is a critical step for authorization.

- Submit the Request: Send the completed form to Shellpoint via the preferred submission method, whether online, by fax, or by mail.

How to use the Shellpoint Mortgage Payoff Request Fax Number

Using the Shellpoint mortgage payoff request fax number is an efficient way to submit your request. Here’s how to do it:

- Locate the Fax Number: Find the official Shellpoint mortgage payoff request fax number, which is typically provided on their website or customer service documentation.

- Prepare Your Documents: Ensure that your completed payoff request form and any supporting documents are ready for faxing.

- Send the Fax: Use a fax machine or an online fax service to send your documents to the Shellpoint fax number. Confirm that the transmission was successful.

- Keep a Record: Retain a copy of the fax confirmation as proof of submission.

Form Submission Methods

There are several methods available for submitting the Shellpoint mortgage payoff request, each with its own advantages:

- Online Submission: Many borrowers prefer to submit their requests online for convenience and speed. Ensure that you have all necessary documents ready for upload.

- Fax: Faxing the request is a reliable method, especially for those who may not have access to online services.

- Mail: For those who prefer traditional methods, mailing the request is an option. Make sure to use certified mail for tracking purposes.

- In-Person: Some borrowers may choose to visit a Shellpoint office to submit their request directly, allowing for immediate confirmation of receipt.

Legal use of the Shellpoint Mortgage Payoff Request

The Shellpoint mortgage payoff request is a legally binding document when completed correctly. Understanding its legal implications is essential:

- Authorization: The borrower’s signature on the request authorizes Shellpoint to process the payoff, making it a legal agreement.

- Compliance with Regulations: The request must comply with relevant laws governing mortgage payoffs and electronic signatures, ensuring its validity.

- Third-Party Involvement: If a third party is involved, their authorization must also be legally documented to avoid disputes.

Examples of using the Shellpoint Mortgage Payoff Request

Understanding practical examples of the Shellpoint mortgage payoff request can clarify its application:

- Home Sale: A homeowner selling their property may use the payoff request to settle the mortgage before closing the sale.

- Refinancing: When refinancing, borrowers often need to submit a payoff request to ensure their existing mortgage is paid off with the new loan.

- Financial Planning: Homeowners looking to eliminate debt may submit a payoff request as part of their financial strategy to pay off their mortgage early.

Quick guide on how to complete shellpoint mortgage payoff request fax number

Get Ready Shellpoint Mortgage Payoff Request Fax Number Effortlessly on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents quickly without delays. Manage Shellpoint Mortgage Payoff Request Fax Number on any device with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The Easiest Way to Modify and Electronically Sign Shellpoint Mortgage Payoff Request Fax Number Effortlessly

- Find Shellpoint Mortgage Payoff Request Fax Number and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important parts of the documents or conceal sensitive information using the tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, exhaustive form searches, or errors that necessitate printing additional copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Adjust and electronically sign Shellpoint Mortgage Payoff Request Fax Number while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Shellpoint mortgage payoff request?

A Shellpoint mortgage payoff request is a formal application you submit to Shellpoint Mortgage Servicing to receive the total amount owed on your mortgage. This amount is crucial for paying off your loan and can impact your future financing options. It's important to ensure that all your information is correct when making a Shellpoint mortgage payoff request to avoid delays.

-

How can I submit a Shellpoint mortgage payoff request using airSlate SignNow?

You can easily submit a Shellpoint mortgage payoff request using airSlate SignNow by creating a digital document and sending it for electronic signature. Our platform allows for quick document preparation and secure electronic transmission, streamlining the entire process. This eliminates traditional paperwork, making it faster and more convenient for all parties involved.

-

What are the benefits of using airSlate SignNow for a Shellpoint mortgage payoff request?

Using airSlate SignNow for a Shellpoint mortgage payoff request offers numerous benefits, including ease of use and cost-effectiveness. Our solution allows you to eSign documents securely, track requests in real-time, and access your documents from anywhere. This leads to faster processing times and less hassle compared to conventional methods.

-

Is there a fee associated with a Shellpoint mortgage payoff request through airSlate SignNow?

While airSlate SignNow charges fees for its electronic signing services, submitting a Shellpoint mortgage payoff request typically does not incur additional costs directly related to the mortgage company. It’s best to review your mortgage terms and airSlate SignNow pricing for a complete understanding of any associated fees. Keeping your budget in mind is essential when utilizing these services.

-

What documents do I need to prepare for a Shellpoint mortgage payoff request?

To prepare a Shellpoint mortgage payoff request, gather essential documents such as your mortgage agreement, account statements, and identification. Proper documentation is critical to ensure accurate processing of your request and prevent any possible hold-ups. airSlate SignNow allows you to upload and manage all necessary documents efficiently within our platform.

-

How long does it take to process a Shellpoint mortgage payoff request?

The processing time for a Shellpoint mortgage payoff request can vary, but using airSlate SignNow typically accelerates this process. Once you submit your request, you can often expect a response from Shellpoint within a few business days. Our platform keeps you informed at every step, eliminating uncertainty and streamlining the timeline.

-

Can I track the status of my Shellpoint mortgage payoff request?

Yes, airSlate SignNow provides you with the ability to track the status of your Shellpoint mortgage payoff request in real-time. You’ll receive notifications when your documents are viewed and signed, ensuring you have full visibility. This feature enhances your control over the request process, making follow-ups simpler and more efficient.

Get more for Shellpoint Mortgage Payoff Request Fax Number

- Procedure mac process form catamaran rx

- Standard form for presentation of loss and damage claim instructions

- Estoppel letter template form

- Ashant dhara application form

- Monumental life claim for life insurance benefits form

- South carolina claim adjustment form 130

- Eviction appeal bond dallascounty form

- Motion to retain case on docket sample 100853564 form

Find out other Shellpoint Mortgage Payoff Request Fax Number

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast

- eSignature Minnesota Retainer Agreement Template Fast

- Electronic signature Louisiana Land lease agreement Fast

- How Do I eSignature Arizona Attorney Approval

- How Can I eSignature North Carolina Retainer Agreement Template

- Electronic signature New York Land lease agreement Secure

- eSignature Ohio Attorney Approval Now

- eSignature Pennsylvania Retainer Agreement Template Secure

- Electronic signature Texas Land lease agreement Free

- Electronic signature Kentucky Landlord lease agreement Later

- Electronic signature Wisconsin Land lease agreement Myself

- Electronic signature Maryland Landlord lease agreement Secure

- How To Electronic signature Utah Landlord lease agreement