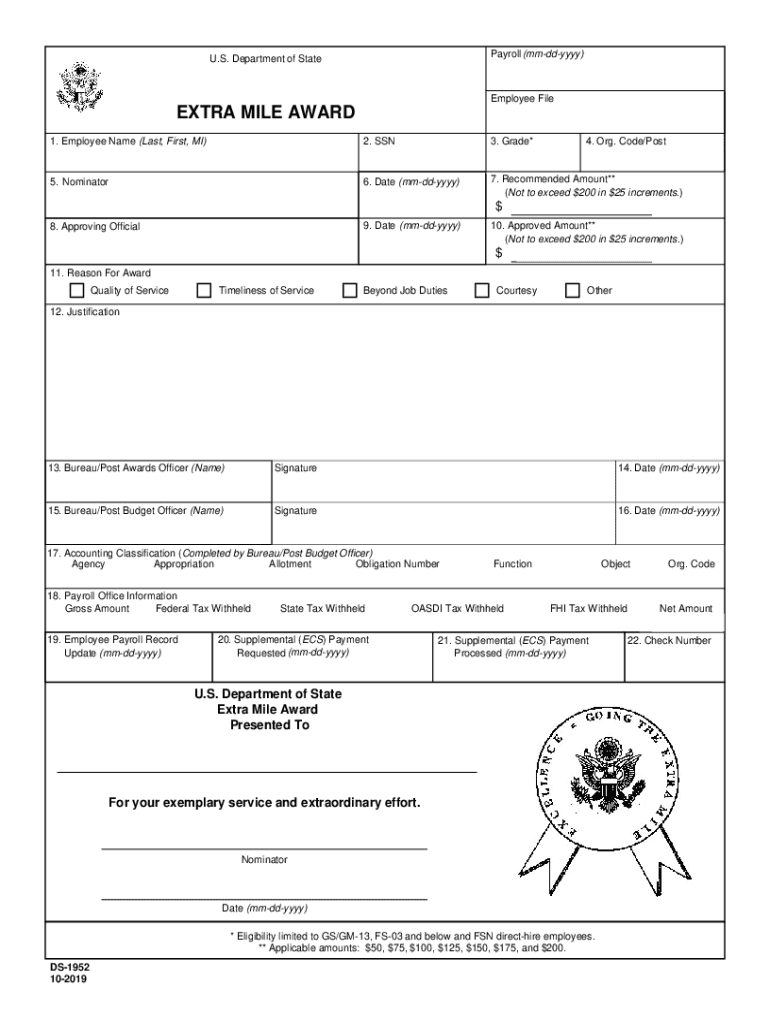

Payroll Mm Dd Yyyy Form

What is the Payroll mm dd yyyy?

The Payroll mm dd yyyy form is a crucial document used by businesses to report employee wages and taxes withheld to the Internal Revenue Service (IRS). This form typically includes essential information such as employee identification details, earnings for the specified pay period, and deductions for taxes and benefits. Accurate completion of this form is vital for compliance with federal tax regulations and ensures that employees receive proper credit for their earnings.

Steps to complete the Payroll mm dd yyyy

Completing the Payroll mm dd yyyy form involves several key steps to ensure accuracy and compliance. Here are the essential steps:

- Gather necessary employee information, including names, Social Security numbers, and pay rates.

- Calculate total earnings for the specified pay period, including regular and overtime wages.

- Determine applicable tax withholdings and any other deductions, such as health insurance or retirement contributions.

- Fill out the form accurately, ensuring all fields are completed and calculations are correct.

- Review the form for any errors before submission to avoid penalties or delays.

Legal use of the Payroll mm dd yyyy

The Payroll mm dd yyyy form must be completed and submitted in accordance with IRS regulations to be considered legally valid. This includes adherence to guidelines regarding the accuracy of reported data and timely submission. Failure to comply with these legal requirements can result in penalties, including fines or additional scrutiny from the IRS. It is essential for businesses to maintain accurate records and ensure that all payroll information is up to date to avoid legal complications.

Filing Deadlines / Important Dates

Timely submission of the Payroll mm dd yyyy form is critical for compliance. The IRS typically sets specific deadlines for filing this form, which may vary based on the type of business entity and the frequency of payroll processing. Businesses should be aware of these deadlines to avoid late filing penalties. Generally, forms must be submitted by the end of the month following the close of the tax year, but specific dates can vary, so it's important to check the latest IRS guidelines.

Examples of using the Payroll mm dd yyyy

Understanding practical applications of the Payroll mm dd yyyy form can help businesses navigate payroll reporting effectively. For instance, a small business owner may use this form to report wages for a part-time employee, ensuring that all earnings and withholdings are accurately documented. Another example could involve a company processing payroll for multiple employees, where the form serves as a consolidated report for tax purposes. Each scenario highlights the importance of accurate reporting to maintain compliance and support employee tax obligations.

Required Documents

To accurately complete the Payroll mm dd yyyy form, certain documents are essential. These typically include:

- Employee W-4 forms, which provide information on withholding allowances.

- Timekeeping records that detail hours worked by employees.

- Payroll registers that summarize earnings, deductions, and net pay for each employee.

- Previous payroll forms, if applicable, to ensure consistency in reporting.

Quick guide on how to complete payroll mm dd yyyy

Effortlessly Prepare Payroll mm dd yyyy on Any Device

Digital document management has gained traction among companies and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without any delays. Manage Payroll mm dd yyyy on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to Modify and Electronically Sign Payroll mm dd yyyy Effortlessly

- Acquire Payroll mm dd yyyy and click on Get Form to begin.

- Utilize the tools we offer to submit your document.

- Emphasize relevant parts of the documents or obscure sensitive data with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or downloading it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Payroll mm dd yyyy to ensure outstanding communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Payroll mm dd yyyy and how does it relate to eSigning documents?

Payroll mm dd yyyy is a specific date format commonly used in payroll processes. With airSlate SignNow, you can easily eSign payroll documents that require this date format, ensuring accuracy and compliance in your payroll management.

-

How can airSlate SignNow streamline my Payroll mm dd yyyy document signing process?

airSlate SignNow simplifies the signing process for your Payroll mm dd yyyy documents by providing a user-friendly interface and customizable workflows. You can send, sign, and manage payroll documents all in one place, reducing time and errors.

-

What are the pricing options for using airSlate SignNow for Payroll mm dd yyyy?

airSlate SignNow offers various pricing plans suitable for businesses of all sizes, ensuring that managing Payroll mm dd yyyy documents is cost-effective. Each plan includes features that cater to different needs, allowing you to choose the one that fits your payroll requirements best.

-

Are there any key features in airSlate SignNow that support Payroll mm dd yyyy?

Yes, airSlate SignNow includes features like templates for Payroll mm dd yyyy documents, automated reminders, and secure storage. These features enhance your payroll process's efficiency and ensure all documents are signed in a timely manner.

-

Can airSlate SignNow integrate with payroll software to manage Payroll mm dd yyyy?

Absolutely! airSlate SignNow supports integrations with popular payroll software, allowing for seamless management of your Payroll mm dd yyyy documents. This integration helps synchronize data and improves workflow efficiency.

-

What are the benefits of using airSlate SignNow for Payroll mm dd yyyy?

Using airSlate SignNow for your Payroll mm dd yyyy documents enhances accuracy, reduces turnaround times, and minimizes paper usage. With secure eSigning and easy document tracking, your payroll process becomes more efficient and environmentally friendly.

-

Is airSlate SignNow secure for handling Payroll mm dd yyyy documents?

Yes, airSlate SignNow employs advanced security measures such as encryption and secure cloud storage to protect your Payroll mm dd yyyy documents. You can trust that your sensitive payroll information is maintained securely at all times.

Get more for Payroll mm dd yyyy

- Pa 600 l form

- Kingstons affidavit form zimbabwe pdf download

- Management plan form 2

- Gymnosperms and angiosperms worksheet answer key form

- Youth ministry registration form

- Fill in the blank business letter format

- Form no 12 memorandum of marriage solemnizationpdf mattannurmunicipality

- Form 3922 rev april

Find out other Payroll mm dd yyyy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online