Use This Form to What is Contributions Splitting?

What is the Use This Form To What Is Contributions Splitting?

The form titled "Use This Form To What Is Contributions Splitting?" is designed to facilitate the division of retirement contributions between spouses, particularly during divorce proceedings. Contributions splitting allows individuals to allocate a portion of their retirement account to their ex-spouse, ensuring equitable distribution of assets. This process is essential for maintaining fairness and compliance with legal standards in asset division.

How to use the Use This Form To What Is Contributions Splitting?

To effectively use the "Use This Form To What Is Contributions Splitting?", follow these steps:

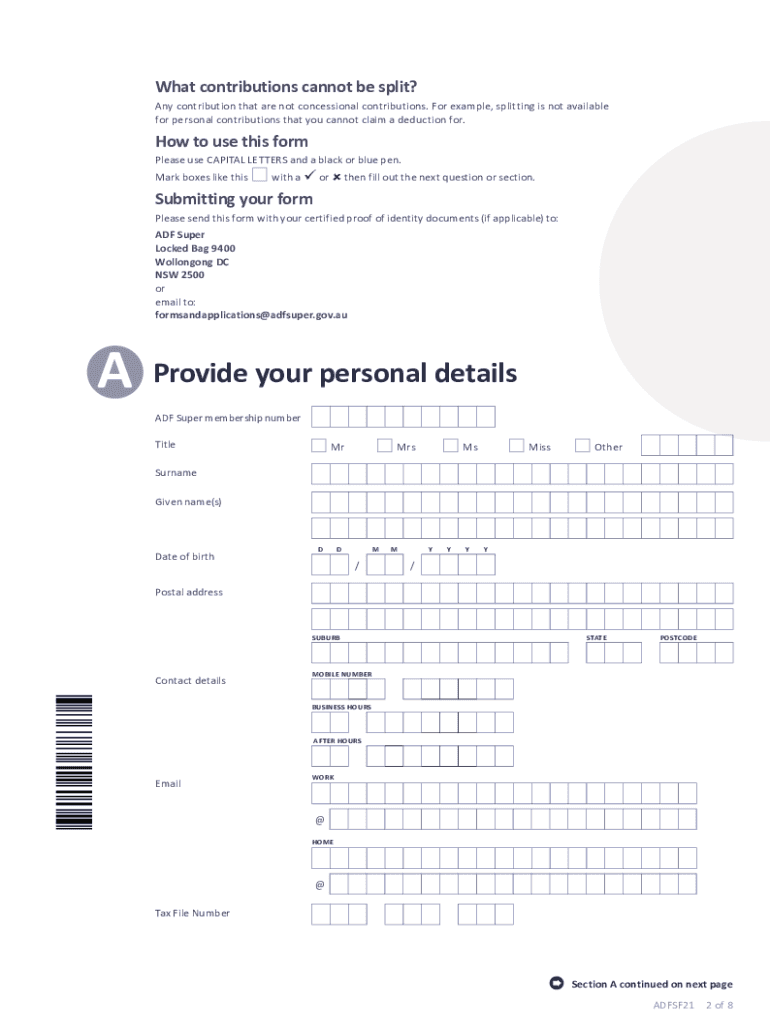

- Obtain the form from a reliable source or your financial institution.

- Fill out the necessary personal information, including names, addresses, and account details.

- Clearly indicate the percentage or amount of contributions to be split.

- Ensure both parties review and sign the form to confirm agreement.

- Submit the completed form to the appropriate retirement plan administrator for processing.

Key elements of the Use This Form To What Is Contributions Splitting?

Understanding the key elements of the "Use This Form To What Is Contributions Splitting?" is crucial for successful completion. The main components include:

- Personal Information: Names, addresses, and Social Security numbers of both parties.

- Account Details: Information regarding the retirement account being split.

- Contribution Amount: The specific percentage or dollar amount to be transferred.

- Signatures: Both parties must sign to validate the agreement.

Steps to complete the Use This Form To What Is Contributions Splitting?

Completing the "Use This Form To What Is Contributions Splitting?" involves a systematic approach:

- Gather all necessary documents related to the retirement account.

- Fill in the form with accurate personal and account information.

- Specify the amount or percentage of contributions to be split.

- Both parties should review the form for accuracy.

- Sign and date the form to confirm mutual consent.

- Submit the form to the retirement plan administrator.

Legal use of the Use This Form To What Is Contributions Splitting?

The legal use of the "Use This Form To What Is Contributions Splitting?" is governed by state laws and regulations regarding divorce and asset division. It is essential to ensure that the form complies with the legal requirements specific to your state. This includes understanding the implications of the split on tax liabilities and retirement benefits. Consulting with a legal professional can provide clarity on how to navigate these regulations effectively.

IRS Guidelines

The IRS provides specific guidelines regarding contributions splitting, particularly in relation to retirement accounts. It is important to adhere to these guidelines to avoid penalties. The IRS outlines the tax implications of splitting retirement contributions, including how such transfers should be reported on tax returns. Understanding these guidelines ensures compliance and helps in making informed decisions regarding retirement asset distribution.

Quick guide on how to complete use this form to what is contributions splitting

Effortlessly prepare Use This Form To What Is Contributions Splitting? on any device

The management of online documents has gained signNow traction among both organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the necessary form and keep it securely stored online. airSlate SignNow provides all the tools required to create, edit, and eSign your documents swiftly and efficiently. Handle Use This Form To What Is Contributions Splitting? on any platform using the airSlate SignNow apps for Android or iOS and enhance any document-driven process today.

How to edit and eSign Use This Form To What Is Contributions Splitting? with ease

- Find Use This Form To What Is Contributions Splitting? and click on Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Emphasize important sections of your documents or conceal sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to store your modifications.

- Choose how you wish to send your form, either via email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your device of choice. Edit and eSign Use This Form To What Is Contributions Splitting? and guarantee outstanding communication at any stage of the form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is contributions splitting?

Contributions splitting is a feature that allows you to divide contributions among multiple participants. Use this form to what is contributions splitting? and understand how it can aid in managing your team’s contributions more efficiently.

-

How can I integrate contributions splitting with airSlate SignNow?

Integrating contributions splitting with airSlate SignNow is straightforward. Use this form to what is contributions splitting? and set it up in our platform to streamline document signing and manage contributions seamlessly.

-

What are the pricing options available for contributions splitting?

Our pricing plans are designed to accommodate various business needs. Use this form to what is contributions splitting? to find out more about our affordable options and find a plan that suits your budget while maximizing your contribution management.

-

What benefits does contributions splitting offer my business?

Contributions splitting enhances collaboration by allowing multiple parties to manage contributions effectively. Use this form to what is contributions splitting? and discover how this feature can simplify your workflows and improve accuracy in document handling.

-

Is contributions splitting secure with airSlate SignNow?

Yes, airSlate SignNow prioritizes security. Use this form to what is contributions splitting? and learn about our robust security protocols that ensure your contributions and documents are protected at all times.

-

Can I customize the contributions splitting process?

Definitely! airSlate SignNow offers customization options to tailor the contributions splitting process. Use this form to what is contributions splitting? to see how you can modify the functionality to better fit your specific needs and preferences.

-

How does contributions splitting streamline my workflow?

By enabling easy division of contributions across involved parties, contributions splitting streamlines your workflow signNowly. Use this form to what is contributions splitting? and explore how it can reduce the time spent on document management.

Get more for Use This Form To What Is Contributions Splitting?

- Skpi untar form

- New mexico real property transfer declaration affidavit form

- Job applications lawyer form

- How to fill in a vec b 14 form

- Az joint tax application 100036943 form

- Irp3 a form 26559308

- Manual flush valve 125 gpf exposed flushometer fo form

- Single family dwelling zoning permit application form

Find out other Use This Form To What Is Contributions Splitting?

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure