Remittance Voucher Form

What is the Remittance Voucher

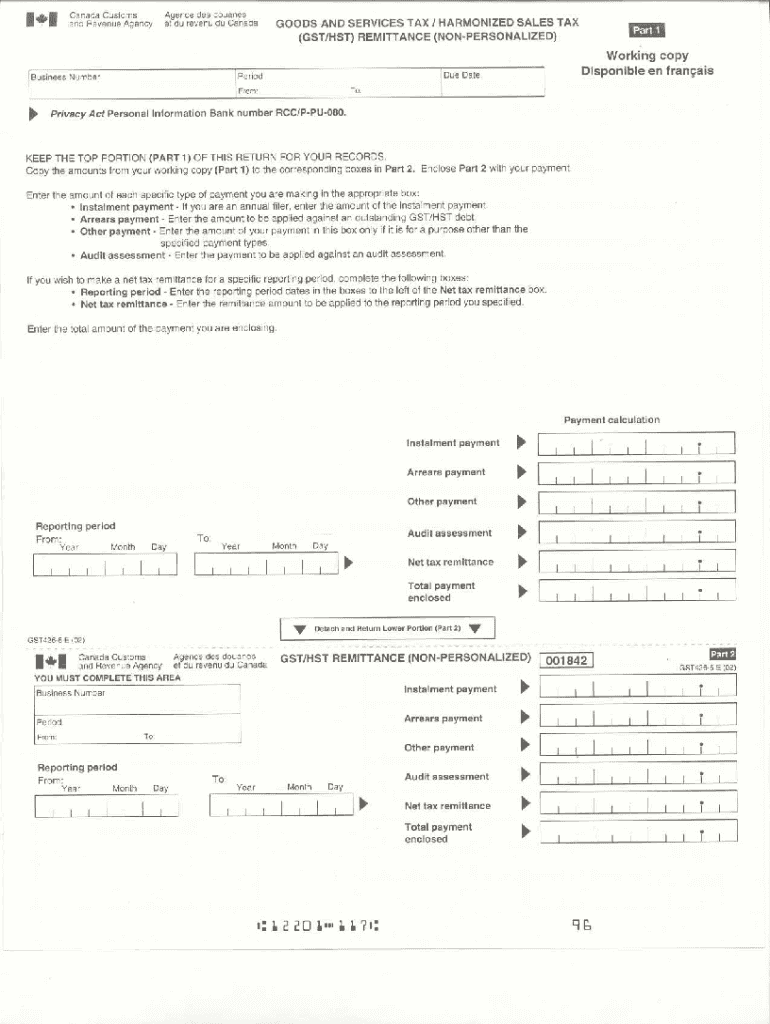

The Remittance Voucher is a crucial document used for submitting payments to the Canada Revenue Agency (CRA) for Goods and Services Tax (GST) or Harmonized Sales Tax (HST) obligations. This voucher serves as a formal record of payment, ensuring that the funds are allocated correctly to the taxpayer's account. It is particularly important for businesses that need to remit their collected GST/HST on a regular basis.

How to use the Remittance Voucher

To use the Remittance Voucher effectively, taxpayers should first fill out the necessary details, including their business number, the amount being remitted, and the relevant reporting period. Once completed, the voucher should be submitted alongside the payment. This ensures that the payment is processed accurately and promptly, reducing the risk of delays or misallocation of funds.

Steps to complete the Remittance Voucher

Completing the Remittance Voucher involves several key steps:

- Obtain the appropriate Remittance Voucher form from the Canada Revenue Agency.

- Fill in your business number and the payment amount accurately.

- Specify the reporting period for which the payment is being made.

- Sign and date the voucher to validate the submission.

- Submit the voucher along with your payment via the chosen method (online, mail, or in-person).

Legal use of the Remittance Voucher

The Remittance Voucher is legally recognized as a valid document for remitting taxes to the CRA. It is essential to ensure that all information provided is accurate and complete, as discrepancies can lead to penalties or delays in processing. Adhering to the guidelines set forth by the CRA ensures that the voucher is used correctly and maintains its legal standing.

Key elements of the Remittance Voucher

Several key elements must be included in the Remittance Voucher for it to be valid:

- Business Number: This unique identifier is crucial for tracking payments.

- Payment Amount: The exact amount being remitted must be clearly stated.

- Reporting Period: Indicating the correct period ensures proper allocation of funds.

- Signature: A signature is required to authenticate the submission.

Form Submission Methods

The Remittance Voucher can be submitted through various methods, accommodating different preferences:

- Online: Taxpayers can submit payments electronically through the CRA's online services.

- Mail: Completed vouchers can be mailed to the designated CRA address.

- In-Person: Payments can also be made in person at authorized financial institutions.

Quick guide on how to complete remittance voucher

Complete Remittance Voucher effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the necessary template and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents swiftly without delays. Manage Remittance Voucher on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and eSign Remittance Voucher with ease

- Locate Remittance Voucher and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Verify all the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or disorganized files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Remittance Voucher and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the role of the Canada Revenue Agency GST in electronic document signing?

The Canada Revenue Agency GST plays a vital role in ensuring compliance for businesses involved in electronic transactions. Using airSlate SignNow allows you to manage document signing in a way that aligns with Canada Revenue Agency GST regulations, ensuring your documents are valid and recognized.

-

How does airSlate SignNow streamline GST submission processes?

airSlate SignNow simplifies the GST submission processes by allowing businesses to securely sign and send documents electronically. This not only accelerates the transaction process but also ensures that all documents are compliant with Canada Revenue Agency GST requirements.

-

What features does airSlate SignNow offer for businesses dealing with Canada Revenue Agency GST?

airSlate SignNow offers a variety of features that cater specifically to businesses dealing with Canada Revenue Agency GST, such as cloud storage, document templates, and automated workflows. These tools help streamline your business’s operations and ensure compliance.

-

Is airSlate SignNow a cost-effective solution for managing Canada Revenue Agency GST documents?

Yes, airSlate SignNow is a cost-effective solution for managing Canada Revenue Agency GST documents. By reducing paper usage and enabling efficient digital workflows, businesses can save on costs associated with traditional document processing.

-

How does airSlate SignNow integrate with tax management systems regarding Canada Revenue Agency GST?

airSlate SignNow seamlessly integrates with various tax management systems to enhance your workflow concerning Canada Revenue Agency GST. This integration allows for better management of tax-related documents and ensures all compliance needs are met effortlessly.

-

Can airSlate SignNow help my business stay compliant with Canada Revenue Agency GST?

Absolutely! airSlate SignNow is designed to assist businesses in staying compliant with Canada Revenue Agency GST regulations. Its electronic signature technology provides a secure and legally binding way to sign and manage GST-related documents.

-

What types of businesses can benefit from using airSlate SignNow for Canada Revenue Agency GST?

All types of businesses—from freelancers to large corporations—can benefit from using airSlate SignNow for handling Canada Revenue Agency GST documents. The platform’s flexibility makes it suitable for various industries, ensuring compliance and effective document management.

Get more for Remittance Voucher

- Ssl form

- Al arafah islami bank rtgs form

- Indiana voter registration change of address fillable form

- Safety suggestion form 219673913

- Loto periodic inspection form

- Sickness benefit reimbursement application form sss

- Form 592 a payment voucher for foreign partner or member

- Form 540 california resident income tax return form 540 california resident income tax return

Find out other Remittance Voucher

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement