350 1579 1 MEAT PROCESSING FACILITY INVESTMENT TAX CREDIT APPLICATION Form

What is the 1 MEAT PROCESSING FACILITY INVESTMENT TAX CREDIT APPLICATION

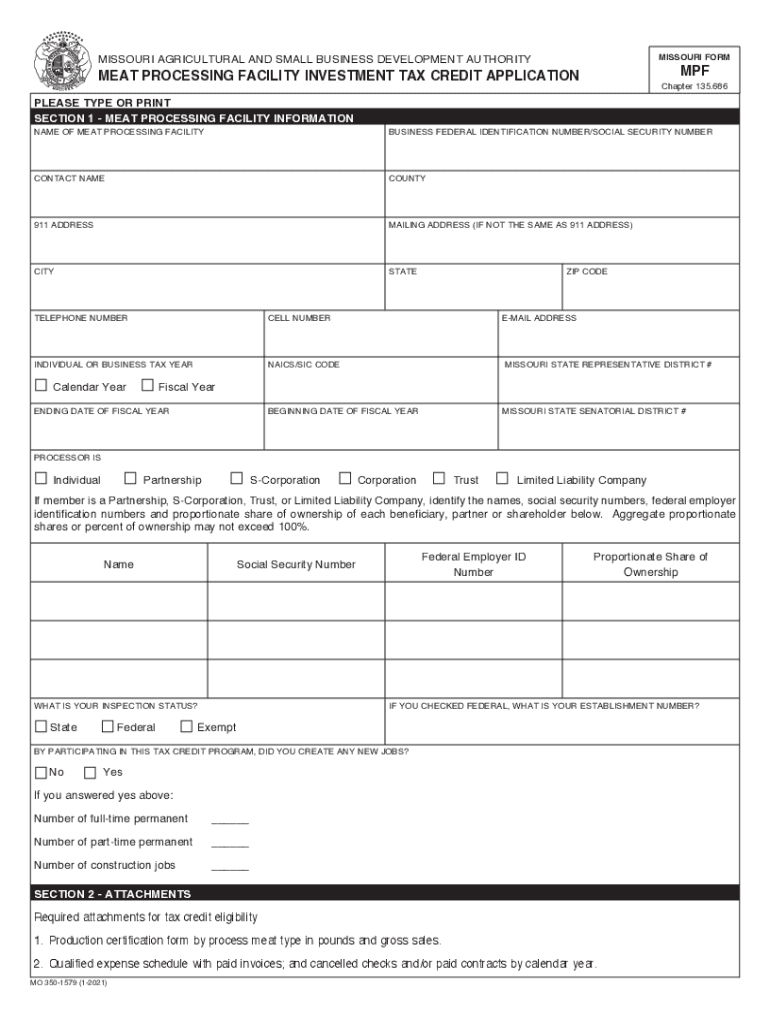

The 1 MEAT PROCESSING FACILITY INVESTMENT TAX CREDIT APPLICATION is a specific form used by businesses in the meat processing industry to apply for tax credits related to investments made in their facilities. This application is crucial for entities looking to benefit from financial incentives provided by state or federal programs aimed at enhancing the meat processing sector. By completing this form, businesses can potentially reduce their tax liabilities, making it an important tool for financial planning and operational growth.

Steps to complete the 1 MEAT PROCESSING FACILITY INVESTMENT TAX CREDIT APPLICATION

Completing the 1 MEAT PROCESSING FACILITY INVESTMENT TAX CREDIT APPLICATION involves several key steps:

- Gather necessary documentation, including proof of investment and financial records.

- Fill out the application form with accurate and detailed information about your facility and the investments made.

- Review the completed application to ensure all sections are filled out correctly.

- Submit the application by the specified deadline, either electronically or by mail, depending on the guidelines.

Following these steps carefully will help ensure that your application is processed smoothly and efficiently.

Legal use of the 1 MEAT PROCESSING FACILITY INVESTMENT TAX CREDIT APPLICATION

The legal use of the 1 MEAT PROCESSING FACILITY INVESTMENT TAX CREDIT APPLICATION is governed by specific regulations and guidelines set forth by tax authorities. To ensure compliance, businesses must adhere to the following:

- Complete the application truthfully and accurately, as any misrepresentation can lead to penalties.

- Retain copies of all submitted documents for future reference and potential audits.

- Understand the eligibility criteria and ensure that your business meets all requirements before applying.

By following these legal guidelines, businesses can safeguard their interests and ensure the legitimacy of their application.

Eligibility Criteria

To qualify for the benefits associated with the 1 MEAT PROCESSING FACILITY INVESTMENT TAX CREDIT APPLICATION, businesses must meet certain eligibility criteria. These may include:

- Being a registered entity in the meat processing industry.

- Having made qualifying investments in facility upgrades or expansions.

- Complying with local, state, and federal regulations related to meat processing.

It is essential for applicants to review these criteria thoroughly to determine their eligibility before proceeding with the application.

Required Documents

When submitting the 1 MEAT PROCESSING FACILITY INVESTMENT TAX CREDIT APPLICATION, certain documents are typically required to support the application. These may include:

- Proof of investment, such as invoices or receipts for equipment purchases.

- Financial statements demonstrating the impact of the investment on the business.

- Documentation of compliance with industry regulations.

Having these documents prepared in advance can facilitate a smoother application process.

Form Submission Methods

The 1 MEAT PROCESSING FACILITY INVESTMENT TAX CREDIT APPLICATION can be submitted through various methods, depending on the guidelines established by the relevant tax authority. Common submission methods include:

- Online submission through the designated government portal.

- Mailing a physical copy of the application to the appropriate office.

- In-person submission at local tax offices, if applicable.

Choosing the correct submission method is important to ensure timely processing of the application.

Quick guide on how to complete 350 1579 1 2021 meat processing facility investment tax credit application

Complete 350 1579 1 MEAT PROCESSING FACILITY INVESTMENT TAX CREDIT APPLICATION effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents swiftly without any hindrances. Manage 350 1579 1 MEAT PROCESSING FACILITY INVESTMENT TAX CREDIT APPLICATION on any device using airSlate SignNow's Android or iOS applications and streamline your document-based processes today.

The easiest way to edit and eSign 350 1579 1 MEAT PROCESSING FACILITY INVESTMENT TAX CREDIT APPLICATION with no hassle

- Obtain 350 1579 1 MEAT PROCESSING FACILITY INVESTMENT TAX CREDIT APPLICATION and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your device of choice. Modify and eSign 350 1579 1 MEAT PROCESSING FACILITY INVESTMENT TAX CREDIT APPLICATION to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the 350 1579 1 MEAT PROCESSING FACILITY INVESTMENT TAX CREDIT APPLICATION?

The 350 1579 1 MEAT PROCESSING FACILITY INVESTMENT TAX CREDIT APPLICATION is a tax incentive aimed at promoting investment in meat processing facilities. This application allows businesses to claim tax credits for eligible expenses associated with the construction or improvement of meat processing facilities, ultimately benefiting operations and reducing tax burdens.

-

How can airSlate SignNow assist with the 350 1579 1 MEAT PROCESSING FACILITY INVESTMENT TAX CREDIT APPLICATION?

airSlate SignNow provides a streamlined platform for businesses to create, send, and eSign the 350 1579 1 MEAT PROCESSING FACILITY INVESTMENT TAX CREDIT APPLICATION. With our easy-to-use interface, you can efficiently manage all related documents, ensuring timely submission and compliance with regulatory requirements.

-

What are the pricing options for using airSlate SignNow for my tax credit applications?

airSlate SignNow offers a variety of pricing plans tailored to different business needs. Our flexible and cost-effective options allow you to choose a plan that works best for managing the 350 1579 1 MEAT PROCESSING FACILITY INVESTMENT TAX CREDIT APPLICATION without breaking your budget.

-

What features does airSlate SignNow provide for document management?

airSlate SignNow boasts several powerful features for document management that are particularly useful for the 350 1579 1 MEAT PROCESSING FACILITY INVESTMENT TAX CREDIT APPLICATION. These include customizable templates, advanced signing options, real-time notifications, and secure cloud storage, ensuring that your application process is efficient and organized.

-

Are there any benefits to using airSlate SignNow for eSigning tax credit applications?

Yes, utilizing airSlate SignNow for eSigning the 350 1579 1 MEAT PROCESSING FACILITY INVESTMENT TAX CREDIT APPLICATION offers numerous benefits. It enhances document security, accelerates the signing process, and reduces paper waste, making it an environmentally friendly option that ultimately boosts productivity.

-

Can I integrate airSlate SignNow with other applications I use?

Absolutely! airSlate SignNow supports integration with a variety of popular business applications, making it easy to import or export documents related to the 350 1579 1 MEAT PROCESSING FACILITY INVESTMENT TAX CREDIT APPLICATION. This ensures seamless workflows and improves collaboration across your business processes.

-

What types of businesses can benefit from the 350 1579 1 MEAT PROCESSING FACILITY INVESTMENT TAX CREDIT APPLICATION?

Any business involved in the meat processing industry can greatly benefit from the 350 1579 1 MEAT PROCESSING FACILITY INVESTMENT TAX CREDIT APPLICATION. This includes new businesses constructing processing facilities as well as established companies looking to upgrade their operations and take advantage of available tax credits.

Get more for 350 1579 1 MEAT PROCESSING FACILITY INVESTMENT TAX CREDIT APPLICATION

Find out other 350 1579 1 MEAT PROCESSING FACILITY INVESTMENT TAX CREDIT APPLICATION

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter