Clgs 32 5 Form

What is the CLGS 32 5?

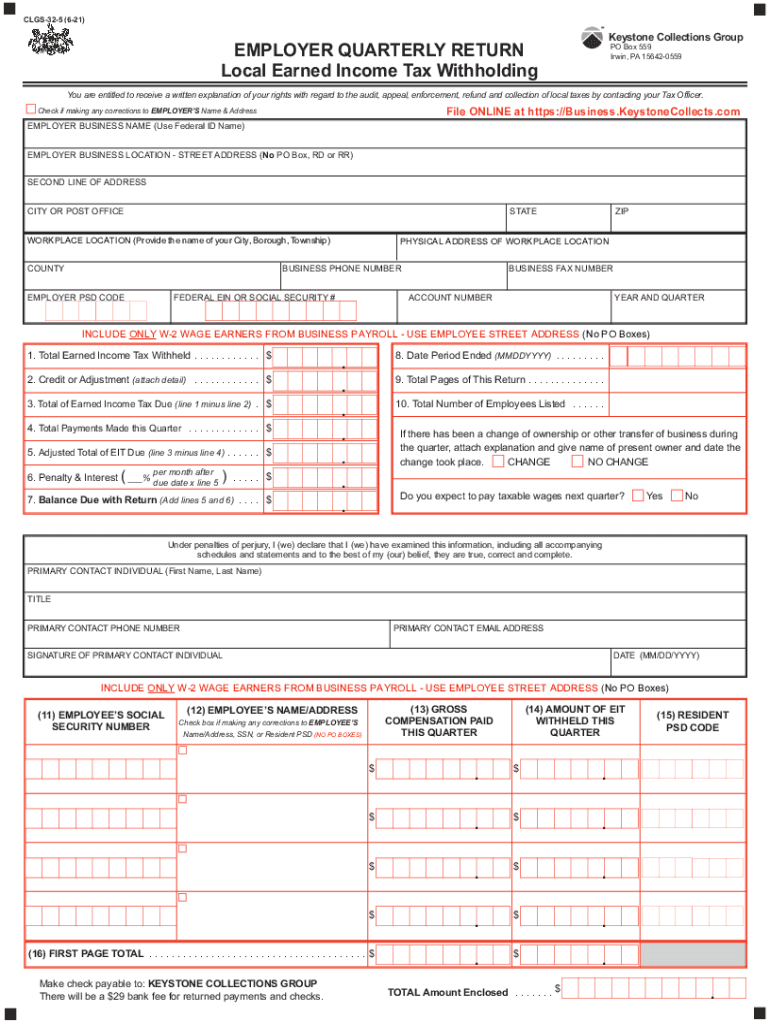

The CLGS 32 5 is a Pennsylvania form used by employers to report quarterly wage and tax information to the state. This form is specifically designed for employers to submit details regarding employee wages, taxes withheld, and contributions to state unemployment compensation. Proper completion of the CLGS 32 5 is essential for compliance with state regulations and to ensure that employees receive the correct benefits.

Steps to Complete the CLGS 32 5

Completing the CLGS 32 5 requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including your employer identification number, employee wages, and tax withholdings.

- Fill out the form accurately, ensuring all employee information is complete and correct.

- Calculate total wages and taxes withheld for the reporting period.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the appropriate deadline to avoid penalties.

Legal Use of the CLGS 32 5

The CLGS 32 5 is legally binding when completed correctly and submitted on time. It must adhere to the regulations set forth by the Pennsylvania Department of Revenue and the Department of Labor and Industry. Accurate reporting is crucial, as discrepancies may lead to audits or penalties. Employers should retain copies of submitted forms for their records, as they may be required for verification purposes.

Form Submission Methods

Employers can submit the CLGS 32 5 through various methods, including:

- Online submission via the Pennsylvania Department of Revenue website, which is the most efficient method.

- Mailing a paper version of the form to the designated state office.

- In-person submission at local offices, if preferred.

Each method has its own processing times, so employers should choose the one that best fits their needs while ensuring timely compliance.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines for the CLGS 32 5 to avoid penalties. The form is typically due on the last day of the month following the end of each quarter. Important dates include:

- First Quarter: Due April 30

- Second Quarter: Due July 31

- Third Quarter: Due October 31

- Fourth Quarter: Due January 31

Staying informed about these deadlines is crucial for maintaining compliance and avoiding late fees.

Who Issues the Form?

The CLGS 32 5 is issued by the Pennsylvania Department of Revenue in conjunction with the Department of Labor and Industry. These agencies oversee the collection of wage and tax information from employers to ensure compliance with state laws. Employers should refer to the official state resources for the most current version of the form and any updates to submission guidelines.

Quick guide on how to complete clgs 32 5

Prepare Clgs 32 5 effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools you need to create, edit, and eSign your documents rapidly without delays. Manage Clgs 32 5 on any device using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign Clgs 32 5 with ease

- Locate Clgs 32 5 and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Select pertinent sections of the documents or obscure sensitive details with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Modify and eSign Clgs 32 5 and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is clgs 32 5 and how does it benefit my business?

clgs 32 5 refers to a specific document signing standard supported by airSlate SignNow. By using this standard, businesses can ensure compliance and security in their signing processes. This helps enhance trust and reduces the risk of document fraud.

-

Is airSlate SignNow affordable for small businesses using clgs 32 5?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses. With a pricing model that aligns with the features for clgs 32 5, it offers flexibility and affordability, making it accessible for budget-conscious organizations.

-

What features does airSlate SignNow offer for clgs 32 5?

airSlate SignNow offers several features for clgs 32 5, including customizable templates, advanced security options, and integration with popular business applications. These features help streamline the signing process and improve productivity for users.

-

Can I integrate airSlate SignNow with my existing software systems for clgs 32 5?

Absolutely! airSlate SignNow supports various integrations with popular software systems to facilitate seamless document management for clgs 32 5. This ensures that your workflow remains uninterrupted, maximizing efficiency across your business operations.

-

How does airSlate SignNow ensure the security of documents signed using clgs 32 5?

airSlate SignNow prioritizes security and uses advanced encryption methods for documents signed with clgs 32 5. Additionally, the platform implements features like audit trails and secure access controls to maintain the integrity and confidentiality of your documents.

-

What types of documents can I sign with clgs 32 5 on airSlate SignNow?

You can sign a wide variety of documents with clgs 32 5 on airSlate SignNow, including contracts, agreements, and forms. The platform is versatile and accommodates different document types, making it an ideal choice for diverse business needs.

-

Is there a mobile app for airSlate SignNow that supports clgs 32 5?

Yes, airSlate SignNow offers a mobile app that supports clgs 32 5, allowing you to sign documents on-the-go. This mobile capability ensures that you can manage your signing tasks conveniently, regardless of your location.

Get more for Clgs 32 5

- Domanda di attribuzione codice fiscale 14014882 form

- Sbb shared service organisation 271491164 form

- Bpsc police verification form

- Student exploration covalent bonds form

- City of scottdale tpt refund form

- Ga 41 form rajasthan government pdf

- Texas renewal application for coin operated machines form

- Printable log sheet for fire departments form

Find out other Clgs 32 5

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now