Domanda Di Attribuzione Codice Fiscale 2006

What is the Domanda Di Attribuzione Codice Fiscale

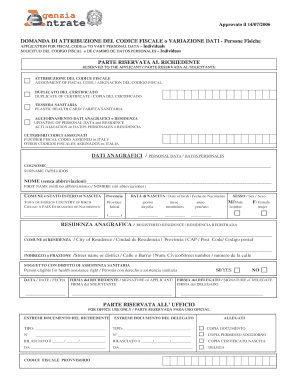

The domanda di attribuzione codice fiscale is an official request form used to obtain a tax identification number in Italy. This number is essential for various financial and legal transactions, including opening a bank account, signing contracts, and filing taxes. The codice fiscale serves as a unique identifier for individuals and businesses, ensuring compliance with Italian tax laws and regulations.

Steps to Complete the Domanda Di Attribuzione Codice Fiscale

Completing the domanda di attribuzione codice fiscale involves several key steps. First, gather all necessary personal information, including your full name, date of birth, and place of birth. Next, fill out the form accurately, ensuring that all details match your official identification documents. After completing the form, review it for any errors before submission. It's important to sign the document where indicated to validate your request.

How to Obtain the Domanda Di Attribuzione Codice Fiscale

The domanda di attribuzione codice fiscale can be obtained from various sources, including Italian consulates and embassies, as well as online platforms that provide access to official forms. In the United States, individuals can visit the nearest Italian consulate to request the form in person or download it from the consulate's website. Ensure you have the required identification documents ready for verification when submitting your request.

Required Documents

To successfully complete the domanda di attribuzione codice fiscale, you will need to provide certain documents. These typically include a valid form of identification, such as a passport or driver's license, proof of residency, and any additional documentation that may be required based on your specific situation. Having these documents ready will streamline the application process and help avoid delays.

Legal Use of the Domanda Di Attribuzione Codice Fiscale

The domanda di attribuzione codice fiscale is a legally binding document that must be filled out accurately to ensure compliance with Italian tax regulations. It is crucial for individuals and businesses to understand the legal implications of the codice fiscale, as it is used for tax purposes and can affect various aspects of financial and legal transactions. Misrepresentation or errors in the application can lead to penalties or complications with tax authorities.

Form Submission Methods

The submission of the domanda di attribuzione codice fiscale can be done through various methods. Individuals may choose to submit the form in person at the relevant Italian consulate or embassy. Alternatively, some may opt for online submission if the consulate offers this option. It is also possible to send the completed form via mail, although this may take longer for processing. Ensure to check the specific submission guidelines provided by the consulate to avoid any issues.

Quick guide on how to complete domanda di attribuzione codice fiscale 14014882

Complete Domanda Di Attribuzione Codice Fiscale effortlessly on any device

Digital document management has gained immense popularity among businesses and individuals. It offers an ideal eco-conscious alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents quickly and smoothly. Handle Domanda Di Attribuzione Codice Fiscale on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Domanda Di Attribuzione Codice Fiscale without difficulty

- Locate Domanda Di Attribuzione Codice Fiscale and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and press the Done button to save your changes.

- Select your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Domanda Di Attribuzione Codice Fiscale and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct domanda di attribuzione codice fiscale 14014882

Create this form in 5 minutes!

How to create an eSignature for the domanda di attribuzione codice fiscale 14014882

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the domanda di attribuzione codice fiscale, and why do I need it?

The domanda di attribuzione codice fiscale is an application form to obtain a tax code in Italy, essential for legal and financial operations. Businesses and individuals need it for tax identification, legal compliance, and conducting business activities smoothly.

-

How does airSlate SignNow assist with the domanda di attribuzione codice fiscale?

airSlate SignNow provides an efficient platform to electronically sign and manage your domanda di attribuzione codice fiscale online. With our solution, you can expedite document processing and ensure your applications are securely signed and stored.

-

What pricing plans are available for airSlate SignNow for businesses dealing with domanda di attribuzione codice fiscale?

airSlate SignNow offers flexible pricing plans tailored for businesses, ensuring that you can select a solution that fits your budget while managing the domanda di attribuzione codice fiscale efficiently. Explore our various plans to find the right fit for your organization's needs.

-

Are there any features in airSlate SignNow that specifically cater to the domanda di attribuzione codice fiscale filings?

Yes, airSlate SignNow offers features such as customizable templates, automated workflows, and instant document sharing, specifically designed to streamline the process of filing the domanda di attribuzione codice fiscale. These tools enhance productivity and ensure compliance.

-

Can I integrate airSlate SignNow with other software for managing domanda di attribuzione codice fiscale?

Absolutely! airSlate SignNow seamlessly integrates with a variety of business applications to enhance your workflow while managing the domanda di attribuzione codice fiscale. This means you can streamline processes across different platforms without any hassle.

-

What are the benefits of using airSlate SignNow for my domanda di attribuzione codice fiscale needs?

Using airSlate SignNow simplifies the submission of your domanda di attribuzione codice fiscale by allowing electronic signatures and efficient document management. This saves time, reduces manual errors, and enhances the overall user experience.

-

Is airSlate SignNow compliant with legal requirements for submitting domanda di attribuzione codice fiscale?

Yes, airSlate SignNow ensures compliance with legal regulations regarding the submission of domanda di attribuzione codice fiscale. Our platform follows the required standards for electronic signatures, providing you with peace of mind while you manage your documentation.

Get more for Domanda Di Attribuzione Codice Fiscale

Find out other Domanda Di Attribuzione Codice Fiscale

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors