AU CitiBank Personal Financial Summary 2020-2026

What is the AU CitiBank Personal Financial Summary

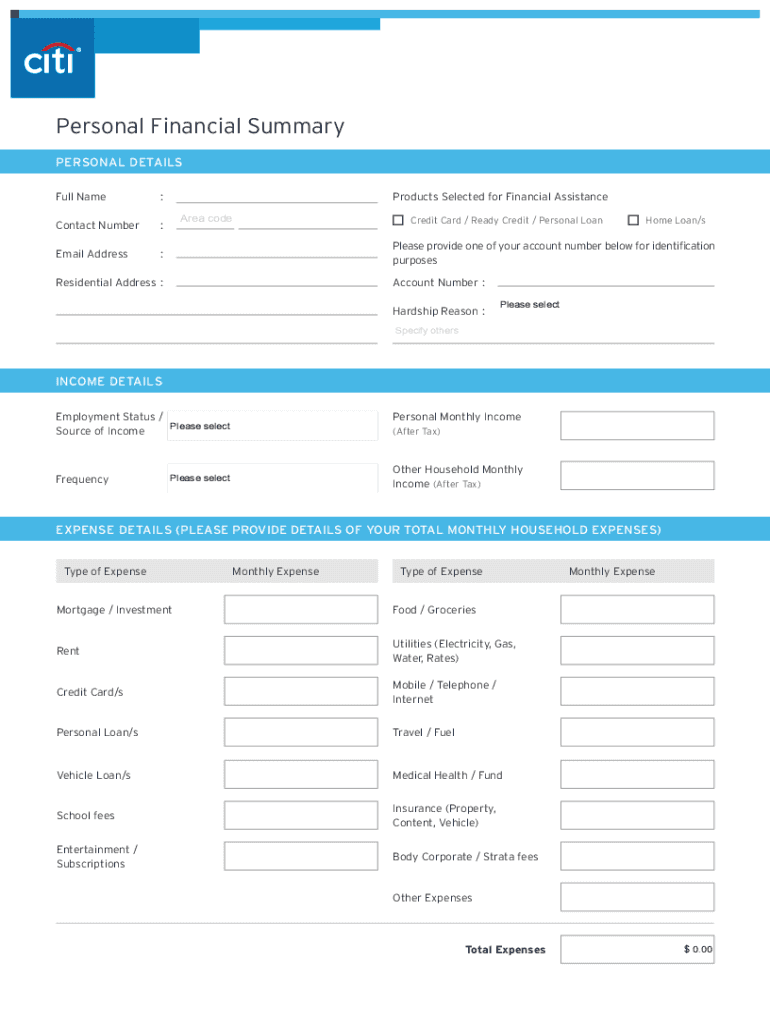

The AU CitiBank Personal Financial Summary is a comprehensive document that outlines an individual's financial situation. This summary typically includes details about income, expenses, assets, and liabilities. It serves as an essential tool for personal financial management, allowing users to assess their financial health and make informed decisions. The summary can be particularly useful for budgeting, applying for loans, or preparing for financial consultations.

How to use the AU CitiBank Personal Financial Summary

Using the AU CitiBank Personal Financial Summary involves several steps. First, gather all relevant financial documents, including pay stubs, bank statements, and bills. Next, input this data into the summary form, ensuring accuracy in reporting income and expenses. Once completed, review the summary to identify areas for improvement in your financial management. This document can also be shared with financial advisors or used for personal budgeting purposes.

Steps to complete the AU CitiBank Personal Financial Summary

Completing the AU CitiBank Personal Financial Summary requires careful attention to detail. Follow these steps for effective completion:

- Collect all necessary financial documents, such as income statements and expense receipts.

- Begin filling out the summary by entering your total income from all sources.

- Document your monthly expenses, categorizing them into fixed and variable costs.

- List your assets, including savings accounts, investments, and property.

- Outline any liabilities, such as loans and credit card debt.

- Review the completed summary for accuracy and completeness.

Key elements of the AU CitiBank Personal Financial Summary

The AU CitiBank Personal Financial Summary consists of several key elements that provide a holistic view of an individual's financial status. These include:

- Income: Total earnings from employment, investments, and other sources.

- Expenses: Monthly costs, including housing, utilities, transportation, and discretionary spending.

- Assets: Items of value owned, such as cash, real estate, and investments.

- Liabilities: Outstanding debts and obligations that need to be repaid.

Legal use of the AU CitiBank Personal Financial Summary

The AU CitiBank Personal Financial Summary can be used legally in various contexts. It is often required when applying for loans or mortgages, as lenders need a clear picture of an applicant's financial situation. Additionally, this summary can be utilized for tax preparation, financial planning, and estate management. It is important to ensure that the information provided is accurate and up-to-date to maintain its legitimacy in legal and financial transactions.

Examples of using the AU CitiBank Personal Financial Summary

There are several practical applications for the AU CitiBank Personal Financial Summary. For instance:

- Individuals seeking a mortgage can present this summary to lenders to demonstrate their financial capability.

- It can assist in budgeting by highlighting areas where spending can be reduced.

- Financial advisors may use it to create tailored investment strategies for their clients.

Quick guide on how to complete au citibank personal financial summary

Effortlessly prepare AU CitiBank Personal Financial Summary on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Manage AU CitiBank Personal Financial Summary on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign AU CitiBank Personal Financial Summary with ease

- Locate AU CitiBank Personal Financial Summary and click on Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Select important paragraphs of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Decide how you want to share your form: via email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and electronically sign AU CitiBank Personal Financial Summary while ensuring exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to au personal financial?

airSlate SignNow is a digital signature platform that streamlines the document signing process for businesses. For those in the au personal financial sector, it simplifies contracts, agreements, and other essential paperwork, enhancing operational efficiency.

-

What features does airSlate SignNow offer for au personal financial professionals?

airSlate SignNow provides features such as electronic signatures, document templates, and customizable workflows. These tools are particularly beneficial for au personal financial professionals, allowing for faster processing of client documents and improved compliance.

-

How does airSlate SignNow ensure data security for au personal financial transactions?

With airSlate SignNow, data security is a top priority. The platform employs encryption, secure servers, and compliance with industry standards to protect sensitive au personal financial data during transactions and document storage.

-

What is the pricing structure for airSlate SignNow in the context of au personal financial services?

airSlate SignNow offers flexible pricing plans suitable for different business sizes in the au personal financial industry. Users can choose from monthly or annual subscriptions, allowing them to select a plan that fits their specific needs and budget.

-

Can airSlate SignNow integrate with other tools used in au personal financial management?

Yes, airSlate SignNow integrates seamlessly with various applications commonly used in au personal financial management, such as CRM systems and accounting software. This integration streamlines workflows, reducing manual data entry and enhancing efficiency.

-

What benefits does airSlate SignNow provide to users in au personal financial sectors?

By using airSlate SignNow, au personal financial professionals can accelerate their document turnaround times, enhance client satisfaction, and reduce operational costs. The platform's user-friendly interface also facilitates quick onboarding and efficient usage.

-

Is there a mobile app for airSlate SignNow for au personal financial professionals?

Yes, airSlate SignNow offers a mobile app that allows au personal financial professionals to manage and sign documents on the go. This convenience ensures that business operations remain swift and efficient, no matter where you are.

Get more for AU CitiBank Personal Financial Summary

Find out other AU CitiBank Personal Financial Summary

- How To eSign Maine Church Directory Form

- How To eSign New Hampshire Church Donation Giving Form

- eSign North Dakota Award Nomination Form Free

- eSignature Mississippi Demand for Extension of Payment Date Secure

- Can I eSign Oklahoma Online Donation Form

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple