The Big List of Small Business Tax Deductions and How to Claim Form

What is the big list of small business tax deductions and how to claim

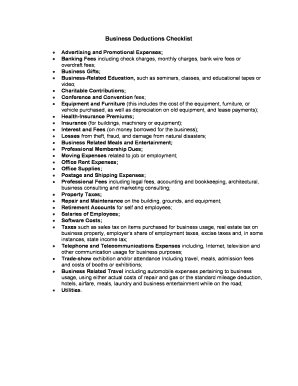

The big list of small business tax deductions includes a variety of expenses that can reduce your taxable income. Common deductions include costs related to operating your business, such as rent, utilities, and office supplies. Additionally, you can claim deductions for employee salaries, contractor payments, and health insurance premiums. Understanding these deductions can significantly impact your overall tax liability.

To claim these deductions, you must maintain accurate records of all business-related expenses. This includes receipts, invoices, and bank statements. When filing your taxes, these records will support your claims and help you substantiate your deductions if you are audited by the IRS.

IRS guidelines

The IRS provides specific guidelines for small business tax deductions, which are essential for ensuring compliance. According to IRS regulations, the expenses must be ordinary and necessary for your business operations. Ordinary expenses are common and accepted in your industry, while necessary expenses are helpful and appropriate for your business.

It is crucial to familiarize yourself with IRS Publication 535, which outlines the various types of deductible expenses. This publication can help you identify which costs qualify and how to report them accurately on your tax return.

Required documents

To successfully claim small business tax deductions, you need to gather and organize specific documents. Essential documents include:

- Receipts for all business expenses

- Invoices from suppliers and contractors

- Bank statements showing business transactions

- Payroll records for employee wages

- Tax forms such as the Schedule C for sole proprietors

Having these documents readily available will streamline the filing process and ensure that you can substantiate your deductions if necessary.

Steps to complete the small business tax deductions checklist

Completing the small business tax deductions checklist involves several key steps:

- Identify all potential deductions relevant to your business.

- Gather and organize the required documentation for each deduction.

- Review IRS guidelines to ensure compliance with tax laws.

- Fill out the appropriate tax forms, including any necessary schedules.

- Double-check your calculations and ensure all deductions are accurately reported.

Following these steps can help you maximize your deductions and minimize your tax liability.

Filing deadlines / important dates

Being aware of filing deadlines is crucial for small business owners. The typical deadline for filing your federal tax return is April 15. However, if you are a sole proprietor or a single-member LLC, you may file using Schedule C alongside your personal tax return. If you need additional time, you can file for an extension, which typically gives you until October 15 to submit your return.

State tax deadlines may vary, so it is essential to check your specific state's requirements to avoid penalties.

Penalties for non-compliance

Failing to comply with tax regulations can lead to significant penalties for small business owners. Common penalties include:

- Failure to file penalty: Charged when you do not file your tax return by the due date.

- Failure to pay penalty: Imposed if you do not pay your taxes owed by the deadline.

- Accuracy-related penalties: Applied if the IRS finds errors or discrepancies in your reported deductions.

Understanding these penalties can motivate you to maintain accurate records and file your taxes on time.

Quick guide on how to complete the big list of small business tax deductions and how to claim

Prepare The Big List Of Small Business Tax Deductions and How To Claim seamlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents quickly and efficiently. Manage The Big List Of Small Business Tax Deductions and How To Claim on any device using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

How to modify and eSign The Big List Of Small Business Tax Deductions and How To Claim effortlessly

- Obtain The Big List Of Small Business Tax Deductions and How To Claim and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your updates.

- Choose your preferred method for sending your form: via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your chosen device. Alter and eSign The Big List Of Small Business Tax Deductions and How To Claim to ensure excellent communication at any point in your form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a small business tax deductions checklist?

A small business tax deductions checklist is a comprehensive guide that outlines potential deductions small businesses can claim during tax season. It helps business owners identify and organize eligible expenses to maximize their tax savings. Utilizing this checklist can simplify the tax filing process and ensure you don’t miss out on important deductions.

-

How can I use airSlate SignNow for my small business tax deductions checklist?

You can use airSlate SignNow to digitally sign and manage your small business tax deductions checklist. The platform allows you to send necessary documents to your tax advisor or accountant easily. This streamlines the process and helps ensure that all required paperwork is in order for your deductions.

-

Are there any features that specifically help with managing a small business tax deductions checklist?

Yes, airSlate SignNow offers features like customizable templates and document reminders that can assist you in managing your small business tax deductions checklist. You can create templates to categorize receipts and expenses efficiently. Additionally, reminders can help you track important deadlines and paperwork submissions related to your deductions.

-

What types of small business expenses can be included in the tax deductions checklist?

Your small business tax deductions checklist can include a variety of expenses, such as home office costs, supplies, and employee wages. Moreover, deductions for business travel and meals can also be included. Knowing what to include helps ensure you're leveraging all possible deductions for your business.

-

How does airSlate SignNow's pricing benefit small businesses looking for a tax deductions checklist?

airSlate SignNow offers competitive pricing tailored for small businesses, making it an affordable choice when managing your small business tax deductions checklist. With various pricing tiers, you can select a plan that fits your budget and the features you need to optimize your signing and documentation process.

-

Can airSlate SignNow integrate with accounting software for tax deduction management?

Yes, airSlate SignNow seamlessly integrates with various accounting software, making it easier to manage your small business tax deductions checklist. This integration allows for a more organized approach to handling financial documents and ensures consistency across your records. You can synchronize data and documentation effortlessly for tax purposes.

-

What benefits do I gain from using airSlate SignNow for my tax-related documents?

Using airSlate SignNow for your tax-related documents offers several benefits, including improved efficiency and reduced paperwork confusion. The eSigning feature makes it easy to get necessary approvals for your small business tax deductions checklist. Additionally, you can access documents from anywhere, ensuring you stay organized throughout tax season.

Get more for The Big List Of Small Business Tax Deductions and How To Claim

Find out other The Big List Of Small Business Tax Deductions and How To Claim

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors