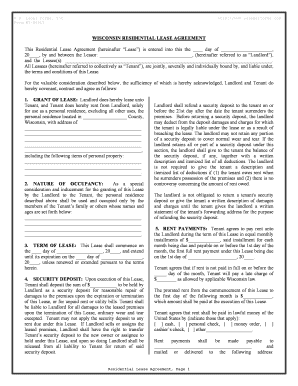

Form WI 864LT

What is the Form WI 864LT

The Form WI 864LT is a specific document used in the state of Wisconsin for tax purposes. It is primarily utilized to report certain income and deductions for individuals and businesses. This form plays a crucial role in ensuring compliance with state tax regulations and is essential for accurate tax reporting. Understanding its purpose and requirements is vital for taxpayers who need to file their state taxes correctly.

How to use the Form WI 864LT

Using the Form WI 864LT involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and deduction records. Next, carefully fill out the form, ensuring that all information is accurate and complete. Once the form is filled out, review it for any errors before submission. Taxpayers can either file the form electronically or send it via mail, depending on their preference and the guidelines provided by the Wisconsin Department of Revenue.

Steps to complete the Form WI 864LT

Completing the Form WI 864LT requires attention to detail. Follow these steps:

- Obtain the latest version of the form from the Wisconsin Department of Revenue website.

- Fill in personal information, including your name, address, and Social Security number.

- Report your income sources, including wages, interest, and dividends.

- List any deductions you are eligible for, such as business expenses or educational credits.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Form WI 864LT

The legal use of the Form WI 864LT is governed by state tax laws. It is important to ensure that the form is filled out correctly to avoid any legal issues. Submitting inaccurate information can lead to penalties or audits by the Wisconsin Department of Revenue. Therefore, understanding the legal implications of the information provided on the form is crucial for compliance and to protect against potential legal consequences.

Key elements of the Form WI 864LT

The Form WI 864LT includes several key elements that taxpayers must be aware of:

- Personal Information: This section requires basic identification details.

- Income Reporting: Taxpayers must accurately report all sources of income.

- Deductions: Eligible deductions must be clearly outlined to reduce taxable income.

- Signature: A valid signature is necessary to validate the form.

Filing Deadlines / Important Dates

Filing deadlines for the Form WI 864LT are typically aligned with the federal tax deadlines. Taxpayers should be aware of the specific dates to avoid late penalties. Generally, the form must be submitted by April 15 for the previous tax year, but it is advisable to check for any changes or extensions that may apply. Keeping track of these important dates ensures timely compliance with state tax regulations.

Quick guide on how to complete form wi 864lt

Complete Form WI 864LT with ease on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Form WI 864LT across any platform using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to edit and eSign Form WI 864LT effortlessly

- Obtain Form WI 864LT and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your method of submitting your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, and errors that require reprinting documents. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Form WI 864LT and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Form WI 864LT and why do I need it?

Form WI 864LT is a tax form used for reporting certain income on behalf of state tax purposes. Businesses often need to fill out and submit this form correctly to ensure compliance with Wisconsin tax regulations. Using airSlate SignNow can simplify the eSigning process for Form WI 864LT, making it easier to manage your documents efficiently.

-

How does airSlate SignNow help with completing Form WI 864LT?

AirSlate SignNow provides an intuitive platform that allows users to fill, sign, and send Form WI 864LT seamlessly. With this solution, you can customize your form, add e-signatures, and save time with automated workflows. It ensures that your Form WI 864LT is filled out accurately and submitted on time.

-

Is there a cost associated with using airSlate SignNow for Form WI 864LT?

Yes, airSlate SignNow offers various pricing plans based on the features and level of usage you require. With our plans, you can take advantage of unlimited eSigning, which is beneficial when handling multiple Form WI 864LT submissions. We encourage prospective customers to review our pricing options to find the best fit for their needs.

-

What features does airSlate SignNow offer for handling Form WI 864LT?

AirSlate SignNow includes features like drag-and-drop form building, eSignature capabilities, and document tracking, all of which enhance your experience with Form WI 864LT. Additionally, you can create templates for frequently used forms, saving time for future submissions. These features streamline your document management process.

-

Can I integrate airSlate SignNow with other applications when working with Form WI 864LT?

Absolutely! AirSlate SignNow seamlessly integrates with numerous applications such as Google Drive, Salesforce, and more. This allows you to import and export data related to Form WI 864LT easily, ensuring that all necessary information is at your fingertips and enhancing overall productivity.

-

Is airSlate SignNow secure for handling sensitive information like Form WI 864LT?

Yes, airSlate SignNow takes security seriously and employs advanced encryption to protect your documents. When working with Form WI 864LT, you can rest assured that your sensitive information is secure during the signing process. We are also compliant with various regulatory standards to safeguard your data.

-

How can I track the status of my Form WI 864LT after sending it for signature?

With airSlate SignNow, you can easily track the status of your sent Form WI 864LT. Our platform provides real-time notifications and status updates to inform you when the document has been viewed or signed. This feature helps ensure that you are always aware of where your Form WI 864LT stands in the signing process.

Get more for Form WI 864LT

Find out other Form WI 864LT

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer