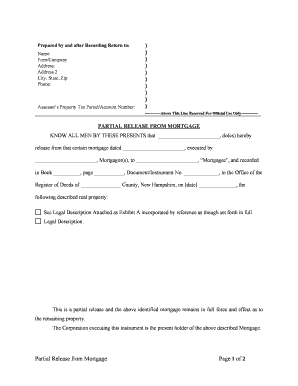

PARTIAL RELEASE from MORTGAGE Form

What is the partial release from mortgage?

A partial release from mortgage is a legal document that allows a borrower to remove a portion of the property from the mortgage lien. This can occur when a borrower sells a part of the property or refinances a section of it while keeping the remaining property under the original mortgage. The document serves to formally acknowledge that the lender relinquishes their claim on the specified portion of the property, which can be crucial for real estate transactions.

Steps to complete the partial release from mortgage

Completing a partial release from mortgage involves several key steps. First, the borrower must identify the specific property portion to be released. Next, they should contact the lender to discuss the necessary documentation and any fees associated with the release. After gathering the required documents, the borrower must fill out the partial release form accurately. Once completed, the form should be submitted to the lender for review and approval. Finally, upon approval, the lender will issue a formal release document that should be recorded with the local county office.

Legal use of the partial release from mortgage

The legal use of a partial release from mortgage is governed by state laws and regulations. This document is typically required to ensure that the transaction is valid and recognized by all parties involved. It is essential for the borrower to understand their rights and obligations under the mortgage agreement, as well as any implications of releasing a portion of the property. Consulting with a legal professional can provide clarity on how to navigate these legal requirements effectively.

Key elements of the partial release from mortgage

A partial release from mortgage must include several key elements to be valid. These include the names of the borrower and lender, a clear description of the property being released, the original mortgage details, and the specific terms of the release. Additionally, the document should be signed by both parties and may require notarization to ensure its legality. Including these elements helps prevent disputes and ensures that the release is enforceable in court.

How to obtain the partial release from mortgage

To obtain a partial release from mortgage, the borrower should start by contacting their lender. The lender will provide the necessary forms and outline the requirements for processing the release. Borrowers may need to provide documentation that supports their request, such as proof of sale or refinancing. It is important to follow the lender's instructions carefully to ensure a smooth process. Once the request is submitted, the lender will review it and issue the partial release if approved.

State-specific rules for the partial release from mortgage

State-specific rules for a partial release from mortgage can vary significantly. Each state may have different requirements regarding documentation, fees, and the process for recording the release. It is important for borrowers to familiarize themselves with their state’s regulations to ensure compliance. Checking with local real estate authorities or legal advisors can provide valuable insights into the specific rules that apply to partial releases in their jurisdiction.

Quick guide on how to complete partial release from mortgage

Effortlessly Manage PARTIAL RELEASE FROM MORTGAGE on Any Device

Digital document management has gained traction among companies and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the correct format and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage PARTIAL RELEASE FROM MORTGAGE on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Modify and Electronically Sign PARTIAL RELEASE FROM MORTGAGE with Ease

- Obtain PARTIAL RELEASE FROM MORTGAGE and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important areas of the documents or redact sensitive information using tools specifically provided by airSlate SignNow.

- Create your signature with the Sign tool, which only takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management requirements with just a few clicks from any device you prefer. Modify and electronically sign PARTIAL RELEASE FROM MORTGAGE to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a partial release from mortgage?

A partial release from mortgage allows a borrower to remove a portion of the secured property from the mortgage without paying off the full loan. This process is often required when a property is sold or developed, enabling the borrower to retain the remaining collateral. Using airSlate SignNow, you can manage and eSign your partial release documents easily and quickly.

-

How does airSlate SignNow facilitate a partial release from mortgage?

airSlate SignNow simplifies the process of obtaining a partial release from mortgage by providing an intuitive platform for creating, sending, and eSigning necessary documents. With customizable templates, you can ensure that all legal requirements are met efficiently. This tool maximizes convenience while reducing the time spent on paperwork.

-

What are the benefits of using airSlate SignNow for a partial release from mortgage?

Using airSlate SignNow for a partial release from mortgage offers signNow benefits including streamlined document management, reduced turnaround time, and enhanced security. The platform ensures that all your documents are legally binding and offers real-time tracking. This guarantees peace of mind for both lenders and borrowers.

-

Are there any fees associated with obtaining a partial release from mortgage through airSlate SignNow?

While airSlate SignNow has affordable subscription plans, there may be additional fees related to the mortgage lender or local regulations when seeking a partial release from mortgage. It's essential to consult with your lender regarding specific costs. Our pricing is designed to fit various budgets while offering valuable features for document management.

-

Can I integrate airSlate SignNow with other tools for managing partial releases?

Yes, airSlate SignNow offers seamless integrations with popular tools like CRM systems and document management software. This ensures that your workflow remains efficient and organized while processing partial releases from mortgage. Integrating these tools enhances collaboration and data synchronization across your organization.

-

How long does it take to process a partial release from mortgage?

The processing time for a partial release from mortgage can vary based on the lender's requirements and the documentation provided. However, using airSlate SignNow can signNowly reduce delays, allowing for faster approvals through eSigning and document tracking. Typically, you can expect a quicker turnaround time compared to traditional methods.

-

What documents do I need for a partial release from mortgage?

To obtain a partial release from mortgage, you typically need the original mortgage deed, a request for release form, and any relevant documents showing proof of sale or development of the property. Utilizing airSlate SignNow, you can easily access templates for these documents to ensure all necessary information is included for a smoother process.

Get more for PARTIAL RELEASE FROM MORTGAGE

- Exxonmobil foundation matching gifts form 811 0029f

- Form board elevation certificate

- Three pin application form

- Nrcs per 40 form

- Simplifying imaginary numbers worksheet form

- Pcfaf 05 04 cdr cdr icici bank careers form

- The louisiana purchase worksheet answer key form

- Home away rental agreement template form

Find out other PARTIAL RELEASE FROM MORTGAGE

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy