Mortgagees Deed Form

What is the Mortgagees Deed

The Mortgagees Deed is a legal document used in the context of real estate transactions, specifically when a mortgage lender (the mortgagee) takes possession of a property due to the borrower's (the mortgagor's) failure to meet the terms of the mortgage agreement. This deed serves as a formal transfer of ownership from the borrower to the lender, allowing the lender to take control of the property to recover the outstanding debt. It is crucial in the foreclosure process and must adhere to state-specific regulations to ensure its validity.

How to use the Mortgagees Deed

Using the Mortgagees Deed involves several key steps. First, the lender must ensure that all legal requirements are met, including notifying the borrower of the default status. Once the decision to proceed is made, the lender prepares the deed, which must include essential information such as the property description, the names of the parties involved, and the reason for the transfer. After completing the document, it should be signed by the appropriate parties and recorded with the local county recorder's office to make the transfer official.

Key elements of the Mortgagees Deed

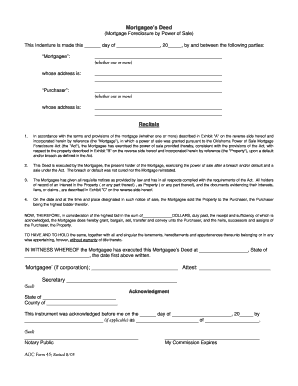

A Mortgagees Deed typically contains several critical elements that ensure its legal effectiveness. These elements include:

- Property Description: A detailed description of the property being transferred, including the address and parcel number.

- Parties Involved: The names and addresses of the mortgagee and mortgagor.

- Reason for Transfer: A clear statement indicating the reason for the transfer, often related to default on the mortgage.

- Signatures: Signatures of the mortgagee and any witnesses required by state law.

- Notarization: Many states require the deed to be notarized to enhance its legal standing.

Steps to complete the Mortgagees Deed

Completing the Mortgagees Deed involves a systematic approach to ensure all necessary information is accurately captured. Here are the steps to follow:

- Review the mortgage agreement to confirm the default status of the borrower.

- Draft the Mortgagees Deed, including all required elements.

- Have the deed signed by the mortgagee and any necessary witnesses.

- Obtain notarization if required by state law.

- File the completed deed with the appropriate local government office to record the transfer.

Legal use of the Mortgagees Deed

The legal use of the Mortgagees Deed is governed by state laws, which outline the procedures for foreclosure and property transfer. It is essential for lenders to comply with these laws to avoid potential legal challenges. Proper execution and recording of the deed not only protect the lender's interests but also ensure that the transfer is recognized in the public record, providing clarity regarding property ownership.

State-specific rules for the Mortgagees Deed

Each state in the U.S. has its own regulations regarding the Mortgagees Deed, which can affect how the document is prepared and executed. These rules may dictate the necessary information included in the deed, the process for notifying the borrower, and the timeline for recording the deed. It is important for lenders to familiarize themselves with their state's specific requirements to ensure compliance and avoid complications during the foreclosure process.

Quick guide on how to complete mortgagees deed

Effortlessly Prepare Mortgagees Deed on Any Device

The management of online documents has gained signNow traction among businesses and individuals alike. It serves as an excellent eco-friendly substitute to conventional printed and signed paperwork, as you can easily access the necessary form and securely save it online. airSlate SignNow equips you with all the tools needed to quickly create, modify, and electronically sign your documents without delays. Manage Mortgagees Deed across any platform using airSlate SignNow's Android or iOS applications and streamline any document-related processes today.

Steps to Modify and eSign Mortgagees Deed with Ease

- Find Mortgagees Deed and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight key sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all details and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or disorganized documents, tedious form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow manages all your document management requirements in just a few clicks from any device you choose. Edit and eSign Mortgagees Deed to ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Mortgagees Deed and how is it used?

A Mortgagees Deed is a legal document that transfers property ownership from a mortgagor to the mortgagee in the event of a foreclosure. This deed serves to secure the lender's interest in the property and outlines the conditions under which the ownership is transferred. Understanding how to properly handle a Mortgagees Deed can streamline the foreclosure process.

-

How does airSlate SignNow facilitate the creation of a Mortgagees Deed?

airSlate SignNow offers an intuitive platform that allows you to easily create and customize a Mortgagees Deed. With our user-friendly templates and drag-and-drop feature, you can quickly generate a legally compliant document tailored to your specific needs. This efficiency saves time and reduces the risk of errors.

-

Is airSlate SignNow cost-effective for managing Mortgagees Deeds?

Yes, airSlate SignNow provides a cost-effective solution for managing all types of documents, including Mortgagees Deeds. With flexible pricing plans, you can choose one that best fits your budget while still enjoying premium features such as eSigning and automated workflows. This financial efficiency empowers businesses to handle paperwork without breaking the bank.

-

What features does airSlate SignNow offer for Mortgagees Deed management?

airSlate SignNow offers several key features for managing Mortgagees Deeds, including eSignature capabilities, document templates, and real-time tracking. These tools ensure that you can easily send, sign, and store your Mortgagees Deeds securely. Additionally, reminders and notifications help keep the document flow efficient.

-

Can I integrate airSlate SignNow with other applications for managing Mortgagees Deeds?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as CRM systems and cloud storage solutions, making it easier to manage Mortgagees Deeds. These integrations enhance your workflow and keep your documents organized across platforms. This means you can access and send your Mortgagees Deeds from anywhere.

-

What are the benefits of using airSlate SignNow for Mortgagees Deeds?

Using airSlate SignNow for your Mortgagees Deeds offers numerous benefits, including enhanced speed, security, and compliance. The platform provides a legally binding eSignature solution that ensures your documents are valid and enforceable. Furthermore, its ease of use fosters better collaboration and more efficient communication among all parties involved.

-

Is it safe to store my Mortgagees Deed on airSlate SignNow?

Yes, airSlate SignNow prioritizes security, ensuring that your Mortgagees Deeds and other documents are stored safely and securely. With features such as encryption, secure cloud storage, and access controls, you can have peace of mind knowing that sensitive information is protected. Our commitment to security means your documents are in good hands.

Get more for Mortgagees Deed

Find out other Mortgagees Deed

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free