Designation Form for Royalty Payment Responsibility, Form ONRR 4425

What is the Designation Form For Royalty Payment Responsibility, Form ONRR 4425

The Designation Form For Royalty Payment Responsibility, Form ONRR 4425, is a critical document used in the United States for managing royalty payments related to federal oil and gas leases. This form allows entities to designate a responsible party for royalty payments, ensuring that obligations are met in accordance with federal regulations. It is essential for both lessees and designated payors to understand the implications of this form, as it formalizes the financial responsibilities associated with mineral rights and royalties.

How to use the Designation Form For Royalty Payment Responsibility, Form ONRR 4425

To use the Designation Form For Royalty Payment Responsibility, Form ONRR 4425, individuals or companies must accurately fill out the required fields, which include details about the lessee, the designated payor, and the specific lease information. After completing the form, it should be submitted to the appropriate Bureau of Ocean Energy Management (BOEM) or Bureau of Land Management (BLM) office, depending on the nature of the lease. Proper submission ensures that the designated party is recognized for royalty payment responsibilities, facilitating compliance with federal regulations.

Steps to complete the Designation Form For Royalty Payment Responsibility, Form ONRR 4425

Completing the Designation Form For Royalty Payment Responsibility, Form ONRR 4425 involves several key steps:

- Gather necessary information about the lease, including lease numbers and property descriptions.

- Identify the lessee and the designated payor, ensuring that both parties agree on the designation.

- Fill out the form accurately, providing all required details in the designated fields.

- Review the completed form for accuracy and completeness to avoid delays in processing.

- Submit the form to the appropriate agency, either electronically or via mail, as per the guidelines provided.

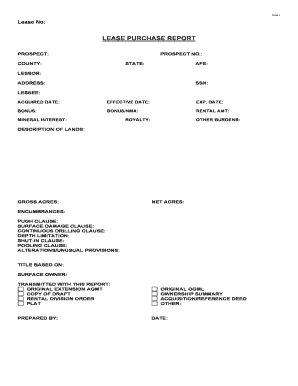

Key elements of the Designation Form For Royalty Payment Responsibility, Form ONRR 4425

The Designation Form For Royalty Payment Responsibility, Form ONRR 4425, includes several key elements that must be addressed for effective use:

- Lessee Information: Details about the entity holding the lease, including name and address.

- Designated Payor Information: Information about the party designated to make royalty payments.

- Lease Information: Specific details about the lease, including lease number and type of mineral rights.

- Signatures: Required signatures from both the lessee and the designated payor to validate the form.

Legal use of the Designation Form For Royalty Payment Responsibility, Form ONRR 4425

The legal use of the Designation Form For Royalty Payment Responsibility, Form ONRR 4425, is governed by federal laws and regulations related to mineral leasing and royalty payments. This form must be completed and submitted in compliance with the rules set forth by the Bureau of Ocean Energy Management and the Bureau of Land Management. Proper execution of the form ensures that the designated payor is legally recognized and can fulfill the financial obligations associated with the lease, thus avoiding potential penalties for non-compliance.

How to obtain the Designation Form For Royalty Payment Responsibility, Form ONRR 4425

The Designation Form For Royalty Payment Responsibility, Form ONRR 4425, can be obtained through the official website of the Bureau of Ocean Energy Management or the Bureau of Land Management. These agencies provide access to the form in both digital and printable formats. It is advisable to ensure that the most current version of the form is used to avoid any issues during submission.

Quick guide on how to complete designation form for royalty payment responsibility form onrr 4425

Effortlessly Prepare Designation Form For Royalty Payment Responsibility, Form ONRR 4425 on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly solution to conventional printed and signed documents, allowing you to access the correct form and safely store it online. airSlate SignNow provides all the tools necessary to swiftly create, modify, and electronically sign your documents without delays. Handle Designation Form For Royalty Payment Responsibility, Form ONRR 4425 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

Easily Modify and Electronically Sign Designation Form For Royalty Payment Responsibility, Form ONRR 4425

- Locate Designation Form For Royalty Payment Responsibility, Form ONRR 4425 and select Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of your documents or hide sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Create your signature using the Sign tool, which only takes moments and holds the same legal validity as a conventional handwritten signature.

- Verify the details and click the Done button to save your modifications.

- Choose your preferred method to send your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow fulfills your document management requirements in a few clicks from any device you prefer. Modify and electronically sign Designation Form For Royalty Payment Responsibility, Form ONRR 4425 and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Designation Form For Royalty Payment Responsibility, Form ONRR 4425?

The Designation Form For Royalty Payment Responsibility, Form ONRR 4425 is a crucial document used by businesses to designate who is responsible for royalty payments. This form is essential for maintaining compliance with government regulations regarding mineral royalties. Utilizing airSlate SignNow to eSign this document makes the process efficient and secure.

-

How does airSlate SignNow streamline the completion of the Designation Form For Royalty Payment Responsibility, Form ONRR 4425?

AirSlate SignNow simplifies the completion of the Designation Form For Royalty Payment Responsibility, Form ONRR 4425 by allowing users to fill out and eSign documents digitally. The platform offers an intuitive interface that enhances user experience and ensures accuracy. This eliminates the need for printing and scanning, saving both time and resources.

-

What are the costs associated with using airSlate SignNow for the Designation Form For Royalty Payment Responsibility, Form ONRR 4425?

AirSlate SignNow offers various pricing plans designed to accommodate diverse business needs. Each plan includes the capability to handle the Designation Form For Royalty Payment Responsibility, Form ONRR 4425 efficiently. By providing a cost-effective solution, companies can manage their royalty payment responsibilities without compromising on quality.

-

What features does airSlate SignNow provide for managing the Designation Form For Royalty Payment Responsibility, Form ONRR 4425?

AirSlate SignNow includes features such as document templates, real-time tracking, and secure storage, which are ideal for managing the Designation Form For Royalty Payment Responsibility, Form ONRR 4425. Users can also leverage customizable workflows and notifications to stay updated on the signing process. This enhances overall efficiency and ensures compliance with necessary regulations.

-

Can I integrate airSlate SignNow with other tools for the Designation Form For Royalty Payment Responsibility, Form ONRR 4425?

Yes, airSlate SignNow seamlessly integrates with various applications like CRM and document management systems. This allows businesses to automate their workflows surrounding the Designation Form For Royalty Payment Responsibility, Form ONRR 4425. The integration capabilities help streamline processes and improve collaboration among teams.

-

What are the benefits of eSigning the Designation Form For Royalty Payment Responsibility, Form ONRR 4425 with airSlate SignNow?

eSigning the Designation Form For Royalty Payment Responsibility, Form ONRR 4425 with airSlate SignNow brings numerous benefits, such as enhanced security and faster turnaround times. The platform ensures that all eSignatures are legally binding and compliant with industry standards. Consequently, businesses can efficiently manage their royalty responsibilities without delays.

-

Is customer support available for users of the Designation Form For Royalty Payment Responsibility, Form ONRR 4425?

Absolutely! AirSlate SignNow offers robust customer support to assist users with the Designation Form For Royalty Payment Responsibility, Form ONRR 4425. Whether you need help with the signing process or troubleshooting, our knowledgeable support team is available to ensure you have a smooth experience.

Get more for Designation Form For Royalty Payment Responsibility, Form ONRR 4425

Find out other Designation Form For Royalty Payment Responsibility, Form ONRR 4425

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe