Do Not Have to Name Specific Property and May Simply State None If No Property is to Be Left Form

What is the Do Not Have To Name Specific Property And May Simply State None If No Property Is To Be Left

The form titled "Do Not Have To Name Specific Property And May Simply State None If No Property Is To Be Left" serves a specific legal function. It allows individuals to indicate that they are not leaving behind any specific property in their estate planning or legal documents. This is particularly useful in wills or trusts, where the absence of property can be explicitly stated to avoid confusion or misinterpretation. By using this form, individuals can clarify their intentions regarding their estate without the need to list every asset or item they own.

How to use the Do Not Have To Name Specific Property And May Simply State None If No Property Is To Be Left

Using the form effectively requires understanding its purpose and the context in which it is applied. When filling out the form, individuals should ensure that they clearly indicate their intent to leave no property behind. This involves completing the necessary sections accurately, including any required signatures. It is advisable to consult with a legal professional to ensure that the form meets all legal requirements and is appropriately integrated into broader estate planning documents.

Steps to complete the Do Not Have To Name Specific Property And May Simply State None If No Property Is To Be Left

Completing the form involves several straightforward steps:

- Read the form carefully to understand all sections.

- Fill in your personal information, including your name and date.

- In the section where property details are required, clearly state "none" to indicate no property is to be left.

- Sign and date the form to validate your intent.

- Consider having the document notarized if required by your state laws.

Legal use of the Do Not Have To Name Specific Property And May Simply State None If No Property Is To Be Left

This form is legally binding when executed properly. It is essential to comply with state laws regarding estate planning documents. The form must be signed in accordance with local regulations to ensure its validity. Legal recognition of the document may vary by state, so understanding local requirements is crucial for its enforceability.

Key elements of the Do Not Have To Name Specific Property And May Simply State None If No Property Is To Be Left

Key elements of this form include:

- The declaration of intent not to leave specific property.

- Signature of the individual completing the form.

- Date of execution, which establishes the timeline of the declaration.

- Compliance with state-specific legal requirements for estate planning.

Examples of using the Do Not Have To Name Specific Property And May Simply State None If No Property Is To Be Left

Examples of scenarios where this form is applicable include:

- An individual without significant assets who wishes to simplify their estate planning.

- A person who has already distributed their property during their lifetime and wants to formalize that no further property is to be left.

- Situations where an individual wants to ensure clarity in their will regarding the absence of property.

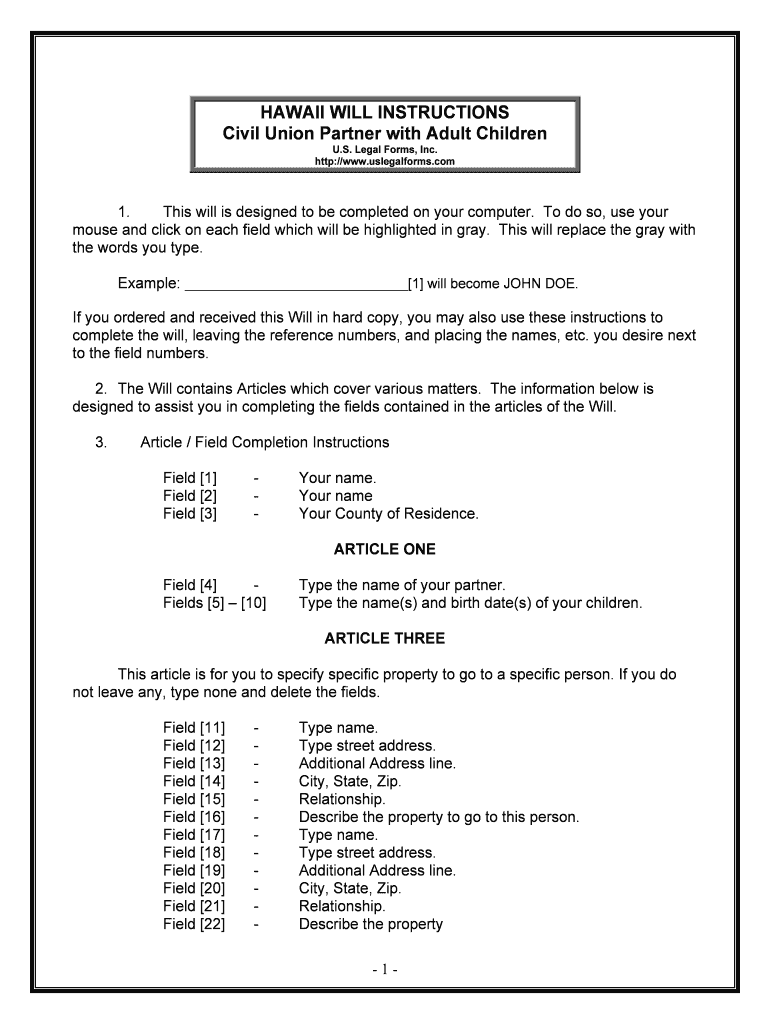

Quick guide on how to complete do not have to name specific property and may simply state none if no property is to be left

Complete Do Not Have To Name Specific Property And May Simply State None If No Property Is To Be Left effortlessly on any gadget

Digital document management has become fashionable among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the required form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents promptly without setbacks. Manage Do Not Have To Name Specific Property And May Simply State None If No Property Is To Be Left on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to edit and eSign Do Not Have To Name Specific Property And May Simply State None If No Property Is To Be Left without hassle

- Locate Do Not Have To Name Specific Property And May Simply State None If No Property Is To Be Left and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your updates.

- Select your preferred method to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Do Not Have To Name Specific Property And May Simply State None If No Property Is To Be Left and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

How to keep a property in the family after death?

Transfer on Death deed A transfer on death (TOD) deed, or beneficiary deed, automatically transfers ownership of property to a beneficiary upon the owner's death. A TOD deed can be an attractive option as it avoids probate and sidesteps the complexity that can come with creating a trust.

-

What are the disadvantages of a transfer on death deed?

Despite appearing as a solution for avoiding probate, TOD deeds can lead to unintentional disinheritance, tax obligations, and family disputes. Our piece also highlights alternative strategies for effective estate planning to mitigate these challenges.

-

Do I automatically inherit my parents' house?

Beck, Lenox & Stolzer Estate Planning and Elder Law, LLC, knows from experience how bad behavior can erupt among the siblings as well. Many people think children automatically inherit a house when their parents die, but this isn't true. It's possible for children to inherit without a will, but it doesn't always happen.

-

Which of the following assets do not go through probate?

First and foremost, there are a number of asset types that typically do not pass through probate. This includes life insurance policies, bank accounts, and investment or retirement accounts that require you to name a beneficiary.

-

How to pass property from parent to child?

A transfer of property can occur by purchase or gift; it can also occur through a trust. For example, if a parent's property is put into a trust where upon the death of the parent, the children are the beneficiaries of the trust, a transfer occurs as of the date of death.

-

How do I keep my house in the family after death?

Some states offer a TOD designation on a deed which essentially names a beneficiary for that property. With a TOD designation, assets pass outside probate, so it's quick and private, and the heirs still get a step-up in basis for tax purposes, which means the value of the house is adjusted to current market value.

-

Does a spouse automatically inherit everything in NYS?

New York law forbids residents from completely disinheriting a surviving spouse. If a person is legally married at the time of their death, their spouse will automatically inherit a percentage of their assets—even if the spouse has been intentionally excluded from the deceased person's will or trust.

-

What happens to property not in a trust in California?

Bank accounts, stocks, bonds, and other financial assets not included in your trust may also need to go through probate if the value exceeds the California probate threshold of $184,500. In some cases, if these accounts have a named beneficiary, they can transfer directly to that person without probate.

Get more for Do Not Have To Name Specific Property And May Simply State None If No Property Is To Be Left

- Insurance questionnaire for personal lines form

- Coggins forms online 16280076

- Form 2985

- Texas commercial rental lease application questionnaire form

- Google maricopapima county self service forms marriage dissolution

- Va form 28 10286

- Unpaid volunteer agreement template form

- Unpaid work experience agreement template form

Find out other Do Not Have To Name Specific Property And May Simply State None If No Property Is To Be Left

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now